Unless you are living under a rock, you can't help but to notice Elon Musk is everywhere. He is far worse than the Kardashians at this point. You can't flip on anything without seeing his ugly mug.

As a fan of Elon I say that with the utmost of honesty. He is a very smart guy. George Clooney...he is not.

Nevertheless, he doesn't need to be good looking to be effective. So while he is conducting Twitter polls, he is sending the shareholders of Tesla stock into a frenzy. Of course, most of them are Wall Street parasites who deserve what they get. They always play their game which is on a quarterly basis anyway.

For all the attacks he took, along with the stock, there is something happening that is very interesting.

Let us take a closer look.

Source

Tesla Is Only A Car Company

This is one of the dumbest things said about Tesla ever. We hear this from the naysayers, mostly people on CNBC who are fools to begin with. If you believe Tesla is a car company, you certainly are not paying attention.

Maybe it is tough to swallow Tesla as a technology company. Okay, I get that. However, it is far more than a car company and one where anyone who talks about a decline in demand is foolish.

The technology part keeps emerging on a regular basis. For some, it might be tough to see. What should be crystal clear is that Tesla, at a minimum, is a battery company. This is an entity that puts batteries on the market.

Over the last few years, the company admitted it was battery constrained. All batteries were first slated to go into vehciles simply because it is more profitable to wrap a car around them. Whenever there was excess, that was then sent to the energy division (for stationary storage).

Thus, we can see how Tesla is a lot more than a car company. This is something that is going to become evident in the next couple years.

100%-200% Annual Growth

If you thought the 50% annual growth for the car division was absurd, wait until you see the energy division. Musk stated on the last earnings call that he believes the energy division can grow at 100%-200% annually for years to come. In the past he stated that it will likely be larger than the car segment.

He is right on the target size but might be underestimating the annual growth.

Tesla energy will far surpass anything the company does with cars. This is a certain due to the total address market for energy along with the penetration that Tesla is going to be making over the next couple years.

So while everyone is watching how many cars are being produced, mixed in with whatever Musk is doing with Twitter, they are overlooking this tidbit

According to the last earnings report, the energy division did $1.1 billion in revenues. This is a bit over $4 billion on an annualized rate. The profit was minimal, like $100 million.

Keep these numbers in mind when we talk about this one project.

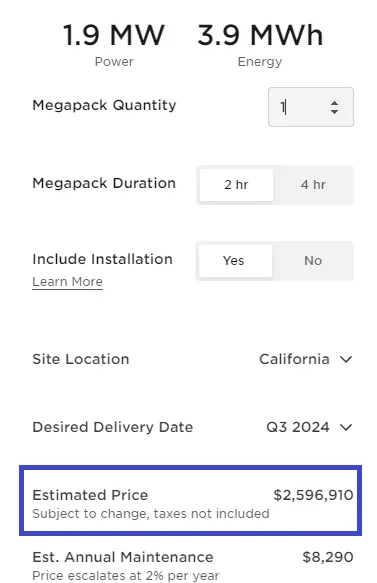

The Tesla Megapack is the flagship stationary storage device. This is for utilities to install to assist the grid. These things do not come cheap.

As you can see, they run over $2 million apiece. They are 3.9 MWh batteries.

Then we have this headline:

This works out to roughly 10,000 Megapacks coming from this facility each year once it is scaled up. At a price of over $2 million each, that is bringing in around $20 billion in revenues per year.

Not such a small number anymore. Of course, this is one factory and does not include the other product, the Powerwall. We saw recent run rates announced where they are now capable of producing 6,500 per week. That equates to over 70,000 per quarter.

With a selling price between $8K-$10K, we can figure that running into another $630M per quarter. Again, this is out of one factory.

Additionally, Tesla has increased Megapack output significantly at the factory. The manufacturer reported a weekly production capability of 42 giant Megapacks, up from 34 during the previous quarter. The automaker also stated that it produced 37,600 Powerwalls in the second quarter, but now it is capable of manufacturing over 6,500 Powerwalls each week, which would bring Tesla’s quarterly output of Powerwalls over 70,000 per year.

This is Giga Nevada. That facility pushed the Megapacks to a run rate of 42 per week. This equates to another billion dollars in revenue each year.

Not bad for a car company.

Perhaps this is why Elon is spending time on Twitter. He knows he had tens of billions in revenue coming in simply by scaling a plant that is already built.

Watch the numbers from the energy division over the next year. If we see the triple digit grow rates hit, it is game on.

This article is for information purposes and not financial advice. Author is a Tesla shareholder.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z