There was a bit of a controversy stirred on Twitter about the Hive Backed Dollar (HBD). Evidently someone took to calling HBD a scam. This got the Hive army going, creating some pushback.

What we have is someone who evidently has no clue about HBD yet, simply due to the 20% APR, it has to be a scam. This should come as no surprise because we have many on Hive who claim that this is unsustainable.

Sadly, what this reflects is a misunderstanding about money, economies, and how the financial system works. We see this all over the Internet, people taking nuggets of information and believing that is the totality of how things operate.

Over the past 18 month, we discussed HBD in great detail. The idea that the 20% rate is a scam is utter nonsense. Yet, so is the idea that it is unsustainable.

People's views make them believe something that is not reality. One of the problem is few take the time to think about the development of an economy from the ground up.

In our discussions about HBD, we delved into some of the particulars.

HBD Scam

Here is the atypical exchange on Twitter. Before starting I will admit I know nothing of this person. However, it is the usual "I am an expert so let me guide you". I would presume he talks about cryptocurrency while thinking he understands money. That appears to be the norm.

So let us look at this situation.

He concludes its a scam, based upon a 20% APR. In this guy's mind, that is impossible. How could 20% inflation rate in a currency be anything but a scam?

Of course, to even begin to answer this, some question might be asked?

They are:

- what is the present circulating supply of the currency?

- how much of it is freely circulating?

- what is the velocity tied to this currency?

- what derivatives were created from this?

- how wide is the currency distributed?

- what payment platforms are in place? (in crypto this is present by default)

- are there lending applications?

- does this lead into any funding or investing projects?

All of these are legitimate questions to ask about a currency. Do you think our "Twitter expert" know the answers? Of course not. There is a segment of Hive that doesn't even consider this.

When it comes to cryptocurrency, we are dealing with something that is still in the very early stages. The transformation of the existing financial system is going to take decades. We are basically a few years into this.

For that reason, even if things aren't in place, what are the plans to implement them. Many of the answers to those questions is in the negative at this moment. That said, for much of it, we know infrastructure is being built. It is hard to provide an application without that. Unfortunately, we have to get the cart and the horse in the right order.

So knowing HBD is not a scam, we have one other question.

Is 20% APR On HBD Sustainable?

This is something that many, including those on Hive, claim is not sustainable. Why is that? How come a 20% rate of expansion of the money supply is not feasible?

The answer is derived, by many, looking solely at the existing system. Again, if we act on ideology, we can be led astray.

One of the challenges of looking at the existing money supply is there is already a distribution. With HBD, we are starting at a very low level.

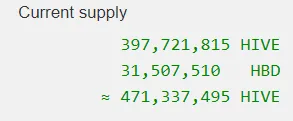

The first question above was "what is the present circulating supply"? For HBD it looks like this (pulled from Hiveblocks):

There are 31.5 million HBD in total. However, we have to deduct the 20.5 million locked in the decentralized hive fund (DHF). This leaves us with a free float of roughly 10.8 million.

That is our starting point.

As a bit of fun, let us map out HBD compared to Tether. That stablecoin has roughly 80 billion in circulation. How long would it take HBD to get there? Certainly we know HBD can be generated in ways other than the interest paid. Nevertheless, it will help to frame things for us.

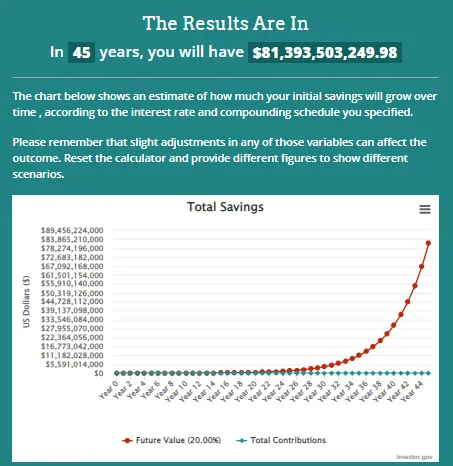

Here are the results:

There answer is we can pay 20% interest on HBD and it will take us 45 years to get what the market cap is on Tether today.

We are presuming that every coin that is not in the DAO is in savings and earning interest which is not the case. That means the actual time will be a bit longer.

Therefore, by this metric, not only is the 20% sustainable, it is still eclipsing the lifetime of a good percentage of us before if even arrives at Tether.

The US Dollar

If we are going to change the system, perhaps we should look at the top dog. In today's world of currency, that is the US dollar.

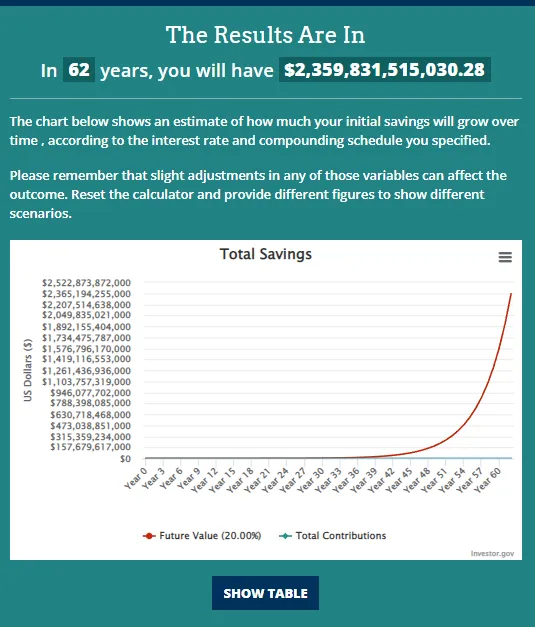

Using the same parameters, how long will it take to equal that?

Here we start with the circulating supply of dollars. Keep in mind this is only banknotes, the physical currency that is distributed by the Federal Reserve. This is a small portion of the total dollars used for commerce and finance, since most of those are digital. Nevertheless, it does provide a target while also showing the enormity of what we are dealing with.

As we can see, from the latest data posted by the Fed, there are $2.3 trillion in USD banknotes around the world. This is significantly higher than the amount of Tether.

Plugging this target into our calculations, here is what we come up with.

If we started today with 10.7 million HBD in savings, paying a 20% APR, it would take us 62 years until we equaled the USD banknotes. This is not the deposits that are in the banks which are "digital dollars". This is the actual currency which we know is used in only a small fraction of the cases.

In Conclusion

The evidence is clear. HBD earning 20% in savings is sustainable for decades to come. The idea that we cannot inflate the supply of this coin is based upon nothing more than trying to transfer knowledge from an existing system. None of this is applicable.

Of course, there is a caveat to all this. Utility for Hive's stablecoin is required. Infrastructure needs to be expanded so that applications can be built out. The key is to offer commercial and financial services with HBD (or a derivative thereof) as the centerpiece.

Nothing operates in isolation. However, to conclude something is a scam or is not feasible without knowing the detail nor how it all interacts is not sound.

HBD is the foundation of building an economy. This is multi-faceted requiring a great deal of infrastructure, applications, and utility. It is not going to be an overnight process yet it is something that can occur over the next few decades.

As the numbers show, there is plenty of room for things to grow.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z