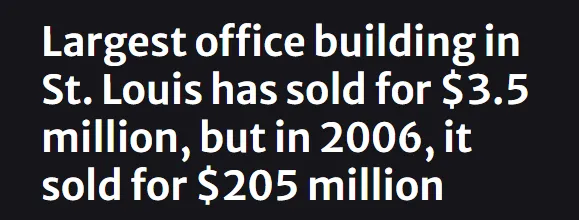

It has sold in 2006 for $205 million.

There is a major deflationary force coming upon us. This is the commercial real estate sector, specifically office space in urban areas.

We are seeing a total collapse in many major cities within the United States. The latest to make headlines is St. Louis.

For a century, the Railway exchange building served as the bustling heart of downtown St. Louis. Locals filled its sprawling, ornate 21-story structure daily, whether for work, shopping at the department store on the lower floors, or dining on the famous French onion soup at its restaurant.

Today, the building stands vacant, its windows boarded up. A fire last year, believed to be caused by copper thieves, left its mark. police and firefighters conduct occasional raids to search for missing individuals or evict squatters. Tragically, a search dog died during one raid last year after falling through an open window.

This is the result of decay in many of there areas.

Naturally, there are a variety of factors feeding into this. For this structure, it is evident the problem started long ago. In fact, it is probably the case for this downtown area.

That said, there is something else at work here that has to be considered.

Remote work

Things changes are great deal post-COVID. The lockdowns really turned the tables on employers.

At that time, there was a "unity" among both sides of the equation. Both employers and employees worked together. Remote work situations were set up. The mantra was "we are all in this together".

That didn't last.

Employees found out they liked working from home. The idea of having to sit in traffic and commute was unappealing. Suddenly, family time was possible with a better work-life balance showing up.

What did employers do, especially those headed by Baby Boomers? The old mantra went out the window and suddenly the back to the office push was on.

Unexpectedly, this was met with resistance.

Over the past year or two I wrote about the battle that was taking place. However, in my mind, it is game over. This is not a battle that is going to last long. companies simply will not win this one. Remote work is the future.

COVID did not create the work-from-home model. This was caused by the Internet. What the lockdowns did was show everyone what was possible.

Hence, 4 years after that struck, rates of return are still low.

The crash in commercial real estate is part of the fall out.

Occupancy Rates

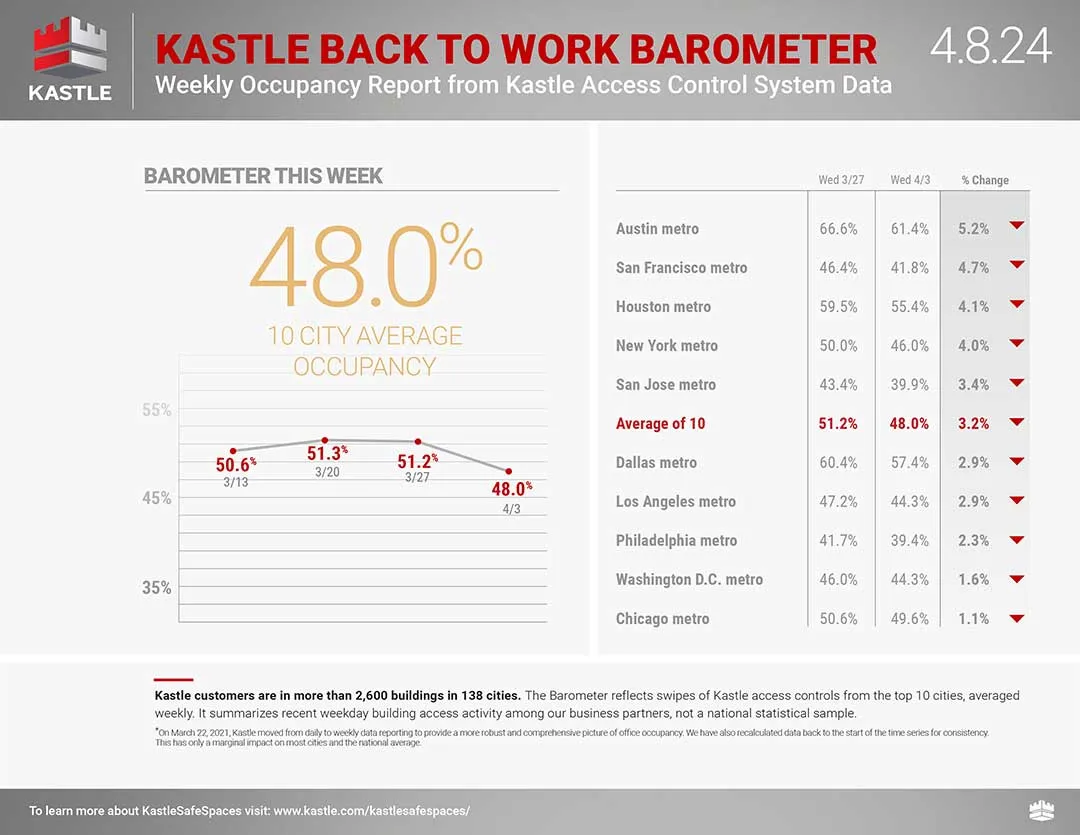

When we take a look at the occupancy rates, we can see how dire the situation is.

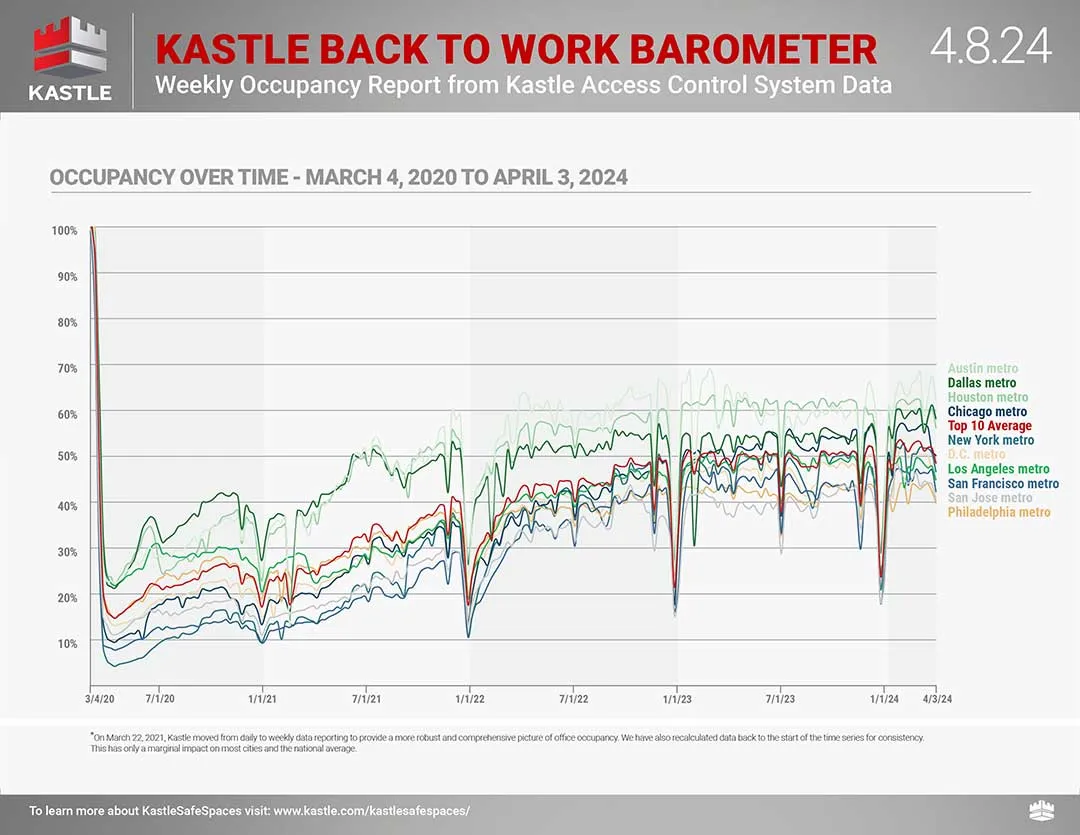

Over the last few weeks, we saw a drop in the rate in the 10 markets that this company, Kastle follows. If we step out, we get a better grasp on the picture.

Notice how we saw a major collapse in the Spring of 2020. From the nadir, we saw a steady increase as companies returned to the office. That lasted a couple years. Something interesting has cropped up since that time.

Since the Fall of 2022, basically 18 months, the rate has flatlined. The average has hovered around that 50% line.

This means that half the offices in these cities, as monitored by this company, are vacant.

We are starting to amass enough data that states we are not going to return to the old "normal".

Technological Age

What we are witnessing is in alignment with the technological era.

Remote work due to technology is a progression that should be expected. As telecommunications, computer networks, and AI systems get more powerful, the need to physically be in an area is reduced. Many jobs will either be handled by computers or done remotely. This is the logical step for knowledge work.

This is going to have impacts in many ways.

As I laid out in The Layout For The Globalization Of Real Estate, this is going to end up creating a global shift.

Real estate is never going to be the same.

We also discussed how @taskmaster4450le/starlink-is-going-to-change-real-estate due to providing communication services to remote areas.

All of this is converging to make the old office experience completely different. We still have generational tendencies to consider. Nevertheless, as the Baby Boomers (and GenX) head for the door, the younger generations, who grew up on the Internet, start to emerge.

The idea of commuting for an hour or two each way is not going to be on the agenda of these people.

This is going to have a major impact upon real estate. We can see a seismic shift forming. Commercial real estate is the first to show what is happening.

People want deflation, here it comes.