I have a couple "Storage Shelves" in crypto, with HIVE being the largest, but a couple other significant holdings that I have spoken about before - namely, Splinterlands and CUB. The latter, has finally got the CertiK report done and hopefully it will be close to launching PolyCub, which promises to bring value to the mostly patient holders of CUB.

I personally bought some more CUB immediately on the announcement and watched the price shift from the mid-40s up to the mid-70s on the hype, but that was several months ago and it has since dropped back and bottomed out around 23 cents. Currently though, with the announcement of "SOON" feeling sooner than the last soon, the price is up at around 31 cents again.

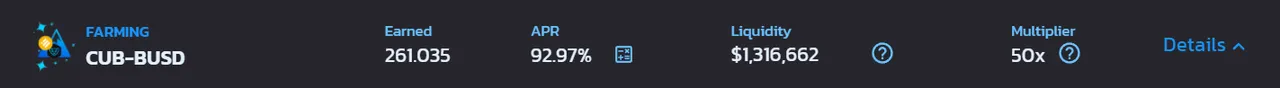

For me, the loss is a technical loss and it has been offset by my other holdings in CUB, which have kept earning me yield averaging around about 25% spread across several Kingdoms, but 92% on the CUB-BUSD Farm. I don't collect every day, but have enough in there to make it "interesting" if the price increases significantly.

Looking at my return across Kingdoms and Farms with some fast and dirty calculations, I am averaging 35% for the year - which is not bad, even after taxes and equates to a few months of salary - which is nothing to sneeze at.

However, one thing that I notice is that while people look at the various income streams I mention, they forget that this comes with exposure - there is nothing "free" about this. For those who have been following my journey for long enough, they also know that I have built from nothing and have openly talked about the various strategies I have taken, with some winners and some losers, but overall, I am currently in the "win" territory.

The biggest one has been holding tokens that allow me to earn something on them and this includes Hive. People scoff at the "meagre" returns now because of DeFi crazy, but they have always scoffed. If I had a HIVE for every time I have been told I am crazy to hold HIVE when there are so many higher yield alternatives out there, I'd have a lot more HIVE.

But, this has been the same with CUB Finance over the last year two, as while all that crazy hype at the start of 2021 pushed the markets up and people chased the highest yield, I settled increasing amounts into Cub Finance so as to earn a more stable "set and forget" yield. Could I have earned more chasing other projects? Of course! But could I have lost more chasing other projects? Of course!

So, while people forget about the risk exposure of investing into projects like Splinterlands and only get jealous of the returns, they also forget that there are a lot of risks in other alternative investments too, as well as the highest risk of all, not investing into anything at all.

I often think "I am getting too old for this shit" but then realize, that without this shit I will be working until I am ancient anyway, unless I win the lottery, if I entered the lottery. I have a decent job and I earn an average salary doing it and between my wife and I, we will probably manage a comfortable lifestyle once we get ourselves sorted, but it is never going to amount to an early retirement for either of us and that life will always be burdened by necessity to continue to work, like it or not. I like working, I don't like needing to work.

But, as I have said, I have continuously been putting crypto on storage shelves that offer a little bit of ROI to hold them there and slowly, that amount starts to creep up as it compounds. Even with the drop in prices from the ATHs of mid-2021, my value hasn't dropped at the same percentage, because my token holdings have continually grown. Another year or two from now, they will be larger again, so even if everything remains flat price-wise, my holdings have increased in size to return more.

For example, a 35% return on Cub gives me the theoretical possibility to extend my holdings there by that amount. If I started with 100 after year one I would have 135. After year two I would have 182 and after year three, 246. that is an increase in holdings of 150% in 3 years and what happens when that meets a bullrun on all of crypto? Even at the BTC rate of 8% - 1 Bitcoin could grow to be 1.25 Bitcoins in three years. That means A Bitcoin Today is 45K and if it hits 100K in three years, that is an additional 25K on top. Not too bad. If it hits 400K - that is another 100K on top of the 1 BTC gains.

But, most people are impatient with these things and are looking to maximize everything they hold to full effect but often, don't recognize how much they are losing along the way. Taking a strategy where there is some continual growth happening automatically means that there is background growth and a sense of stability, rather than the stress of every move made being a Hail Mary.

For me, if the trifecta of HIVE, CUB and Splinterlands comes in, I won't have much to worry about financially, but in order to benefit from the bet, I have to expose myself to financial risk. I don't know if it is going to happen for me or not, but I do think there is a good chance that a couple years down the track, I will look back at this post and say, I wish more people had taken a risk on the uncertainty and put a little on the shelves for themselves.

Taraz

[ Gen1: Hive ]