The Hive Back Dollar (HBD) is a unicorn within the cryptocurrency world. We discussed it at great length, showing how the tentacles are starting to spread. While utility is still a bit limited, we are seeing things happening that are going to enhance its power.

As this occurs, it is a way to drive Hive forward.

When thinking about a currency, most only consider the use cases as a payment system. Unfortunately, this overlooks the areas where the real numbers exist. The number of transactions (in addition to value) is dwarfed by the financial applications as compared to commerce. Payments are a minor element of use cases for a currency.

The Hive Backed Dollar is fundamental to driving the Hive economy. Currency is required to facilitate trade. This is its role. Because of that, if we want the Hive to thrive, we will see HBD as the centerpiece.

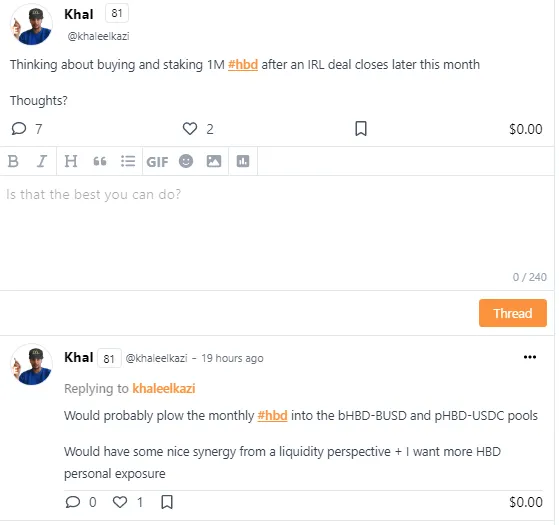

We had a recent Thread posted that exemplifies how HBD can unfold and how long its tentacles are.

This is an exciting decision if it comes to fruition. Let us look at the impact of this as it filters through the Hive economy.

Acquiring 1 Million HBD

There is no doubt that HBD is in rather limited circulating supply. That means we have the situation where liquidity is lacking. Therefore, it is almost impossible to acquire HBD on the open market. To reach the goal would require weeks (if not months of buying).

It is obviously an issue that these Threads look to help with. Before getting to that, we have to look at how one even goes about getting 1 million HBD.

There is really only one way to acquire this type of stake. It requires purchasing $1 million worth of $HIVE from the exchanges and then using the conversion mechanisms to create the HBD. At the present pricing, this is 2.5 million.

Hence, the decision to put $1 million into HBD savings is going to require the purchase and conversion of roughly 2.5 million $HIVE. This will reduce the supply of that coin, instead transferring the value over to HBD.

This shows the relationship between HBD and $HIVE. It is a two-coin system at the base layer, allowing the value to be transferred back and forth.

1 Million HBD Locked Up

Here we have a situation where the desire it to use HBD as a fixed income instrument. The money put into savings will stay there. It is an ideal use case for time vaults and one of the reasons why they are needed on Hive. This could be an instance where the user would be willing to lock up the HBD for a year or two in an effort to gain yield.

Nevertheless, the HBD will be in savings and not in a liquid state. From a liquidity standpoint, this did not create any extra while removing the $HIVE from the open market. This is a mechanism few discuss but can be very powerful.

At the present interest rate, we have a situation where it will net 16,666 HBD per month. The second part of the Thread is very important and really starts to show the tentacles.

Derivatives Locking Up More HBD

pHBD and bHBD are derivatives of the base coin. These operate on other blockchains, hence require a bridge to access. Under the proposed scenario, we have 8,333 HBD going into each of these tokens. As we can see, it will be used to enter the liquidity pools.

It is at this point that an understanding of the dynamics is important.

When one "creates" either pHBD or bHBD, the HBD is sent from the user to an assigned wallet. This is how bridges are created. The HBD is moved on Hive to the appropriate account with the token on the other blockchain being distributed.

Thus, even the new HBD created is not completely liquid. Instead, it goes as a backing agent for the derivate created on the other chain (also known as a wrapped token). This means that a portion of the liquidity pool can be placed into savings, earning a greater return.

Each year that passes, another 200K HBD is produced, transforming into the associated derivatives and moving the use cases outward.

Liquidity

Even though liquidity is not created in HBD, it is generated. Here we see the number of tokens on the other chains increasing. Since the plan is to dump them into the liquidity pools, this will provide more liquidity at that level.

Ultimately, we could see this idea expand to a HBD derivative-BTC. Since regulators appear to be cracking down on the exchanges and different cryptocurrency, it appears that Bitcoin is one of the few safe ones. This is likely going to take an added turn for HBD since it is an algorithmic stablecoin. We can bet the ranch that regulators are going to ban it from CEX.

This means that decentralized options are the path we will take. Liquidity pools and other decentralized finance choices is where the focus has to be. This one decision will solve that. It is going to add roughly $16,666 each month to the pools on BSC and Polygon.

As we can see, the impact of a move like this occurs on many levels. This is the power of HBD. Things do not happen in just one area.

Imagine if the $16K per month was used for development. What would that do for the Hive economy.

Another Shop in Sucre Accepting HBD

The folks in Sucre are really working to spread the word regarding Hive and the power of HBD. Each month, they are signing up new businesses that accept the currency. This is a strong basis that could become an essential part of the local economy.

Here is the announcement post that Cumana Makeup has joined the mix. This is just another example of how the tentacles of HBD are spreading.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z