Price is set by supply and demand. That is why you often see irrationality in the markets. Despite all that, someday the markets have to reconcile with fundamentals. Eventually the market will represent the fundamentals only to move into irrational territory again. If there is a market or asset that exhibit the same type of contradiction again and again; you have a golden goose at your hands.

Congratulations on Your Gains

$HBD takes good things from both regular cryptocurrency and other stablecoins. Usually buying a stablecoin is a way to have a guaranteed loss due to inflation. The APR gained from stablecoin pools may at times be higher than official inflation figures. But we all know that the data does not fully reflect the loss of purchasing power experienced by fiat holders.

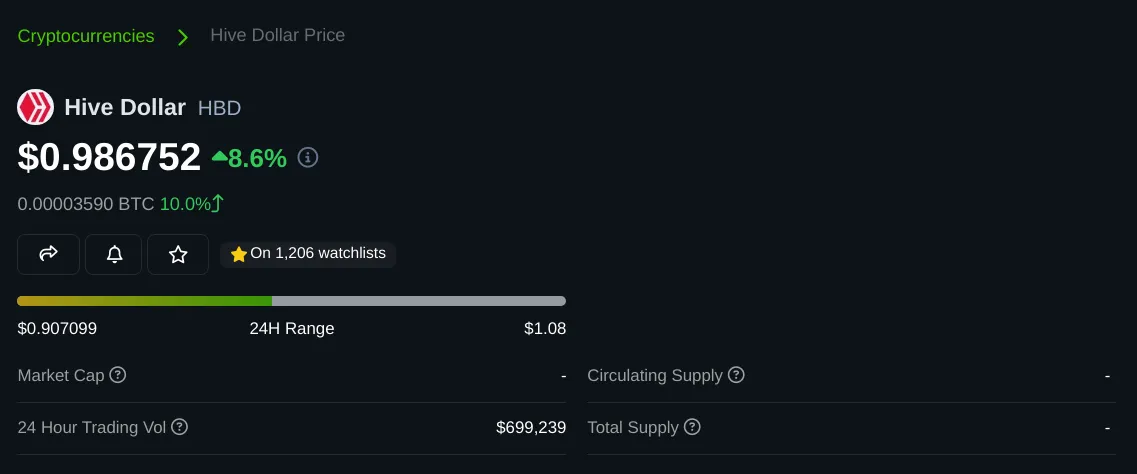

HBD has a 20% APR for the time being. That is a bigger interest rate than inflation and can be considered a real investment to engage in while rest of the cryptocurrency market goes down. I do consider it a wise strategy to buy stablecoins nearing the end of a bull market. But selling your crypto for stablecoins when we could be close to a new bull market is a bad idea. Even the some of most incompetent projects with bad tokenomics end up multiplying value when the hype reigns the day.

Special Advantages of HBD

We are the best stablecoin project IMHO. I say this based on what I have seen and researched. There could be other good stablecoin projects. HBD is at the very least; among the top!

Aside from the decentralization, we have volatility. I consider this to be a feature rather than a bug. Reaching the All Time Lows of $0.63 is a bad outcome. Reaching 90 cents on the other hand is an opportunity.

24 Hour Price Chart

7 Day Price Chart

90 Day Price Chart

After HBD Stabilizer started operating, the peg has been mostly stable. Based on historical results, we can expect the peg to be restored in a few days. Sometimes like yesterday, the difference in price is enough for a profitable arbitrage operation. I was distracted by other things in life. I did not manage to gain anything from the recent opportunity that was presented. At least I can prepare for a future arbitrage trade.

Check Fundamentals Before Investing

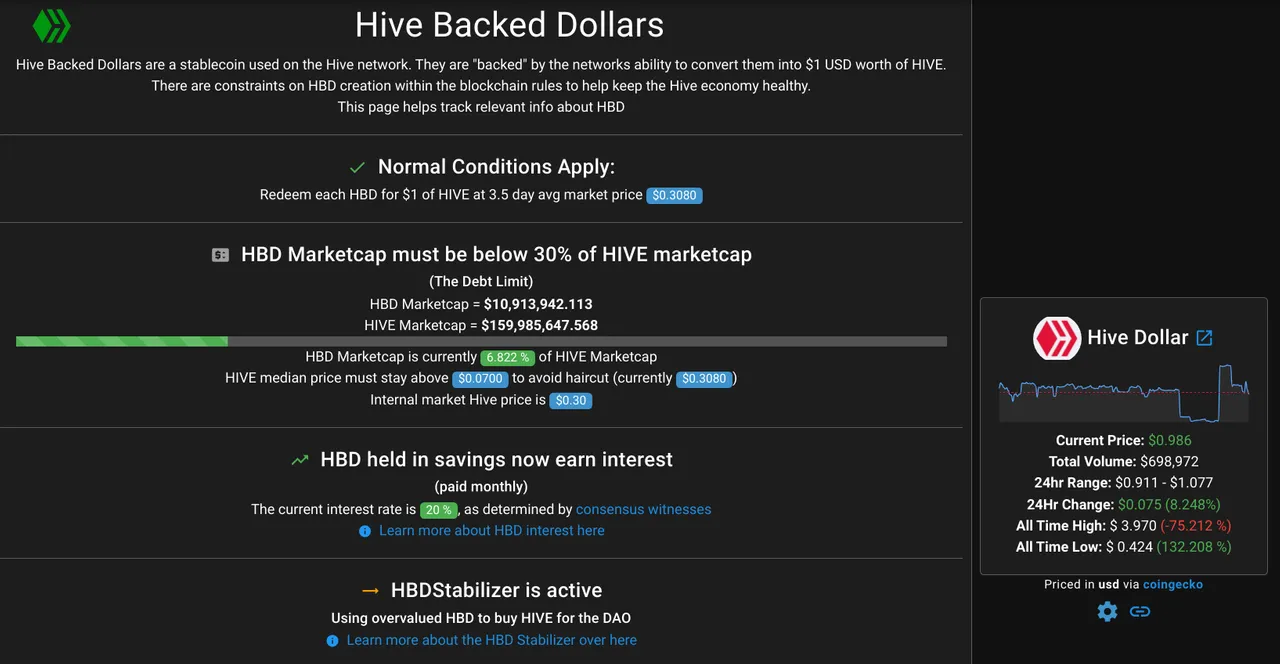

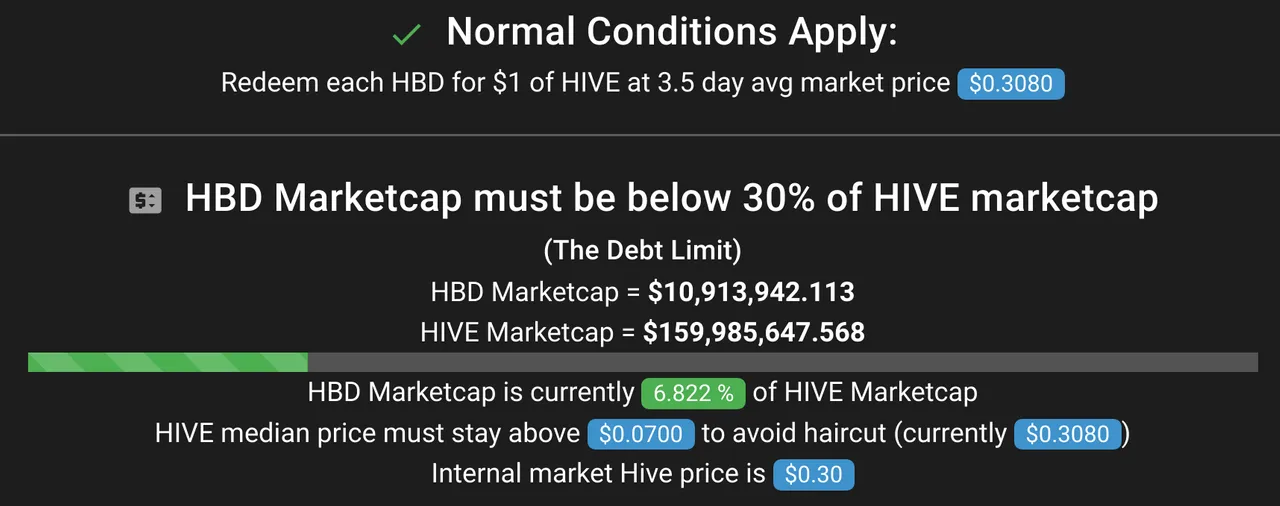

@ausbitbank is a HIVE witness and he has many tools that can be used to gain more insights about HIVE blockchain. Hive Dollar Monitor is one of them. Try not not be like the investors who invested into Terra (LUNA) after the disaster caused by their own stupidity. It is extremely risky to jump into a trade without a solid grasp in fundamentals.

When $HBD is not backed by $1 worth $HIVE, you will be taking a higher risk. You will have to bet that HIVE will manage to climb higher in price. I believe in HIVE for the long term. HIVE assets makes up the largest part of my portfolio. This is a long term investment. Swing trading and day trading should be handled differently. You won't expect housing market to act the same as commodities markets. You must prudently select the appropriate approach to the investments you are making.

This is The Most Important Part

I you don't think $HIVE will not make a new All Time Low by reaching 7 cents, you can start buying HBD when it is under the peg. Later you can set the orders to sell it a a profit. Trades on HIVE and HIVE-Engine are feeless. @vsc.network will allow users to choose between staking for a feeless experience or paying a small fees per transaction.

Keep in mind that a change in HBD supply can change the minimum HIVE price needed to avoid the haircut. It is best to keep Hive Dollar Monitor bookmarked. You can learn more about haircut rule on LeoGlossary.

Don't Forget $CUB and $POLYCUB

@leofinance is doing a good job spreading HIVE assets across Web 3. I don't consider it anywhere near sufficient. What we have is a convenient start that expose HIVE to more traders and more arbitrage trades. I wrote about this at length. I want all these projects to succeed. I have a stake in them. I can't write DAPPs. I'm going to be writing articles instead.

bHBD/USDC on PancakeSwap

pHBD/USDC on SushiSwap

These are phenomenal due to two reasons. HIVE + HBD have strong fundamentals. With the level of stability offered by HBD, it can be compared to a blue chip investment that is safe to HODL but also possible to go up few percentage points within a day. If Whales try to make any moves, they can cause a lot of slippage or not even have enough liquidity to support their trading needs. In other words we have a safe investment that is exclusive for the Minnows and (maybe) Dolphins.

I'm not even sure why these arbitrages are left alone. Are there any things that I'm not seeing here? Are investors completely out of the loop on prices or is there a missing piece?