There is a lot of talk these days about "the singularity". When this occurs, what they are referring to is the technological singularity. There are many components to this, outside the scope of this article.

Basically, this concept states the technology will advance to the point where computers are better at everything as compared to humans and the rate of progress (knowledge) will be such that each day sees a larger separation.

This is still an unproven theory, one that is debated by experts. It does appear, however, the consensus leans toward it happening at some point. Thus, even if the when is all over the map, the if is mostly agreed upon.

Another hot topic is whether this is of benefit or not? Again, here is where people are simply forecasting since we do not know.

One favorable factor is technological history.

Technology is a double-edged sword. It is neutral meaning it has both positive and negative impacts. Overall, while there are downsides, society has benefitted more.

This is simply history. There is no guarantee it will repeat itself in this instance. AGI is feared by many yet ASI amounts to generating a completely new species.

Alas, that topic could cover a hundred articles.

For now, we will focus upon another singularity that will arise.

The World Will See The Economic Singularity

Over the last 6 years, I discussed the Age of Abundance. This is simply another way of phrasing the idea of an economic singularity.

For the last 200 years, we have basically operated within this state. Since we are dealing with a long timeframe, it is easy to get lost in this fact.

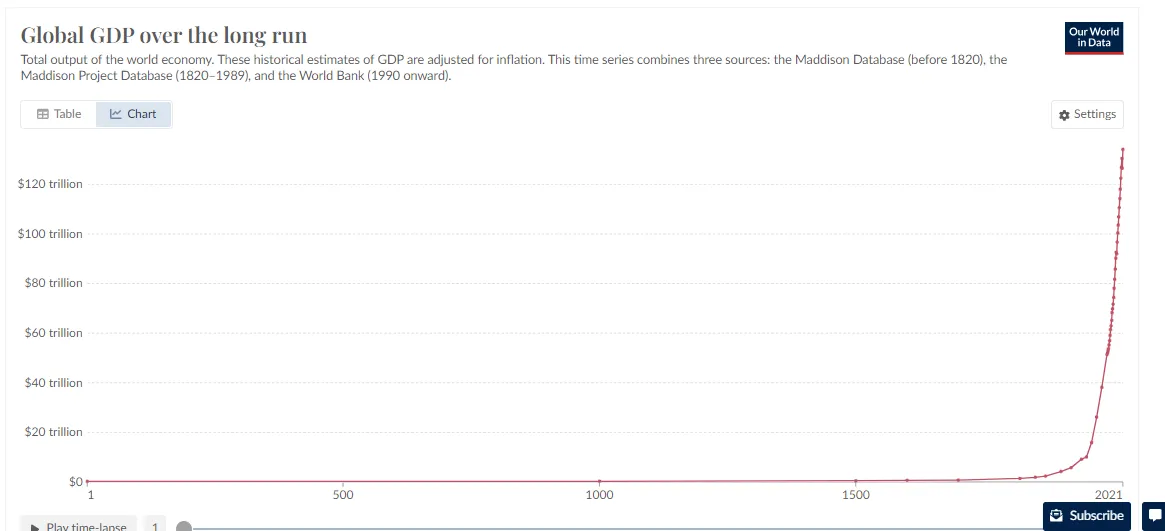

Here is a chart put together by Our World In Data.

As we can see, for much of human history, the needle did not move much at all. It only started to perk up around 1820. At that point, the number was $1.4 trillion.

Going forward, the elbow was around 1950. Here we see a total of $10.09 trillion. From there, it was liftoff.

If we overlay this with how society changed, we can see it clearly. Life before 1820 was mostly an agricultural society. Commerce was a part of the equation but things were completely physical. In other words, it was nothing more than an analog world.

The 1950s through today saw two major ages.

First we had the electronic age. This moved us away in an early form of automation, even if more mechanical than today.

After that, we saw the explosion of the digital age. This is what we reside in now. If we look at the fractals of this chart, we would see a similar shape if we looked from 1950. The rate of growth only accelerated from the immediate post WW2 period.

The digital age sent things skyrocketing.

Continued Acceleration

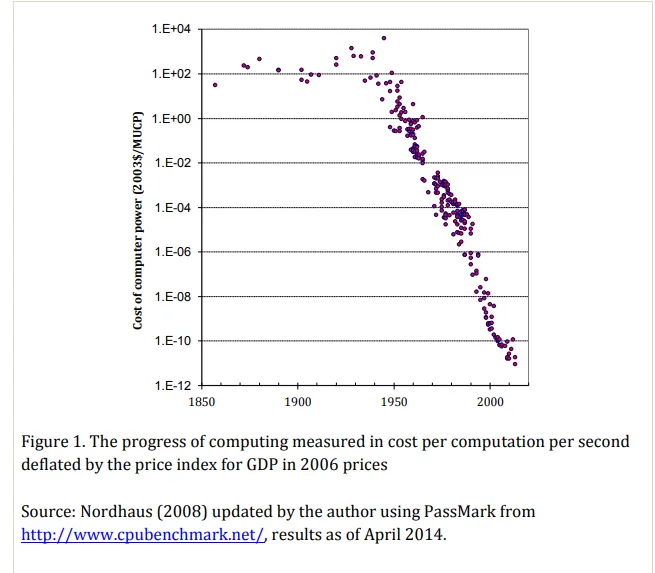

At the center of this is the cost of compute. Here is where we see the game changer.

By looking at another chart, we can start to see the parallel. This is dealing with declining cost, so the graph is an inversion.

Notice a similarity?

We see the elbow around the same period, the 1950s. While this is not exact, there is an impact that we are feeling throughout the entire world.

Many feel this is not going to continue.

However, we are now being immersed in the world of generative AI. This means GPUs are starting to be center of all progress. NVIDIA is the top banana when it comes to this realm.

Here is something that is important to note in a comparison of the H100 to H200.

The H200 not only provides enhanced performance but does so at the same energy consumption levels as the H100. The 50% reduction in energy use for LLM tasks combined with the doubled memory bandwidth reduces its total cost of ownership (TCO) by 50%.

This is only one piece of the puzzle but it does show how the trend is continuing. We also have different software architecture, advancements in compression, and other aspects that are also improving performance.

Economic Output

Gross domestic product (GDP), the metric in the first chart, is actually understated.

To be honest, it is outdated yet we fail to have an adequate replacement. The problem is it fails to capture something that is zero.

For example, in the mid 1980s, there was a cost for music. People purchased cassette tapes or CDs. These cost anywhere from $7-$15.

Today, we have access to millions of songs, on demand, without spending a dime. Where did all the money go? It obviously left the recorded music industry. Sure, we can use the subscriptions of something like Pandora or Spotify but that is a drop in the bucket compared to what took place before.

Basically, the cost of one CD in the 1980s is a month's subscription. That gives one access to more than 40 million songs.

This is the epitome of the digital world. We can see the same thing in gaming. There use to be a per game cost, where people bought cartridges for their systems. The industry now operates on an entirely different business model, one that allows playing for basically free.

The expansion of this world (digital) is enough to continue the increased economic output. What we have, actually, is something else that is going to keep the exponential curve going.

It is what will really bring about the economic singularity.

Robotics brings the digital world to the physical. It spans the world of bits to atoms. Here is where the massive disruption, from a societal standpoint, is going to occur.

Economic growth tends to come mostly from expansion of the population and technology. Again, this follows the exponential line we saw for the last 200 years.

What happens when both can move at paces we never saw before?

Robotics is going to allow the world to add hundreds of millions of new "workers" each year. Actually, it is plausible we see this number getting into the billions.

This is only one aspect of the equation.

With more robots, we start to enhance the capabilities of the AI. At present, spatial is still lacking. We are starting to see more of that added with the ability to train on video. Robots are going to be massive data collectors as they operate in a 3D environment.

Here we see a powerful feedback loop that keeps accelerating.

In the late 1980s, mobile phones were toys for the wealthy. Successful doctors, lawyers, and business people owned them. The cost for the equipment was out of reach for most and the airtime charge exceeded a dollar per minute. At the same time, the service was awful.

Time travel to today. We have billions of mobile phones (that are actually computers) all over the world. People in developing countries have them. No longer is the airtime charge in dollars per minute. The devices themselves are also, in many instances, under $50.

No consider the exponential when one simply logs into a chatbot and enters a few prompts. The information available with bit of typing outpaces what the top leaders has access to 40 years ago.

As this spreads to more industries, the trend will continue. Robots put more sectors under the laws of information technology, which operates under a completely different set of rules as compared to the physical world.