There is a lot made of the yields earning in cryptocurrency by staking. This is something that added a dimension to the speculation approach favored by so many.

While it did not eliminate that, it is a supplement to what people are doing. For example, while waiting for their favorite coin or token to moon, they can earn a bit more by receiving some yield.

It is not a bad way to approach things.

Ethereum Make News

The most notable coin to do this was Ethereum. When they switched from Proof-of-Work (PoW) to Proof-of-Stake (PoS), the ability to stake was presented to holders. This pays out at a 4% yield.

This got the attention of people like Raoul Pal. While he is purely a speculator and doesn't really go for yield. he did see the value in the opportunity that Ethereum is presenting.

Understanding how there is a huge market for fixed income instruments only enhances the appeal. Many can receive a bit of a return in addition to the price moves made by the market.

Over time, the yield decreases as more ETH is staked. Nevertheless, when compared to the rates on most fixed income assets over the past decade, this is still rather strong.

The Return on HIVE

We are seeing something emerging with Hive that blows this away. We often focus upon the stablecoin and the 20% APR that the Hive Backed Dollar (HBD) is paying.

However, the other base layer coin is offering something that really stands out.

When $HIVE is power up (creating Hive Power) we see something interest emerging.

To start, there is an adjustment paid to HP wallets for inflation. This decreases over time as the coin is disinflationary.

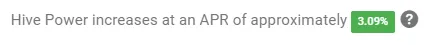

According to PeakD, here is the rate (as of 24 hours ago):

It is now paying 3.09% on an annual basis. This is a bit below what some other opportunities are paying.

However, this is just one aspect to the equation. There is also a more active approach which cannot be overlooked.

Using Hivestats, this is what the curation APR was on my account:

We see a return of 8.94%. That put the total return for Hive Power over 12%.

In the world of finance, this is outstanding no matter how you break it down.

Granted, there is some activity required. To garner the curation return, the button on the mouse has to be pressed at least 10 times each day.

That said, a 12% return will really enhance an account over time.

Overlooked Gem

Some of us believe that Hive is an overlooked gem in the cryptocurrency world. It is a forgotten animal while people focus upon the shinier objects that are out there.

In the meantime, building takes place. One of the keys, on an individual level, is to keep active. The idea of each account being a business due to monetization is something often espoused.

How many assets out there can provide a 12% yield? Even in cryptocurrency where the returns are known to exceed traditional finance (or TradFi), we do not commonly see this. Yet this Hive, we can count roughly forecast the return based upon the change in the inflation rate over the rest of the decade.

Of course, we are leaving speculation out of the discussion. I operate under the presumption this network will get more valuable over time. As it does, that will eventually be reflected in the price of the value capture token by the market.

Again, while we wait for the mooning, it is nice to keep filling our bags a bit more.

Compounding Effect

There is no doubt that Hive offers an opportunity to compound our returns. We can easily see how the APR turns into an APY as time passes.

The payouts are not in liquid $HIVE. Rather, one receives Hive Power for the inflation adjustment as well as curation. This means we are garnering a return on the coins that were distributed as part of the earlier return.

None of this discussion includes post payouts or layer 2 tokens. We are simply dealing with curation and inflation adjustment. Yet, with just those two, we see a 12% return.

Of course, when we factor in other possibilities, we see how even greater returns can be garnered. Those require having a belief in some of the Layer 2 projects. Nevertheless, those opportunities exist also.

logo by @st8z