I am not a fan of the central banking system in many respects, but at the same time, they are predictable, aren't they? This means that given conditions, they only have a select few tools to use and how they use them, is remarkably unsurprising, which is why the futures market can be used to indicate expectations of what they are going to do.

In the case of rising inflation, the response has pretty much always been, increase interest rates. And, because of the last two and a half years of pumping debt through various cash injections into the economy and supply chain struggles, all on top of the lowest interest rate period in the history of interest rates to the point they were negative, inflation was inevitable and therefore, so too were interest rate rises.

Yet....

Is it really thanks to the Reserve Bank of Australia (RBA), or does blame lay at our own feet, where we have played a part in driving this inflation And the conditions we find ourselves in? Especially because so many of us FOMO'd into house, because we didn't want to miss, making 30-year decisions on conditions that would last a couple years, like Corona. And, Corona lasted longer than expected, meaning that people were making those long-term decisions on what would likely be their largest purchase in their life, on conditions they expected to last several months and, those conditions weren't good "forever home" conditions.

When my wife and I bought our house, we moved the weekend that lockdowns were started in Finland, but we had already negotiated our deal before Corona was "a thing" globally. This meant that prices were still low (relatively) and we were lucky, because we were able to sell our apartment at a decent price and have equity to inject in. Not only this, we were also able to secure our loan at a low interest rate and collar it for ten years.

At the time, people thought we were crazy spending a little extra on the collar, but with historically low interest rates, I felt there was only one way it could go, even more so as there had been a bull market for some ten years already. At some point, the economy has to cool down, but there was also a massive amount of cash floating about, which has to go somewhere.

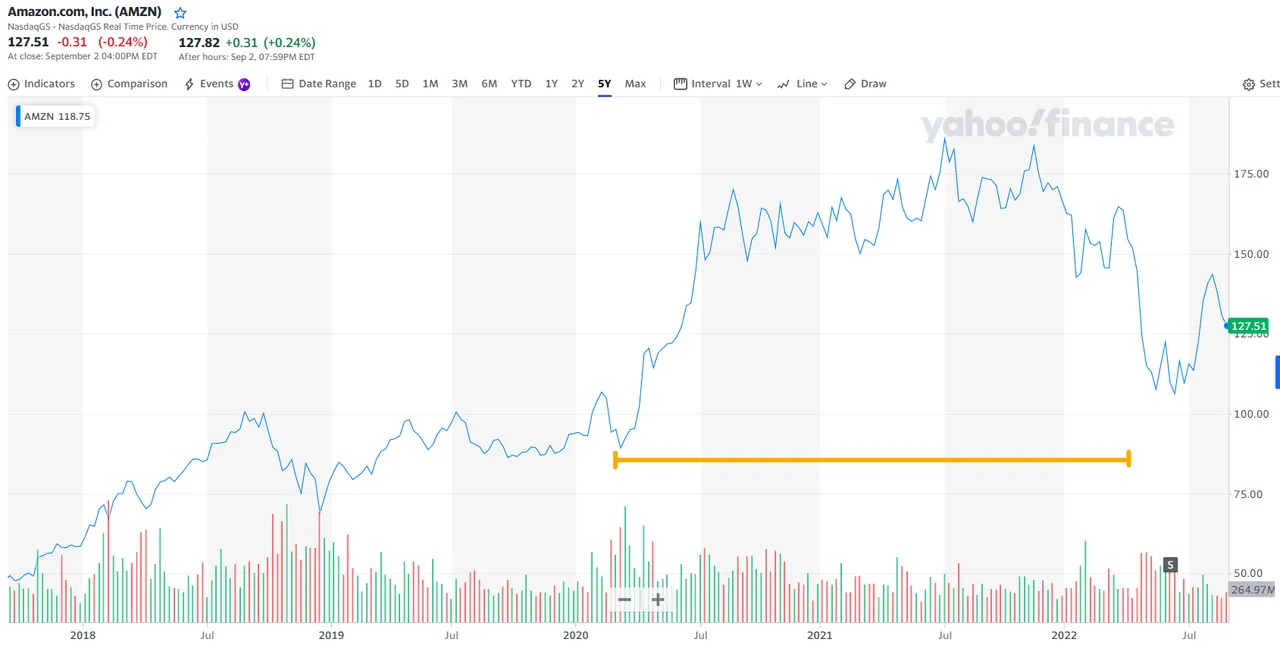

Then, from day one of Corona - all that debt pushed into the economy and whilst local businesses were forced to shut down, the global conglomerates with scaled online presence, were the only place to buy. Which, led to its own inevitable pathway;

This is a massive amount of capital getting driven into a small range of businesses that are capitalizing on a captured market by customer support, investment support, and government support through lockdown measures. Meaning, once lockdowns start to end and the reliance on these businesses reduces, the markets open again to competition again too, and inevitably, they are going to face a decline, especially since there are still supply chain challenges which they face in delivering to their customer base.

The large investment money withdraws from these companies, leaving the retail investors scrambling, but also, because of the increasing costs of living and increased cost of the loans people have taken, more of the money is being used to shore up defenses, with more ultimately going back into bank pockets, as they cash in on all of that debt they generated through the support of overpriced housing. As said;

Predictable.

Isn't it? Well, for anyone paying attention, but for people like those above who at least seemed to reign in what they spent on a house, considered the possibility of rate rises, but underestimated how aggressive they would be, it wasn't quite as obvious to all. So, now, there are an absolute mass of people globally who were convinced to push their debt out to the limits while interest rates were low, only to have those rates move very quickly upward, severely limiting their options, as the housing market starts to cool and in some places collapse and they have a debt that is larger than the value of what they hold.

A rock and a hard place.

For many people now, it is about survival, where they are looking to save where they can in order to cover their rising debt obligations, in the hope that it will be enough to make it through until there is some respite. Easing isn't "expected" until 2023 at the earliest, but even as it eases, it is going to ease slowly, so if using saved resources and investments to cover the rising costs, they will still be depleted at a decreasing rate, which means that once things are "normal" again, there isn't much left, if any at all.

Where did it go?

Into the pockets of those who encouraged them to get into this position in the first place so that they are able to buy the dip in the markets, getting in at the bottom. As things recover and the rest of us will be able to spend again, most will go into consumer items from the very companies that have been financed by that group, pumping up valuations. For those who are going to invest instead, they are going to be buying into these companies that will see a return, but on the back of the dip buyers, inflating their profits once again.

Debt is the devil

At least for most of us, because we aren't taking on debt to generate a higher rate of income than what we are paying in interest, we are taking it on to cover our living arrangements and then, to cover our debt obligations, worsening our ability to invest to generate, by digging our hole just a little bit deeper.

Predictable.

Taraz

[ Gen1: Hive ]