Not much, just a little - a trickle here and there, in the hope that one day, after the bear, it will amount to something worth far more.

HIVE is currently sitting ever so slightly above the $0.30 mark, which really isn't enough to fill me with confidence that it will stay there, but I do get the feeling that we have turned some kind of corner and in the next month or so, we are going to see some kind of action.

Since it is HPUD:

There are a lot of factors in play, with a large one being how China is going to handle its ridiculous, self-inflicted debt challenges. But one working in support is the shifting of attitude to increasing the interest rates further. They aren't that high now in comparison to where they could be, but with so much money pumped into the economy over the last few years, they needed to claw it back.

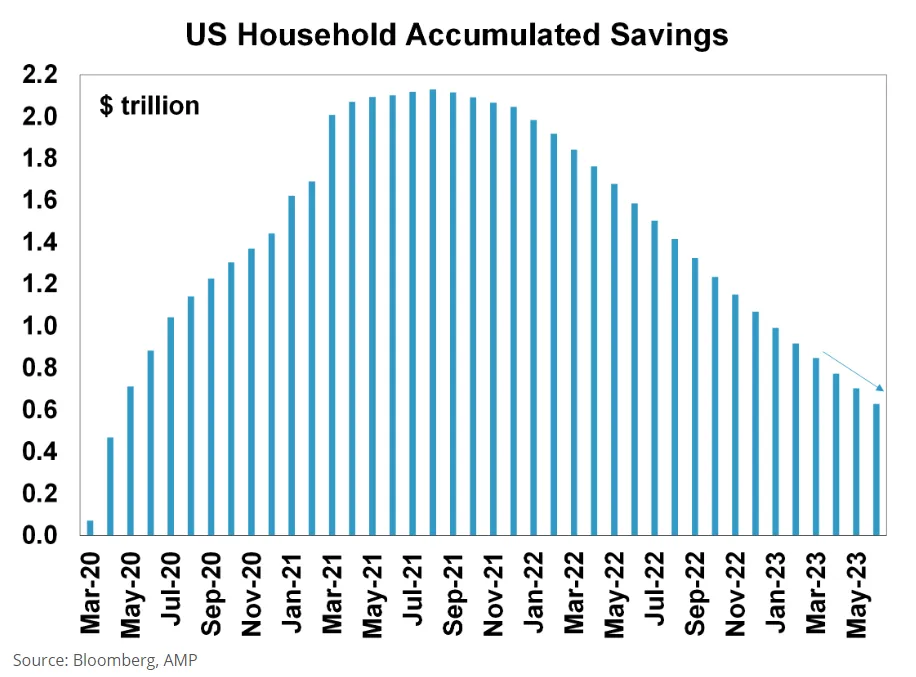

The Covid handouts allowed for a huge amount of savings to be added into the bank accounts of average people, but of course, this money is actually theirs to begin with. Well, that is not true, it was future theirs, as it is debt borrowed from the future. For instance in the US, we can see what has been happening with accumulated savings.

A huge amount extra was able to be squirreled into savings, but since the peak around September 2021, it has started to fall away, losing 70% in the last two years and if continuing at the same pace,

If savings continue to be run-down at the same pace, accumulated excess savings will be exhausted by March-2024.

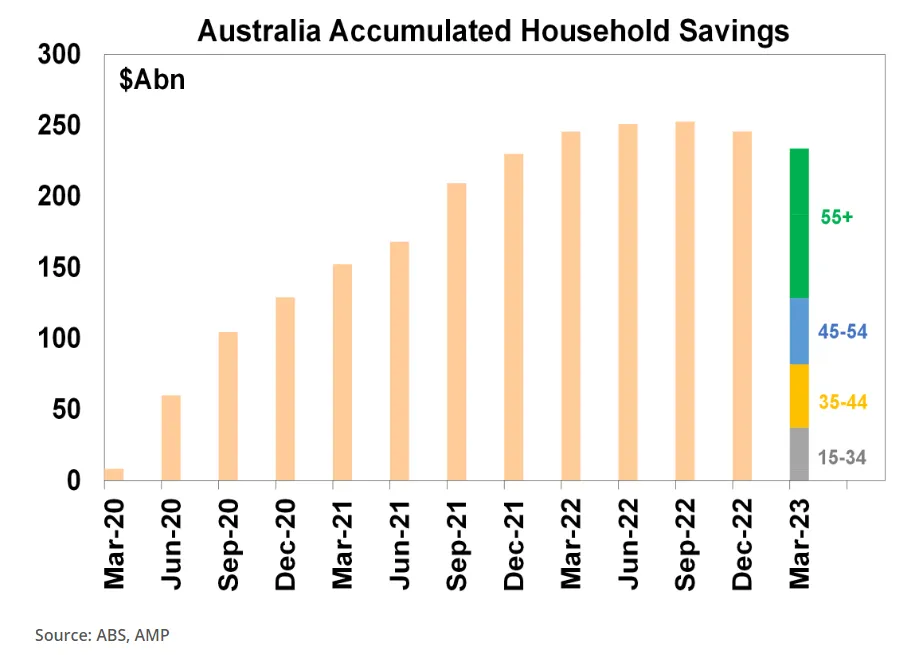

Looking at Australia, it is interesting to note that the slope is about a year behind or so, but in that last column, you can see the savings by age.

Almost half of what has been accumulate in the last few years is held by people over the age of 55, but what is important to note is that they are also far more likely to own their home. However, the 35-54 year group are unlikely to own their house, but are likely to have a mortgage on an overpriced home, which means they are also more likely to have to keep dipping into their savings to make repayments. This is also how they are covering the inflation on goods and services too. And, for those who didn't FOMO into a house, they are contending with increasing rent prices.

But what this means is that rather than sitting in bank accounts, that money is going to find its way into investments soon enough, and with a little more confidence creeping into the economy in terms of inflation rates easing, it seems like it might not be too far away before it pours in again. Of course, this is just me speculating on random things that might not be meaningful at all, but there is a shift of some kind coming and it is more fun to believe it is going to be to the upside, than the down.

I am still hoping there will come a day where HIVE price will be adequate enough for me to live off curation, or a portion of curation in the future, but that isn't very likely, because it would need to be high enough, and stable enough to do so. More likely it will be one of those short periods of spike events and then fall back down to be somewhere around where it is now, awaiting for the next run.

What is interesting to consider is, there has never been as much money in the world as there is today. It is funny to think about, because so many people are struggling, but this is the case. So much money has been printed in the last years, yet it seems that no one has any, so where has it gone? Well, since debt makes the world go round, it has been pushed into paying back debts of some kind or another, with that payment going to pay other debts that have been waiting.

Most governments seem hellbent on taking more money over the coming years, because even though they can't manage the debt burden they have generated for us, they still have to keep us happy. Printing more from our future and handing it out as if they are Santa Claus is a tried and true method of buying votes.

At some point we must realize that they haven't built anything that generates value, right?

Probably not. So, it is up to us as individuals and pockets of people who want a better economy to take ourselves off this ridiculous carousel ride and create something better. Of course, if we are the ones that keep on taking debt burden and then whenever we have a little extra we have to pay an installment, then we are no better than the government, right?

And this is why while money isn't everything, we do have to consider the value of what we are doing and whether it is going to take us to where we want to be. At least for me, if I am not investing into something that generates the chance at a greater value in the future than its value today, I better damn well like what I am buying.

I like HIVE.

Taraz

[ Gen1: Hive ]