Unsurprisingly, considering the proximity, Finland has a fair bit of business dealings in Russia. Also unsurprisingly, when the HSE opened today, it was a bit of a bloodbath for the companies who are connected, with some of them losing up to 8% before recovering a little before close. Of course, this was expected as it is reflecting NYSE on Friday when the likelihood of an imminent invasion of Ukraine by Russia was announced, but the European exchanges had already closed for the weekend.

Remember this dip?

This is a 15 dollar close in April 2020 and today it is up at around 93 dollars for a 600% gain in under two years - which is pretty sizable swing for a "stable" commodity.

It looks like gold might be looking for a new top also.

War is not good for absolutely nothing. It is good for making money in sectors where most people don't play, by people who don't play like most people. While most people avoid risk and uncertainty, those "in the know" lean into it. Crazy people lean in too - that is why we here are in crypto.

But, with all the news of increasing interest rates that will affect mortgage holders, inflation on living costs and the uncertainty around Ukraine - it is no wonder that after two years of controlling people's lives, there is pushback from the people and, the governments are opening up, even though relatively, nothing much has changed in the world, making the last two years, predominantly a waste of time. Extended sieges aren't good for the political parties that enforced them, when the people under siege get to vote who takes over.

Personally, I don't own much in way of assets, other than my house which has a mortgage on it and a collar for the next 10 years, so if those interest rates do climb, at least they can't increase too far from here for me for a while. My friends and the bank told me I was crazy for taking the collar, as it is just extra money down the drain. We'll see.

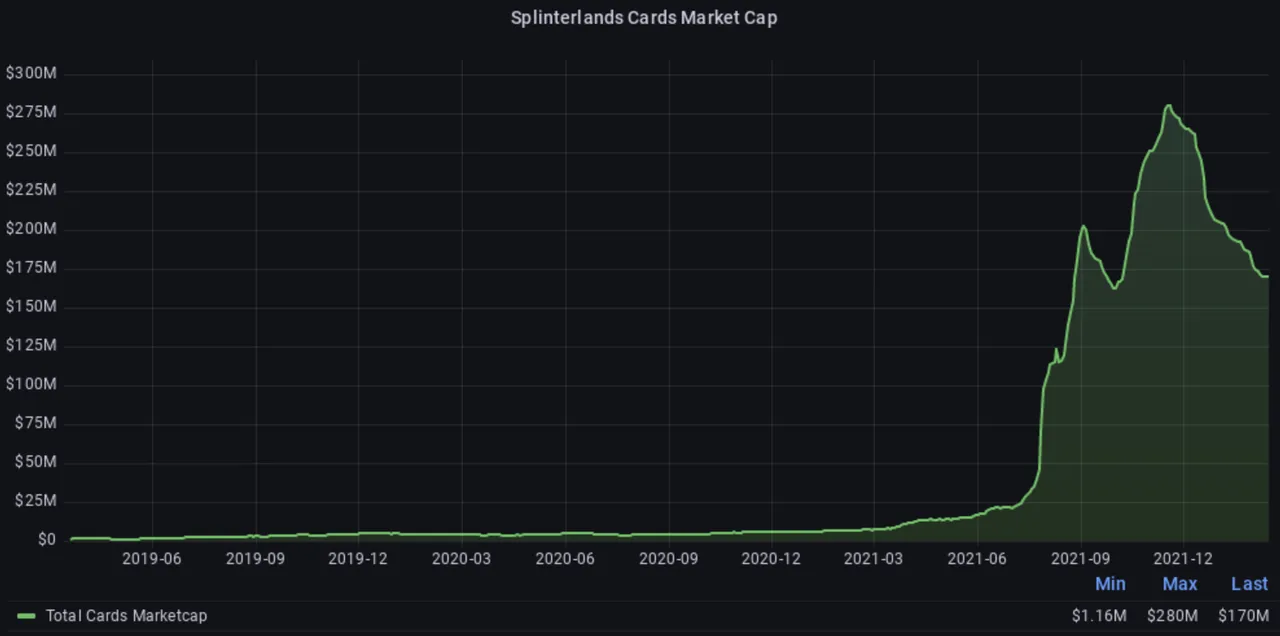

So, no traditional assets, but I do have a few non-traditional assets - like Splinterlands.

I don't know what is going to happen in the global markets or the crypto markets, but owning something that generates over nothing that generates value has to be the way to go. If there is a case of hyper inflation for example, holding anything will be the go-to play. In the case of a massive recession or depression, holding anything will be the go-to play.

Unless living in the middle of a war zone, owning property is probably a decent call for a part of the holdings. But if you need to move fast, you want to own something that travels well. I think that one of the superpowers of crypto is its ability to "be" wherever you are, because it doesn't have a physical location, as it resides on the blockchain. This gives it all kinds of important traits that will become increasingly relevant the more chaotic this world becomes.

While governments and banks are still warning against it due to the risk, the question really should be why they are warning against it. The reason is that it is far more borderless than fiat and as such, harder to control, so less of an economic weapon that can be used against us.

For example, while the average salary in Finland has gone up by about 50% since I arrived in 2003, the price of fuel has increased by 120% - and about 75% of the cost is in government taxes. Buy electric? The cost of electricity is going up too and what many people don't seem to realize is, chargeable means "renter" unless able to produce enough energy oneself to cover all those mAh.

"Dude, you need to save the environment!"

While they charge their phone three times a day

There is a reason that energy is the most important commodity, because without it, we can do nothing.

A colleague not long back stated that crypto collapses if the internet shuts down. Yes. It does. However, if the internet shuts down, that same person is jobless, has no way to earn, no way to pay their bills, no way to shop - and that is just personally. If it shuts down, the last thing people will need to worry about is their Bitcoin - because it will be the return to the dark ages.

It is actually quite interesting that in most places in the world, if a technology that has only been in usage publicly for about 30 years ceased, we would collapse into a heap. We are all renters on the internet.

Contemplating this doesn't help me in a recession however, nor in hyperinflation - so I think that for most of us, it is going to be a question of whether we have set ourselves up to have some additional diversified revenue streams and whether we have the mental, physical and emotional fortitude to hold on and ride it out.

What I witnessed back in 2008 at the valley of the GFC was that a lot of people who are well educated and reasonably well off, favored keeping their lifestyle over holding their investments. Most people under standard of living duress, seem to have hands of clay. Not a diamond in sight.

In our life times, we probably experience a handful of large economic events that we have some way to affect - but one thing has always been consistent - unless a nomad that can live off the land, ownership is the strategy to come through the other side with the potential to thrive, not just survive under more trying conditions. Ownership - not rentership.

Rent what you are happy to do without.

Own what you want to keep.

Taraz

[ Gen1: Hive ]