The Black Economy Task Force Oct 2017

I was having a read through,the Black Economy Task Force, the purpose of which was,

"The report) presents our findings on the black economy, the drivers and

risks underpinning it, and an innovative, forward-looking blueprint for

tackling it."

link to the report

My read on it that we are a bunch of shifty pricks ("endemic cultural problem") for a number of reasons.

However, through propaganda, tougher laws, monitoring, cash limitations, and other ways, the Govment, would be able to reduce the impact of the Black Economy.

It is interesting to note that there are some nasty pasty repurcussions of the Black Economy. Exploitation of people, illegal drugs/gambling/sex trade, and an increased burden upon good tax payers.

The report does a reasonable summary of the black economy and methods to remedy it.

Legal Theft

I found myself laughing at the report.

More due to a combination of my experience of Corporation's manipulations of Tax Laws, illegal operations of our "finest" institutions, and my own experiences of being involved in the Black Market.

Manipulations of Tax Law

Have you ever heard of the term, Transfer Pricing?

"Transfer price is the price at which related parties transact with each other, such as during the trade of supplies or labor between departments." source

What that means is, if I buy a product from an overseas company for $10, a subsidiary, owned by the oveseas company, should also pay $10 for the product.

However, many international corporation are using the tax law, to pay minimal taxes.

How do they do this? By reverse engineering the price.

Product Cost from Overseas HeadOffice = $10

Product Sold by Local Office to Customer = $20

Profit = $10

Here, you would assume, that if we keep it simple maths and not overcomplicate it, then the Local Office should pay tax of 30% on their profit = $3

But, the Overseas Headoffice does not want to pay the government $3. They want to pay ummm, let's get a smart consultant company to justify only paying ... $0.18 ... 18 cents!!

So, the HeadOffice changes the Product cost from $10 .. to $19.40

$20 - $19.4 = $0.60 * 30% tax = $0.18

I KID YOU NOT! THAT IS HOW THEY DO IT!

And they use a contradiction within the tax laws to do it!

Illegal operations of Our Finest

If I laundered money for drug cartels. If I stole money from customers. If I lied. If I did any of those things... would I still be able to run a business?

I'd say, Nope. I would be a Pariah.

Banks can do it though, because, they can shirk responsibility due to, Poor Processes & Procedures... and then just receive a fine.

It doesn't take long to find our "finest" are embroiled in corrupt, criminal, unethical & immoral behaviour.

But you cannot rip down the foundations of our civilisation, right?

This is just a peek at the bank's behaviour. You can go down a very deep rabbit hole of frustration, disbelief, & exasperation .. meanwhile, shake your finger at a lady not wearing a mask! How many people's lives have been destroyed from corrupt operations?

Despicable.

my own experiences of being involved in the Black Market

Yes, I am a criminal, I paid someone in cash to get a better price.

Was I complicit in a potential act of tax avoidance?

I also used the Tax Laws to reduce the amount of tax, the company I worked for, paid.

It was such an unethical behaviour that the Government's approach was laughable.

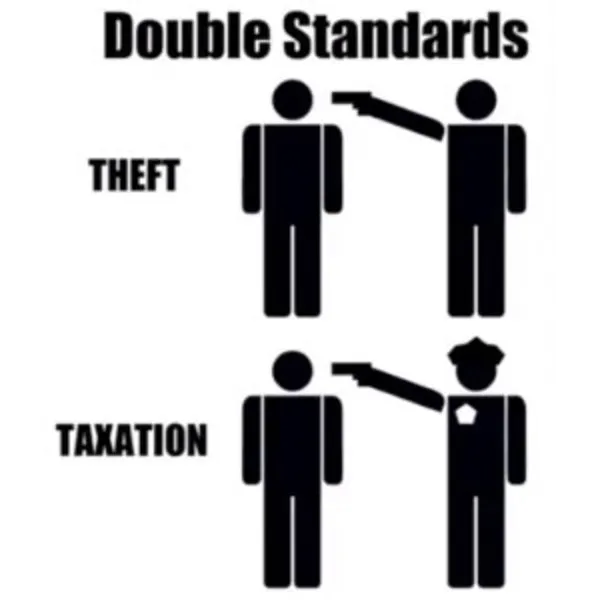

Taxation is Theft?

Liberatarians believe taxation should be voluntary. Other, like the idea of being able to decide where their tax dollars get spent.

I'm optimistic that our culture, ethics & morals would improve, communities would flourish, if people felt more of a buy in to the system.

Although, I not naive enough. I have experienced many different types of people & can see many problems with modifications - sometimes a stick just gets the job done, more effectively, than a carrot.

I'm more in the realm of tithes, that taxes should be based on turnover, and not profit. Consumption taxes need to be more environmentally conscious, that the importer of non-recyclables, should be penalised for not making a better product.

Again, without the grounding of ethics, morals & community, most systems are destined to fail. Taxation is just one of them.

Black Market will always Flourish

The Black Market will continue to flourish. Once the Government removes cash.. and they are trying.. It will change into other forms.

The clash between, Universal Basic Income, as people lose their jobs globally due to technology & automation, & cranking an age-old system of State Revenue raising to pay for the infrastructure.

Governments have played the money printing machines & borrowing money to avoid the true issues with the existing system. The Global Economy, makes countries fearful to lose Companies from their shores, to keep themselves in power, via the popularity voting game.. it's almost as though they need a foe (cough cough CCP party) or a threat (cough cough pandemic) ... to push through some reforms - that, on the surface, just seem like Gorgon Shite .. no fixing the bigger issues.

As some have said.. it's like shuffling the deck chairs on the Titanic.

IF there are GLOBAL WARS

IF there is GLOBAL POVERTY

IF there is GLOBAL DEBT

... Then, those in POWER, do not DESERVE IT!