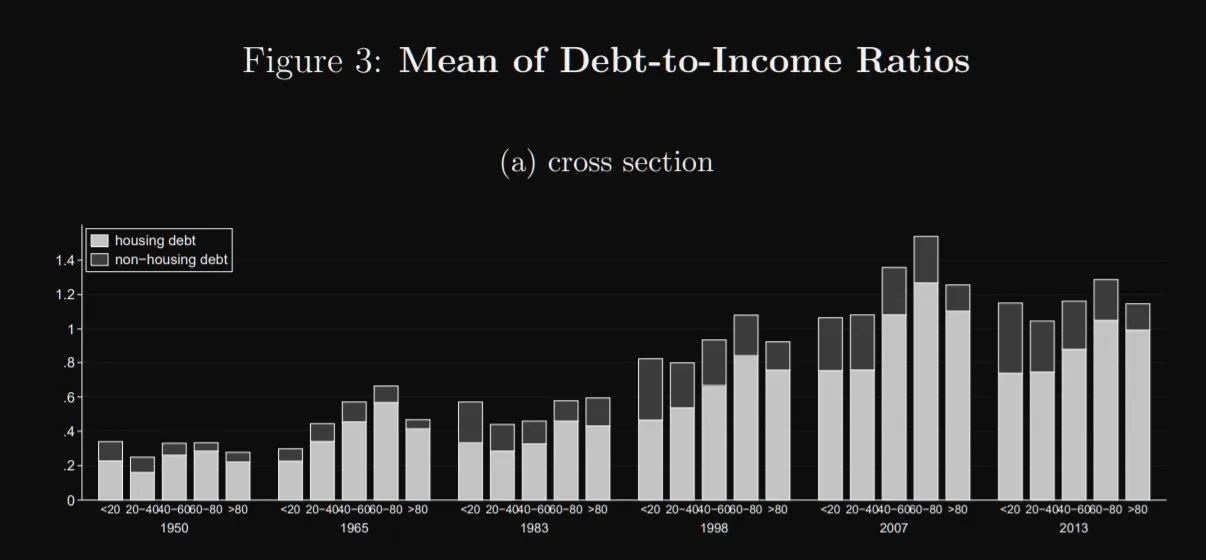

The above graph is the debt to income ratio for United States households from 1950 to 2013.

- The y-axis that runs from 0 to 1.4 is the debt to income ratio.

- The x-axis that runs from 1950 to 2013 is split up between all five income quintiles.

In the 1950s all income quintiles were below 40%, meaning, if I make $10,000 a year, my total debt is $4,000.

Fast forward to 2013, all quintiles are above 100%. Most of this debt is housing debt.

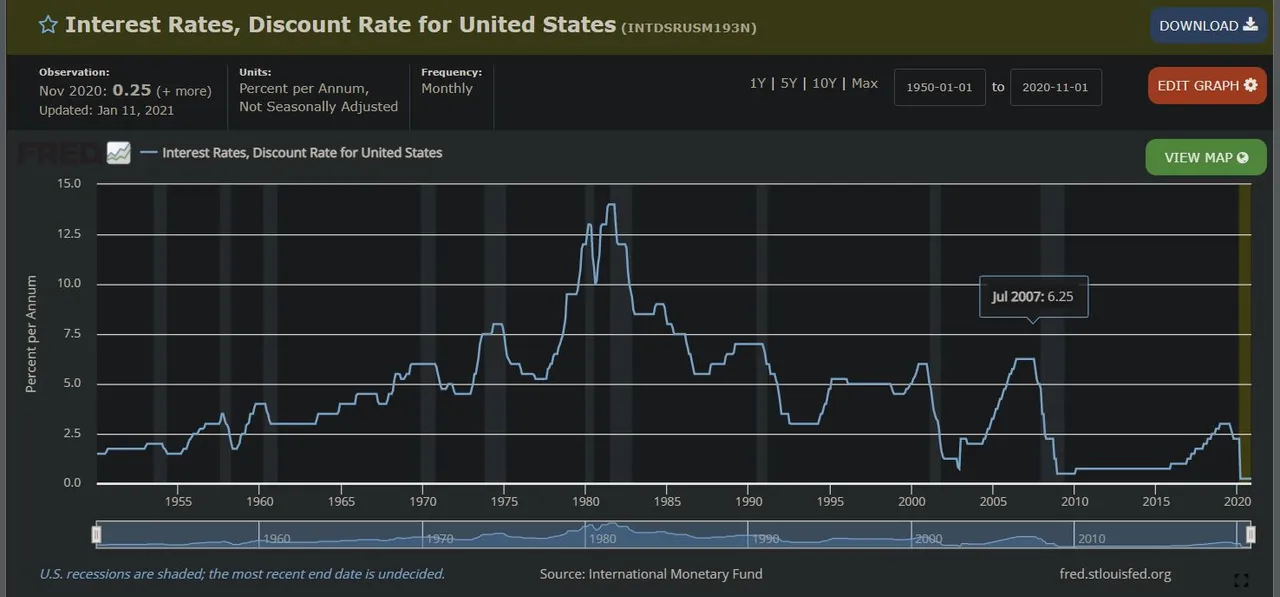

https://fred.stlouisfed.org/series/INTDSRUSM193N

Above is the United States Federal Reserve discount rate, the interest rate at which the Federal Reserve (central bank) lends to commercial banks, which determines borrowing cost for United States households.

For example, the Federal Reserve lends Citibank $1 billion at a discount rate of .25%, with the hopes that Citibank lends that money to households for house loans, car loans, etc… Citibank charges 2% for a car loan, and makes a profit of 1.75%.

This discount rate determines household's accessibility to debt. All debt; car loans, home loans, credit cards, home equity loans, small business loans, commercial loans, etc…are based on this rate. And the lower the interest rate, the lower the borrowing cost, and the higher probability people will take out a loan, spurring economic growth but also increasing their debt to income ratio.

In Conclusion.

Especially since the 1980s, American households have been taking on more debt relative to their income, in large part due to lower borrowing costs. It's hard to say when this debt load plateaus in this debt cycle, no longer stimulating economic growth and we start entering a deleveraging phase, which is deflationary and painful if not done correctly.

My wife and I are anticipating this severe economic downturn by paying off all of our debt over the next few years. Hopefully we still have time.

Stay frosty people.

50% allocated to ph-fund