Inflation is a very emotional subject. It is something that really can hurt when it occurs. People are susceptible to falling for the headlines, rarely probing deep into what is taking place.

One of the major mistakes people make it to look at things through a short-term lens. Things are not unfolding as most believe. What is really scary is they especially do not happen for reasons people are led to believe.

I am sure you heard that "money printing" leads to inflation. This is a textbook argument put forth by people who memorized the same theories from the 1970s. The challenge with the academia world of economics is it is woefully wrong. What they espouse does not happen most times in practice.

If the Fed was responsible for the inflation we are seeing due to Quantitative Easing, then why did Japan spend the last 2 1/2 decade in a deflationary freefall? Aren't they the ones who invested QE? Does anyone remember the promises of Abenomics and the idea of spending Japan out of its troubles?

How did that work out?

There Is More To One Side To The Income Statement

It seems like most forgot this basic accounting function. There are two sides to the income statement. When the inflation discussion is undertaken, the income side is completely ignored. The only side that matters is the expense.

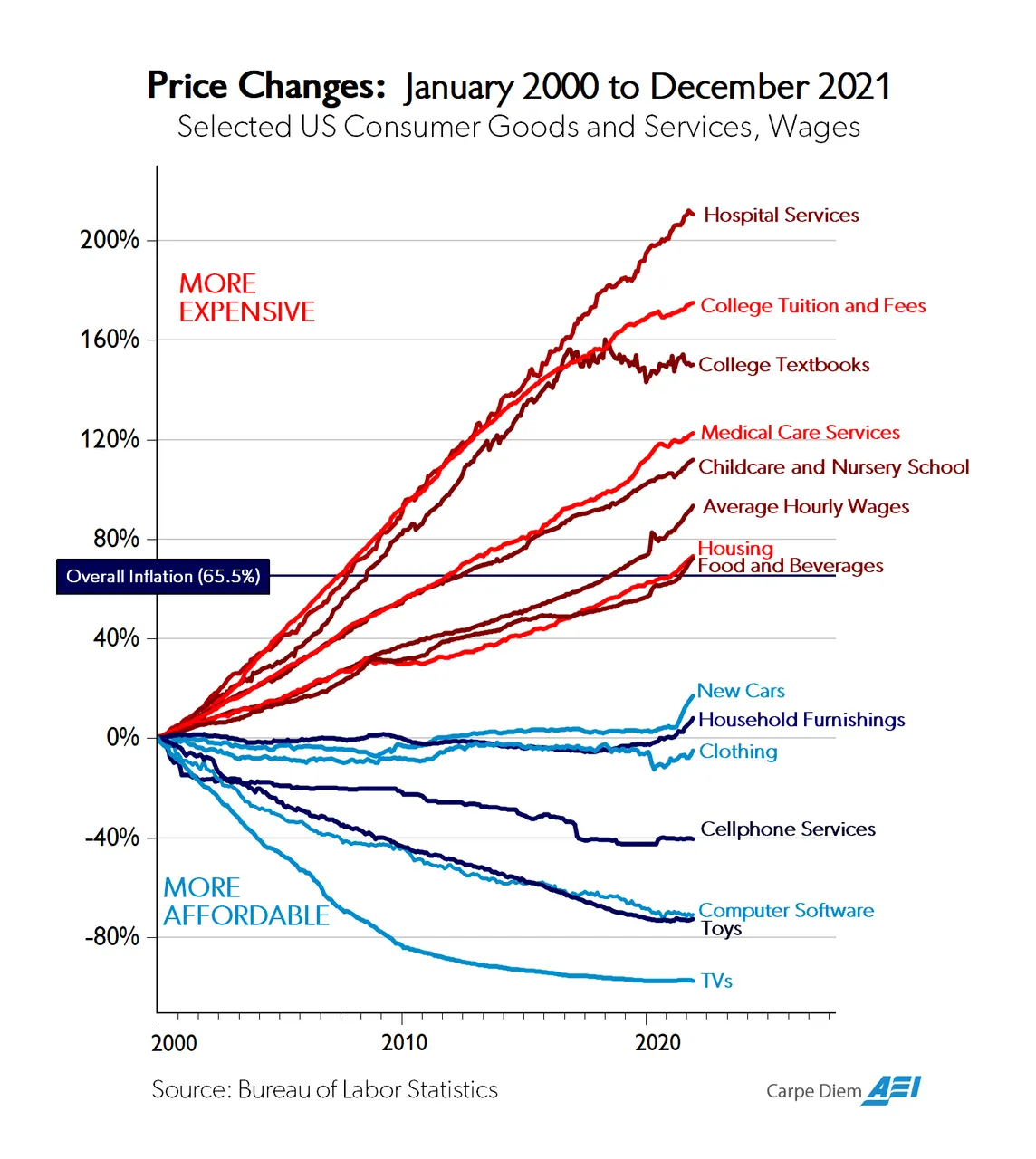

Mark Perry has one of the best known charts on inflation. He has compiled this over a number of years, continually updated every couple of years. As we can see, the chart tracks pricing of many items since the turn of the century. We are now dealing with a nice macro time period.

The first point to bring up is the wages are up 93.5%. The overall inflation rate is 65.5% meaning even items that saw price increases are more affordable.

Even items people traditionally point to such as housing and food great at a rate barely above the overall. This is still a big difference as compared to wages.

Here is where an important point enters the picture. The term "Real" means when inflation is pulled out. Hence, real wages are up over the past decade. The absurdity of the dollar buying less doesn't fit since people are receiving more dollars. Of course, with the household income is now over $62K compared to $500 in 1913, that is a huge jump.

Does that mean all is rosy and sunshine? No.

Government Interference

Do you not something about all the industries that deflated or are near even over the past 22 years? Is there something that jumps out?

These are all driven by free market forces. Competition exists along with technological advancement. Companies are continually trying to pick up more market share. To do that, they need to be cutting edge.

Where technology is allowed to flow, price plummet. Even something like cell phone service, nothing thought of as highly competitive, saw a big drop. Also, this does not take into account the hardware, with the price of phones dropping, especially compared to when Android phones were first introduced a decade ago.

Notice the top of the chart. What do hospital services, college tuition, medical care services, and child care all have in common? These are fields where there is a great deal of government involvement. Whether it is regulation, monopolistic practices due to lobbying, or government footing the bill, all see the same pattern. The ascent is fairly consistent and steady.

How come this industries that are mostly affected by government saw the greatest price increases while the ones where people were offered choices saw a massive decrease? Of course, this is a rhetorical question since it has been long debated, with the evidence clearly telling the story.

There are, however, a couple cracks in the armor.

Notice college textbooks. They actually decreased in price. Here is something that was completely out of control due to the monopolistic practice whereby students would be forced to buy a book for a particular class, often written by the professor teaching the class. That changed in the last few years. Here again, we see technology taking over.

When we look at the open textbook world we see how students can get them for a fraction of what they were costing before. Expect this line to continue down as more options are created online.

Speaking of online, the entire tuition situation is about to get upended. We already see that starting to slow a bit. Why is this? It is likely the combination of overcapacity, since we there are fewer kids compared to 20 years ago, coupled with the push for alternatives. Online education is going to become a bigger part of our future. The only hindrance is the acceptance of this schooling by corporations. Once companies start to accept that form of education, things will change radically.

Real Wages Tell The Present Story

We have inflation numbers coming in at 40 year highs. The latest number, for the month of January, came in at a blistering 7.5%. This has the hyperinflations going nuts.

Of course, they were wrong for 30 years so why should they be right this time? The fact is they will not be. There will be no hyperinflation in the US (which is an absurd thought because that is 50% monthly).

How do I know? Simple. Real wages.

Few actually take the time to read the actually unemployment report, instead opting for espouse the headlines.

Here is what the BLS report has to say about real wages.

Real average hourly earnings decreased 1.7 percent, seasonally adjusted, from January 2021 to January 2022. The change in real average hourly earnings combined with a decrease of 1.4 percent in the average workweek resulted in a 3.1-percent decrease in real average weekly earnings over this period.

Yes Young Skywalker, the Fed originally had it right: the inflation will be transitory. Of course, keep in mind that doesn't mean it will change in a month or two. Macro situations are timed in years, not weeks or months.

Here is a chart from Investing.com of the real wages:

Notice how 9 of the last 10 (10 out of 12) have been negative. This means that wages fell in comparison to prices. Here is the crux of the matter.

Ultimately, inflation stops because people cannot afford the higher prices. As stated on a number of occasions, after debt is exhausted, then people start to cut spending. We know credit card usage skyrocketed in the last year, along with the reduction in savings rates. This means people are running out of money, especially since the stimulus payments stopped.

What this all leads to is economic contraction (crash?) since households cannot keep up with the increase in prices. Once prices start to get rejected, we see inventories (a forward looking indicator) start to rise, telling us demand is softening.

Once that happens, the upward path begins to stall out. Like most things that run up fiercely, when things reverse, it can be hard and quick.

The longer this transpires, the more incentive for entrepreneurs to step in and create technologies that will reverse the situation. We saw this with oil in 2007. The price of $140 per barrel was not reached again.

A macro view helps us to rise above the temporary noise that the media and talking heads on television run on about.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z