Four days ago, I wrote my first article about RWA tokenization. I mentioned in this article that the RWA category includes assets such as stablecoins, treasuries, shares in the automotive sector, and gold. Aside from the emergence of tokenized treasuries and gold-backed stablecoins, real estate tokenization is also a hot issue in the crypto space.

Overcoming Traditional Real Estate Barriers

Andrew Zapo, co-founder and COO of PropKeys, believes that using blockchain technology can revolutionize the real estate industry. He thinks that real estate tokenization is the way for millennials and Gen Z to have affordable home ownership.

There are many drawbacks to traditional home ownership. Apart from inflation, it also includes high processing fees, interest rates, brokers' commissions, and a lack of transparency. These obstacles are said to be the reasons why the rate of home ownership is low in the two generations mentioned. This does not include fraud, competition of companies, and monopoly which erodes trust in real estate transactions.

According to Andrew, blockchain technology can solve these problems through tokenization. Intermediaries and unnecessary transaction fees will disappear and above all, there will be transparency. By converting assets to digital tokens the so-called fractional ownership can be applied. As a result, investment in real estate will be more accessible. This is the realization of the so-called democratization of investment opportunities.

Realities Speak Otherwise

Although Oleksii Konashevych agrees with the above idea, for him, it is not that easy to implement real estate tokenization. Real estates are indeed considered illiquid assets and through tokenization, liquidity will become a reality in this sector. But contrary to the expectations of many, tokenization cannot revolutionize the real estate market for two main reasons:

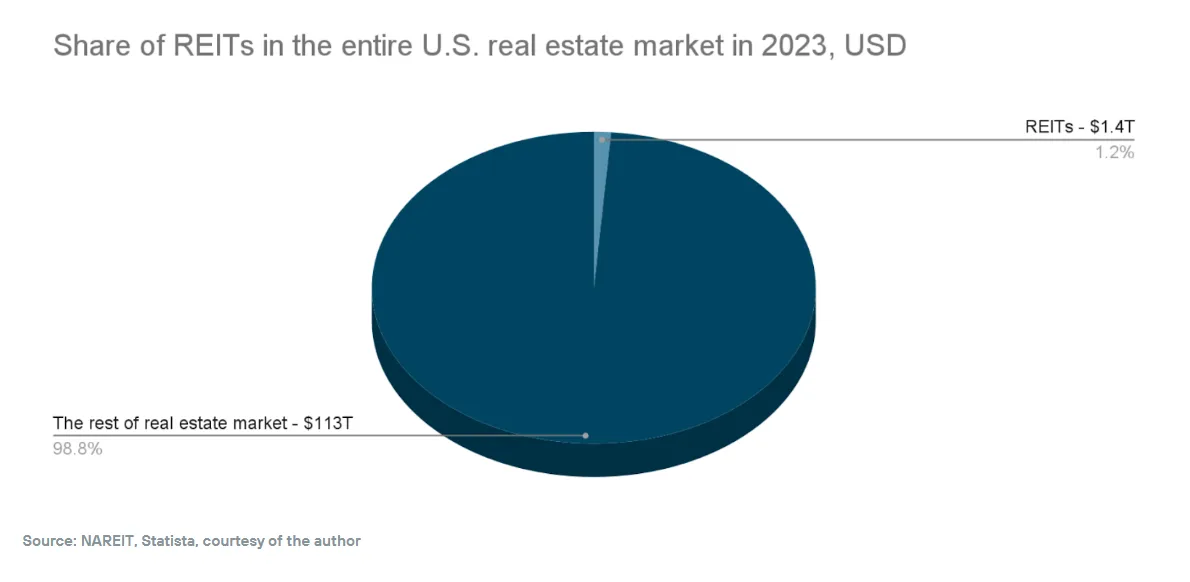

First, securitized real estate is only a very small fraction of the total real estate industry in the US. According to Oleksii, its market cap is only 1.4 trillion USD compared to the total 113 trillion USD market cap of total real estate value in the US as of last year.

The most serious obstacle is the bureaucratic character of the current registry of real estate property. Land registry is a very important issue but it is not discussed when it comes to real estate tokenization.

Vision for Blockchain-Based Title Tokens

To prove his opinion, Oleksii mentioned that his Ph. D. research is related to this topic. For him, traditional land registries are vulnerable and require intermediaries for registration and verification. With blockchain, these processes can be automated, combining agreement and registration into one transaction. Instead of a security token, he suggests having a “title token,” an asset that would represent an actual record of ownership on the blockchain.

Oleksii's proposal would not eliminate the role of intermediaries. For him, there are situations where registrars are still required.

Ultimately, what Oleksii wants to see is a “multi-chain system” that addresses the issue of transaction and scalability. In this way, blockchain technology will be the way to modernize land registries and integrate them into the digital economy.

Apat na araw na ang nakalipas ng isinulat ko ang kauna-unahang kong article tungkol sa RWA tokenization. Nabanggit ko sa artikulong ito na kabilang sa category ng RWA ang mga assets tulad ng stablecoins, treasuries, shares in the automotive sector, at gold. Bukod sa emergence ng tokenized treasuries at gold-backed stable coins, ang tokenization ng real estate ay isa rin mainit na issue sa crypto space.

Overcoming Traditional Real Estate Barriers

Naniniwala si Andrew Zapo, co-founder at COO ng PropKeys na ang paggamit ng blockchain technology ay may kakayanang irevolutionize ang real estate industry. Sa tingin niya, ang tokenization ng real estate ang daan para sa mga millennials at Gen Z upang magkaroon ng affordable home ownership.

Maraming mga sagabal sa tradisyonal na home ownership. Bukod sa inflation, kasama rin dito ang mataas a processing fee, interest rates, komisyon ng mga brokers at ang kawalan ng transparency. Ang mga sagabal na ito ang sinasabing mga dahilan kung bakit mababa ang rate ng home ownership sa dalawang henerasyon na nabanggit. Hindi pa kasama dito ang fraud, kumpetisyon ng mga kumpanya at monopoly na siyang sanhi ng pagkawala ng tiwala sa real estate transactions.

Ayon kay Andrew, kayang lunasan ng blockchain technology ang mga suliraning ito sa pamamagitan ng tokenization. Mawawala ang mga intermediaries at mga hindi kinakailngang transaction fees at higit sa lahat ay magkakaroon ng transparency. Sa pamamagitan ng pagko converts sa assets tungo sa digital tokens magiging makatotohanan ang tinatawag na fractional ownership. Bunga nito, mas magiging accessible ang inbestment sa real estate. Ito ang pagsasakatuparan ng tinatawag na democratization ng investment opportunities.

Realities Speak Otherwise

Bagamat pabor si Oleksii Konashevvch sa ideyang nabanggit, subalit para sa kaniya hindi ganoon kadali para maisakatuparan ang tokenization ng real estate. Totoo na ang real ay kinukunsidra na illiquid assets at sa pamamagitan ng tokenization ang liquidity ay magiging realidad sa sector na ito. Subalit salungat sa inaasahan ng marami hindi kayang irevolutionize ng tokenization ang real estate market sa dalawang pangunahing dahilan:

Una, ang secutitized real estate ay napakaliit na bahagi lamang ng kabuuang real estate industry. Ayon kay Oleksii, 1.4 triilion USD lamang ang market cap nito kung ihahambing sa kabuuang 113 trillion market cap ng kabuuang real estate value sa US sa nakalipas na taon.

Ang pinakamabigat na sagabal ay ang byurukratikong karacter ng kasalukuyang registry ng real estate property. Ang paksang ito na may kinalaman sa land registry ay napakahalaga subalit ito ay hindi pinag-uusapan pagdating sa tokenization ng real estate.

Vision for Blockchain-Based Title Tokens

Upang patunayan ni Olkesii ang kaniyang opinion, binanggit niya na ang kaniyang Ph. D. research ay may kinalaman sa paksang ito. Para sa kaniya, ang tradisyonal na land registries ay vulnerable at nangangailangan ng mga intermediaries para sa registration at verification. Sa pamamagitan ng blockchain, maaaring i-automate ang mga prosesong ito, pagsasamahin ang kasunduan at registration sa isang transaksiyon. Sa halip na security token, iminumungkahi niya ang pagkakaroon ng “title token,” isang asset na magrerepresent ng aktuwal na record ng ownership sa blockchain.

Ang proposal ni Oleksii ay hindi ganap na mag-aalis sa role ng inetermediaries. Para sa kaniya, may mga situwasyon na kinakailangan pa rin ng mga registrars.

Sa bandang huli, ang ang gustong makita ni Oleksii ay isang isang “multi-chain system” na natutugunan ang isyu na may kinalaman sa transaksiyon at scalability. Sa ganitong paraan, ang blockchain technology ang magiging daan para sa modernization ng mga land registries at ma-integrate sila sa digital economy.

References:

Tokenizing real estate is a gateway to affordable home ownership

Tokenization of real estate: evaluating the promise of securitization