KEY FACT: Tether has proposed launching a boron-backed token in Turkey. With the country holding over 70% of the world’s boron reserves, this initiative would use blockchain technology to tokenize boron minerals. While Turkey’s government acknowledged the discussions, they stressed that it is still in its early stages. Tether’s CEO, Paolo Ardoino, emphasized the firm’s commitment to Turkey, a key market for stablecoins, given the country’s demand for dollar-pegged assets to hedge against inflation.

Image Source: Tether, Etimaden

Tether Proposes Boron-Backed Token to Turkish Government

Tether, the issuer of the largest stablecoin by market capitalization, has proposed creating a Boron-backed token for the Turkish government. Boron, a primary element extracted from borate minerals, is a critical element in many industrial applications, and is abundant in Turkey, with the country holding over 70% of global reserves. This initiative aims to combine blockchain technology with one of Turkey's most valuable natural resources, creating a stable digital asset linked to boron reserves.

Turkey plays a crucial role in the global boron market, as the country holds the largest boron reserves and has been a top producer of this resource for decades. Boron is essential for industries such as energy, glass manufacturing, and agriculture, among others. It has strategic significance because of its use in advanced technologies, particularly in energy storage, aerospace, and green technologies. This has led Turkey to position itself as a key player in the boron trade.

In light of these strategic reserves, Tether's plan to tokenize Boron is a unique opportunity to create an asset class that could benefit both Turkey and the global market and will be considered a gigantic stride in the Real-World Asset (RWA) token category. RWAs are tokens that represent tangible assets or commodities from the physical world, like real estate, precious metals, or natural resources. A boron-backed token would represent a claim on Boron, linking the digital asset to a real, physical commodity. To qualify as an RWA, the token must be backed by actual boron reserves or assets tied to boron production, creating value through the connection to the underlying physical asset and this is what Tether is pushing for. This will give the Boron-backed token holders exposure to the real-world value of boron in a tokenized form.

Boron’s versatility as a commodity adds to the potential value of a boron-backed digital currency. Paolo Ardoino, Tether’s CEO, emphasized that this initiative would provide an alternative investment vehicle for Turkish citizens, further integrating digital assets into the country's economy.

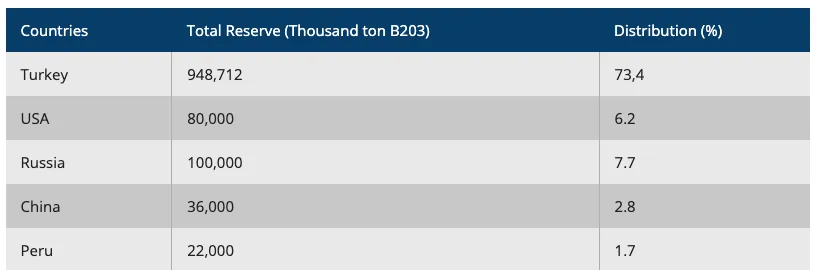

Turkey’s state-owned boron provider, Eti Maden Isletmeleri Genel Mudurlugu, estimates that Turkey holds over 73.4% of the world’s Boron reserves. The local government reportedly forecasts about $1.3 billion in boron sales in 2024. This volume is considered sustainable, hence, Tether’s suggestion for a digital currency backed by Boron in alignment with the crypto industry’s growing interest in tokenization of real-world assets.

Five top countries for global distribution of boron. Source: Etimaden.gov.tr

Tether's CEO, Paolo Ardoino, has emphasized that Tether is deeply committed to innovation in Turkey’s digital asset landscape amid massive adoption. He furthered that Tether’s commitment to industry adoption in Turkey has been increasing, with Tether’s local expansion manager, Anadolu Aydinli, meeting multiple local government officials in recent months.

“With Turkey emerging as a key hub for blockchain technology, we’re excited to continue supporting this momentum and exploring new opportunities for growth in the region.”

Turkey’s government acknowledged the discussions, however, a Turkish official said that Tether’s Boron proposal is not something that can be currently implemented. Another official at the country’s Energy Ministry reportedly claimed that the talks with Tether are at an early stage.

Turkey is one of the world’s leading markets for cryptocurrency adoption, particularly in the stablecoin sector. This is primarily driven by inflation concerns, as the Turkish Lira has experienced significant devaluation in recent years. Citizens have turned to stablecoins, particularly Tether’s USDT, as a hedge against inflation and currency fluctuations. Market analysts have also posited that USDT transactions represent a substantial portion of the crypto market in Turkey.

Tether's offering of a boron-backed token could add further diversification to the Turkish stablecoin market, providing a stable investment tied to a tangible and highly valuable commodity. The proposed token could also serve as a model for other resource-rich countries looking to tokenize their natural assets.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966