For the last couple weeks I have been trying to push my wife to have a look at the energy contracts before the winter comes. She has been "busy" and has kept saying "I will do it", like she is promising to take the bin out. A couple days ago, a gas pipeline into Finland was potentially sabotaged, and the available contracts I had suggested were taken down, as they awaited news. Even though there is supposedly minimal damage and there should be no disruptions, the contracts are now 20% more expensive.

Should have just made the decision myself.

And I knew it.

The problem is, if I had just done it, I wouldn't have been inclusive and it would be like her parents, where if her father dies, her mother can't pay any bills, as she doesn't know how. And if her mother dies, her dad will just be eating steak and barbecued food for the rest of his life.

But, this is the thing - if someone doesn't have interest in learning about the things that affect their lives, should they be included in the discussions? And when it comes to money matters, generally, men are more interested, active and engaged in improving their position. This doesn't exclude women from being so, but if we think of economics as a game played against others, where the ones with the highest amount of money wins, it is natural that the ones who take the most interest, are likely to be the ones who perform the best.

Women tend to have more savings than men.

But, men tend to have more investments than women. There are many reasons for this perhaps and pay inequality is often cited, but it is good to understand what happens over time, all things remaining equal.

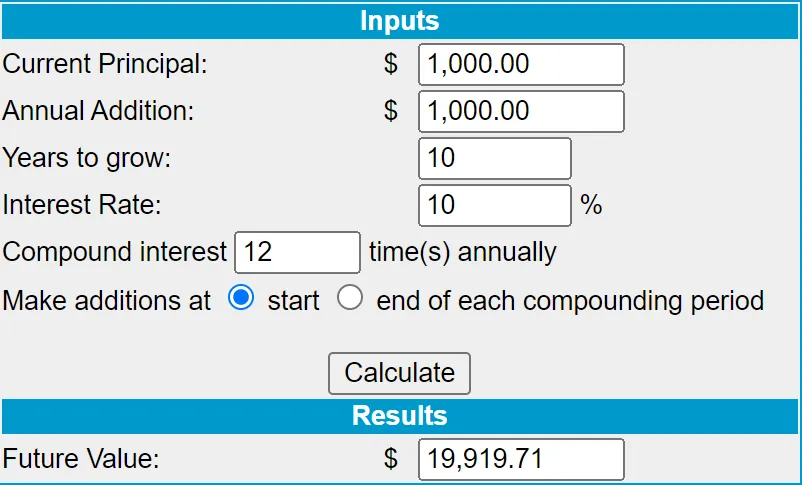

The man starting with $1000 invested and adding $1000 each year for 10 years, at 10% ROI.

19,919

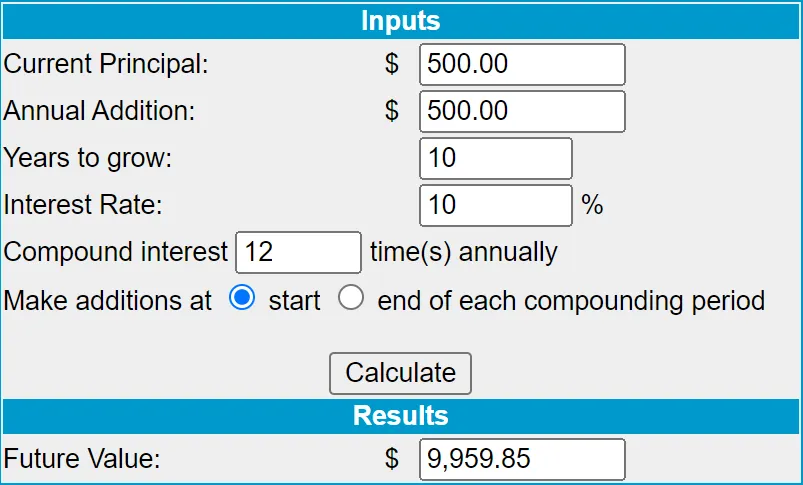

The woman starting with $1000, investing 500, saving 500, adding 500 a year for 10, at 10%.

9,959 + 5000 = 14,959

That is over a 33% difference in the space of ten years.

71,136.

35,568 + 10,000 = 45,568

That is a 56% difference in the space of twenty years.

If the man wants to play it safer and go 750 start, add 750 for 20y at 10%, the result is

53,352 + 5000 = 58,352, which is a 28% difference on the upside.

Men tend to be more risk-seeking than women on average, which probably accounts for why they don't live as long, as many die stupidly. But there are benefits to being risk-seeking financially, without having to swing for the fences. The other thing to factor in here is bleed, because whether the money is tied up in an investment portfolio, or loose in a bank account, is going to change the hurdles to spend it. Once invested, most people don't want to divest it - however, when it is liquid, it seems more like free money, available to spend on something that might only be a cost, not financially generative.

Money matters.

One of the lessons I have learned over the years is that while money can't buy happiness, life without money in the world in which we live is shit. Pretending that we can be happy without enough money, is like pretending that eating only junk food isn't going to have a negative affect on your body. The experience of pretty much everyone I have ever met in real life is the same,

Being poor sucks ass.

But, it is also this fear of being poor that holds many of us back from actually investing, because we fear losing the little we have. We struggled to get it, so we want to make it count, and for most of us, that means spending it on something that makes us feel good. Making investments doesn't feel good.

The return on investment does.

Making the investment feels bad because we are opening ourselves up to risk and loss, meaning that in order to invest, we have to fight the urge to go in the other direction, to run away. Investing is making the choice to face the fear of the uncertain future, rather than deciding to feed the desire of feeling secure right now - with "security" being something to show for the money.

It takes time for an investment portfolio to be significant enough to "feel it" and even longer for it to be enough that it feels more secure. Then, there is the constant fluctuations in evaluations and at times, the downward shifts can be quite severe. For some, it feels more secure to have the money in savings, where it is always the same amount - even though it isn't generating anything and is actually decreasing in value through inflationary pressures.

Over the last few decades, there has been a lot of media pressure driving for the "independent women" earning her own money - which is fantastic. However, I wish that there was as much discussion around the investment of those earnings being the real catalyst of wealth, not the saving of it.

This is a lesson for all of us.

We should all be learning firstly how to be more financially independent, and secondly, about what it takes to be so. Multiple revenue streams, passive incomes, investment strategies, and about finance and economics as a whole. If we were all more financially literate, we wouldn't have the wool pulled over our eyes nearly as often, and we would be far more demanding on governments and the businesses they enable and protect. But, because we aren't literate, we are slaves with our hands out, begging to be treated nicely.

Well, tomorrow I will have to make a contract with an electricity company at a price 20% higher than it would have been, but about 50% higher than it should be.

What will the difference cost me in ten or twenty years?

Taraz

[ Gen1: Hive ]