The last few articles were leading up to this one. It was actually a design to pull different pieces under one umbrella.

In this article we will cover how Hive has a circular nature that is not seen elsewhere and the fact that it is an access token means it operates differently than most other cryptocurrency, even other base layer coins.

All of this is very good for those involved with Hive. Today it is an overlooked gem. However, those who understand the tokenomics along with how the components fit together will see the amazing opportunity that exists.

For this reason, everyone should get excited about making Hive their home. It is a situation that is hard to find anywhere else, either within or outside of cryptocurrency.

Access Token

Hive Power is what provides access to the blockchain. This is something most are familiar with. By staking $HIVE, we are able to gain resources credits which allow base layer activities.

In the last article, we discussed the idea of a million user application. The idea was to encourage people to think about something bigger and having numbers that really alter the path of Hive.

Here were a couple of the comments:

There are a few projects working on it as we can see. Whether they get there is not relevant. The fact that some are thinking in this direction is vital.

It is an important criteria in the future of Hive.

Hive Backed Dollar (HBD)

We discuss the Hive Backed Dollar a great deal on here. This has the potential to be one of the most powerful stablecoins there is.

Here is what I Tweeted about it:

When it comes to international payments, this is a game changer. Compare this to the likes of Western Union, BIS, and the rest of the international financial system. Even when we look at cryptocurrency, it is unrivaled. Visa might be able to compete with it on transaction time yet it charges merchants a fee for each transaction plus the settlement time is a day or two.

We also covered the how Venezuela is making HBD a reality. This detailed the events that are taking place in nations like this. HBD is a payment system that not only offers what was just described yet also provides these individuals with access to the USD as opposed to their native currency. This is vital because they are doing so without having to deal with either their national banking system nor physical banknotes.

HBD simply offers more security.

Many feel HBD takes away from $HIVE but the exact opposite is the case. An increase in activity relating to HBD is only going to require more Hive Power.

HP is needed to use HBD.

Transactions

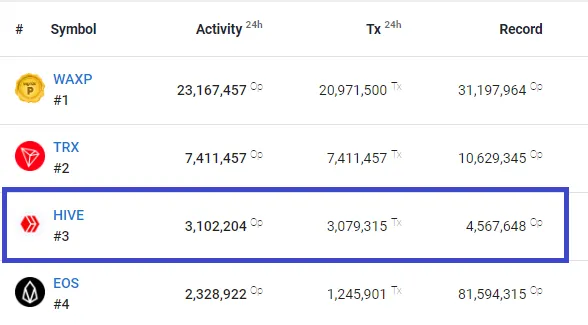

Hive is always known for being one of the more active blockchains. What makes it unique is the fact that Hive transactions are not all finance based. Where most other operate as a ledger similar to a bank, Hive encompasses the social media aspect of things. Here is where we see things diverge greatly.

Social media coupled with finance is the future. We see this with what Elon Musk is proposing with Twitter. That said, Hive is in position to start taking advantage of this.

According to Blocktivity, Hive was over 3 million transactions in a 24 hour period:

Here is the crucial point: each of these transactions requires some Hive Power. Someone has to provide the resource credits to engage with the blockchain. Due to the resource credit delegation feature implemented in Hard Fork 26, this does not have to be the end user. Nevertheless, from a system standpoint, it has to be created.

Going back to the original feature put forth, what happens to the number of transactions if we have an application with 1 million users? In fact, how do things look if we have 1 million daily active users regardless of what they are using?

Network Effect

By now we grasp that $HIVE is a value capture coin. Whatever occurs within the ecosystem is valued there. Of course, markets might be awry in their estimation but that is expected.

The fact that this base layer coin is an access token means that any network effect that occurs is pushed there. If activity on-chain increases, demand for $HIVE follows out of need.

Where can this come from?

Here is where we see the true potential on the future impact of the price of $HIVE.

The activity on-chain can come from either social media engagement or finance, it matters none. In fact, the more social media transactions occurring, this is compounded by an increase on the financial side.

Most features of Hive has a financial component to them. When we give an upvote, there is a financial transaction that results. Both the content creator and curator are paid after the 7 day voting window closes. That means each upvote affects two payouts.

This delivers HP and possibly HBD to people's wallets. What happens from there? Do people put the HBD into savings? Is it swapped for $HIVE on the Internal Exchange and powered up? Is the HP powered down and turned into HBD, then used to make a purchase in Venezuela?

As we can see, an assortment of other transactions and activity can occur. The network effect on Hive can come from many different areas.

Of course, all of this requires resource credits.

This is the circulate nature of the Hive economy. Ultimately, it all feeds back into the main coin because of the fact it is an access token. There is no way around it.

Hence, the only variable in the equation is getting to the point where the growth rate eats up most of the existing Hive on the market and then outpaces the inflation rate.

It all fits together very well.

Are you excited yet?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z