This is not a post that will focus upon token price. The markets are what they are and, if the value if there, it should follow. For this reason, I believe that if we can grow the user base we will see the token price will follow.

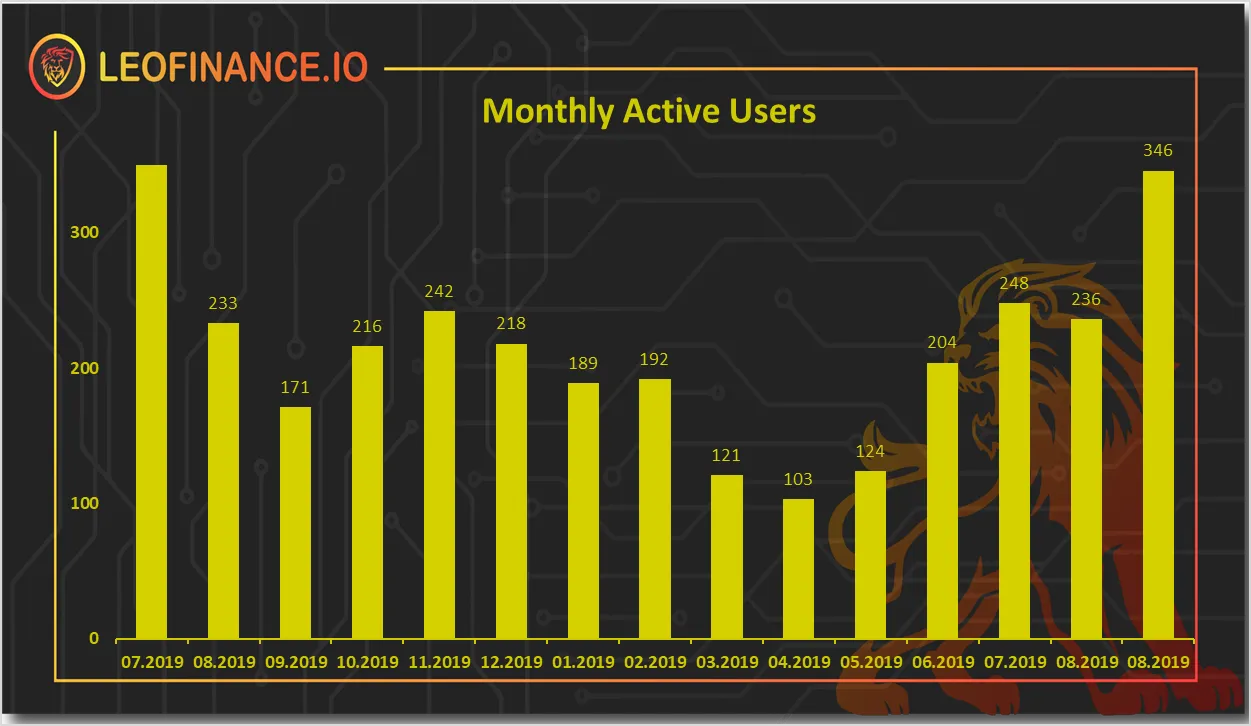

We can start by looking at where things are presently. This is the number of front end users throughout the year.

Notice how the month of September saw 346 users of the UI. This was up from 236 the month before. It also is an increase from the 103 users in April. This is more than a 3.4x off the low.

What needs to happen is a 100x from this point. That would put the platform at roughly 34,000 users. In the world of the Internet, this is a small number.

This is from Seeking Alpha's website. Notice how they have 15 million users per month generating over 40 million pages viewed.

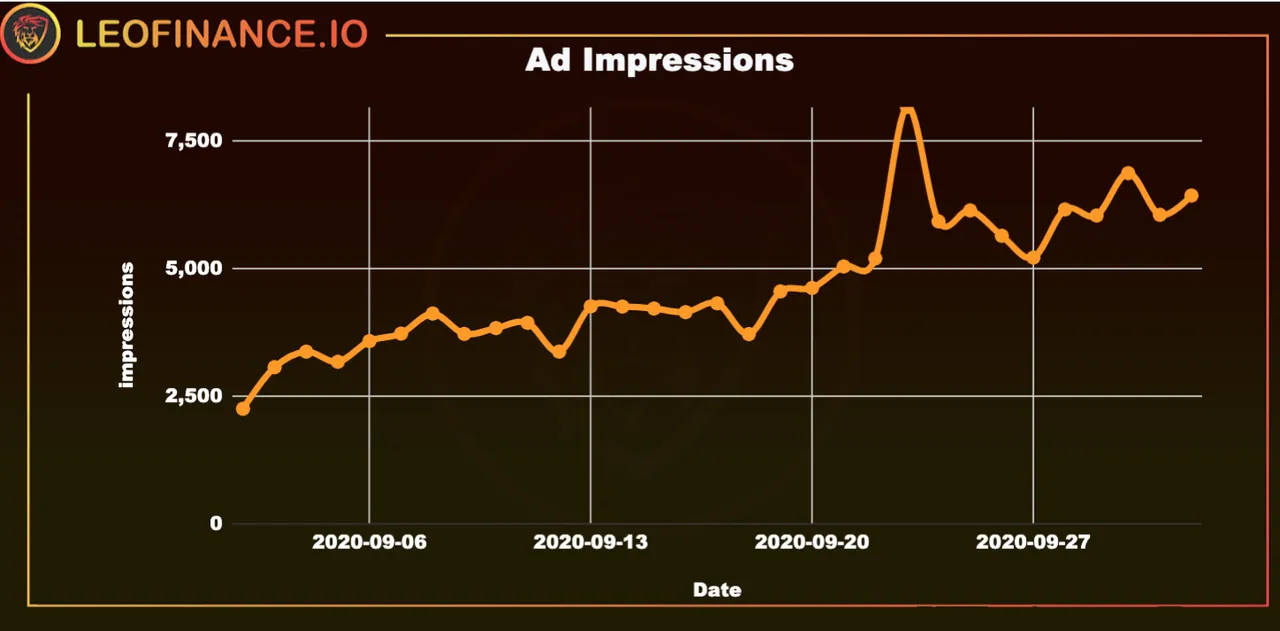

Let us contrast that with the impressions according the Leofinance's latest ad report.

This is an enormous difference. Leofinance is generating 6,500 pages per day while Seeking Alpha is over 1 million. When looking at things from this perspective, we can see how much of a joke 34,000 users really is.

Of course, this provides an enormous opportunity for Leofinance. Seeking that it already had a more than tripling in 6 months, we can start to guesstimate where things will look if we focus upon a consistent growth rate.

Using the starting point of 350 users, we can start to deduce what things will look like if we use certain growth rates.

While we witnessed a 3% over the past 6 months, it might be unrealistic for that to continue. So let us drop that to 2% going forward.

This is how things look if we utilize that growth rate:

September 2021 1,400

March 2022 2,800

September 2022 5.600

March 2023 11,200

September 2023 22,440

December 2023 33,600

How would things look if Leofinance had 33K users by the end of 2023? Is that a time period that we could wait for the growth rate to take hold? The inclination is to focus upon the quick hits and instant gratification. However, growth rates provide huge leverage when time is factored in.

Of course, if we want to look at the token price, 34K monthly users would certainly provide the value for the price to be much higher than it is now.

The question is how realistic is all this? We can manipulate numbers all we want in forecasts. Yet, the key is to followed a path that is sustained.

With all that is taking place, we could see something like this taking place. We must remember that, it took Steem only a couple years to achieve 1 million accounts. While most of them left, the core issue here will be retention. The fact that Leofinance is focused upon a particular market could help to keep users once they arrive.

For those who think that not much attention is being paid, it is best to look at the Butterswap project. They chose Leofinance to post their information regarding the events unfolding with that project.

@coin8/introducing-butterswap-a-democratized-amm-for-everyone-dux4z

Here we see a project that opted to post on Leofinance due to the community that exists. This is a point that cannot be underestimated going forward. Showing cohesion is vital for other platforms looking in.

Going forward, as more features roll out, it is very possible to see a doubling every 6 months in the number of users on Leofinance. This is not an astronomical growth rate considering the starting point. There should be a few years where this rate is not too difficult to attain.

Leofinance will be a rather large blockchain project with just 34K users. It is not as if we are forecasting the 15 million that Seeking Alpha presently has. The bar we are trying to attain, at least in the medium term is much lower.

Imagine what this would do to the token price if this comes to fruition.

If you found this article informative, please give an upvote and rehive.

gif by @doze