Investment firm, Fidelity, has done some analysis about the pricing of Bitcoin. Through it, the Wall Street giant reaffirmed the price of Bitcoin of $1 million by the end of this decade.

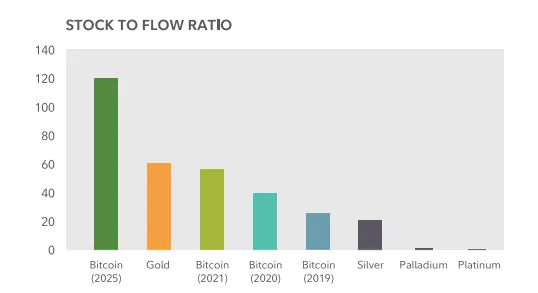

The analysis took a look at the Stock to Flow model that is used to size up the long term price movements of scarce assets. Typically, it was applied to the commodities sector but Bitcoin, since it has a limit to the number, fall into the category.

Assets that are looked at using this ratio tend to fall into two categories. They are either speculative or used for industrial purposes. Those that are scarce tend to fall into the former. This is where value is derived.

Historically, gold is at the top of the list in terms its resilience. This means that it holds up as a great store of value.

Bitcoin keeps closing the gap with gold. As the above chart shows, the halvings of the mining rewards every 4 years allowed Bitcoin to near the traditional asset.

The next halving, in 2024, will put Bitcoin firmly ahead of gold in terms of being a store of value. Hence, "digital gold" is affirmed.

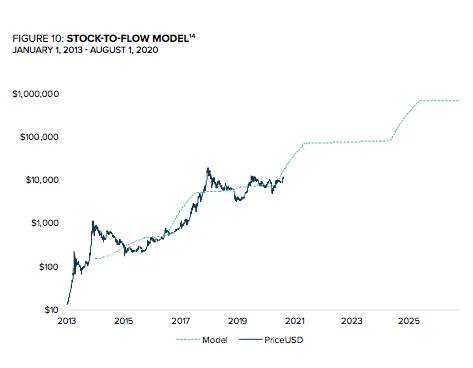

Here is how the model looks. The price is overlaid, showing an incredible correlation. There is no doubt that we can simply assume that this will be followed in the future. However, for more than a decade, the ratio has held up.

The Stock to Flow ratio is what many speculate will push the price of Bitcoin to $100,000 within the next year. According to Fidelity, following the path laid out, this will just be following the trend that is in place.

By the end of the decade, we could see $1 million Bitcoin.

Imagine what this would do for the rest of the industry if it comes to fruition.

If you found this article informative, please give an upvote and rehive.

gif by @doze