Most of the crypto users ignored fees in the transaction until ETH showed the world that the transaction fees can be twice the size of the transaction itself. And so the world started thinking about how does the transactions work in a blockchain.

So let's take a look at how the blockchain transaction fees work and how can we choose a better cryptocurrency based on it's transaction fees and the speed of the transactions.

What are blockchain transaction fees?

Whenever you perform any form of the transaction on blockchain, the ledger creates an entry which miner has to mine for the exact block. And this process is called mining. And the reward for such activity is covered through the transaction fees.

If the blockchain has the staking system in the algorithm, the stakers does the voting in each transaction and you earn the reward in the process. This reward is covered from the transaction fees for the cryptocurrency.

Each cryptocurrency has it's own mechanism on charging the user and the accepter the way to cover the fee. They call it network fee, some call it miner fee or some even cover all of this under the transactions fees.

What happens to the fees collected?

As you know each cryptocurrency deals with this in a different way. For example some cryptocurrency has the stakes, oracles, validators and the miners. Each of them get their own percent from the network fees taken out of the fees.

So basically the ledger records the entities working into the smart contract and then it rewards them accordingly. Here the smart contract based cryptocurrencies also take care of the 3rd party oracle specific services to pay for the entities involved in the process.

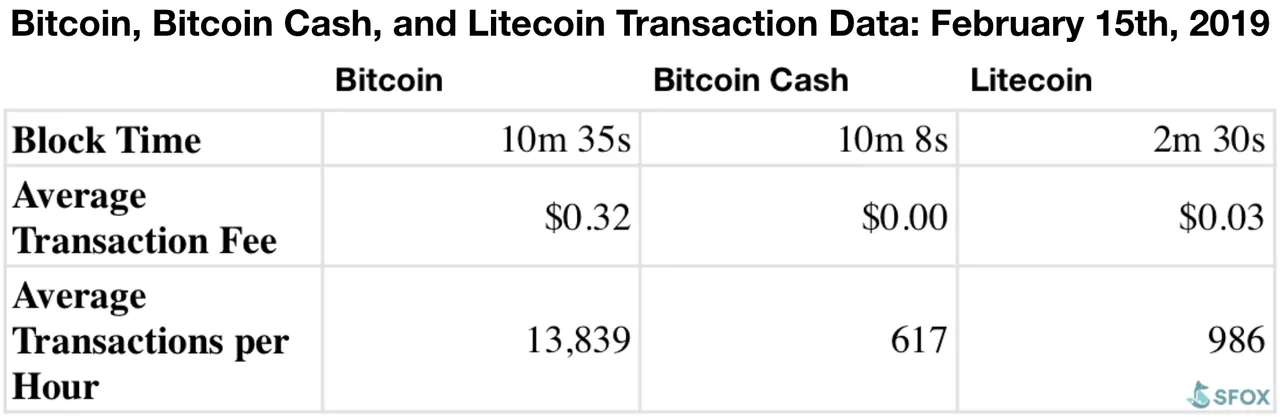

Image Credit: SFOX

Some cryptocurrencies have lower price and some have the higher price because of this process.

How does the Binance and ETH calculate the transaction Price?

Binance smart chain make use of it's own homegrown BNB to adjust the fees within it's ecosystem. And so the traded and non-trade transactions are handled in such way that the overall price through this chain turns out to be lot lower in the cost.

ETH on the other hand seems to be keeping the blockchain the miner benefiting algorithm. And so with each transaction the gas fee increases as the transactions keep on mounting and so does the gas required to mine those transactions. So that's why more tokens and the projects on ETH, the more traffic and the more contention observed in the fees.

Binance is smart, much smarter than the ETH team to handle the transaction and also the prices are lot lower with the BSC. The reason being they calculate the project ledger in such way that it does not burden the miners or the stakers in the pool for the calculation of the transaction price.

ETH continues to give you the reason being 2.0 will be faster. But each deployment of the fix for the price turns out to be more expensive. And the thing is that it continues to unfixed and the fees for the blockchain continues to rise with the market update.

Conclusion

Each blockchain has it's own means to handle the network fee and the transaction fees. A lot of times the transaction fee includes everything in the fee structure. A lot of cryptocurrency choose lower transaction fees to retain the investors and the community. Some just keep it dependent on miners and the validators and so their fees structure gets expensive over a period of time.