Week40-Oct4 Option Trades

- Oct 4 Markets as of 10 am (EST).

- Oct 4 option trades

- Wait and Watch

- Coming Recession? Inverse Yield Curve

Oct 4 Markets as of 10 am (EST).

Markets open GREEN today, but it is moving toward the RED side as of 10 AM (EST). While I don't know where it is going to close today, it just appears that the markets want to continue DOWNTRENDING.

Oct 4 option trades

The "4" SPY Iron Condor is part of my 2023 Social Media Option Challenge, where I post my trades the same day I make it. Since it only 10 AM right now, I'm posting this within the FIRST hour of trading.

- Rolling of the "6" Call Legs (Down for more risk) of the DEC 29 IC.

- Rolling Down the BAC Covered call for more risk.

Wait and Watch

At this point, I am just sitting back and watching the markets. I will wait to see what happens next. If the needs can go GREEN, that will be the BEST for me as it brings the Index back to near the MIDPOINT of my Iron Condor. If it continues to move down, I will close my Iron Condor Earlier to lock in whatever PROFITS I have remaining in that trade.

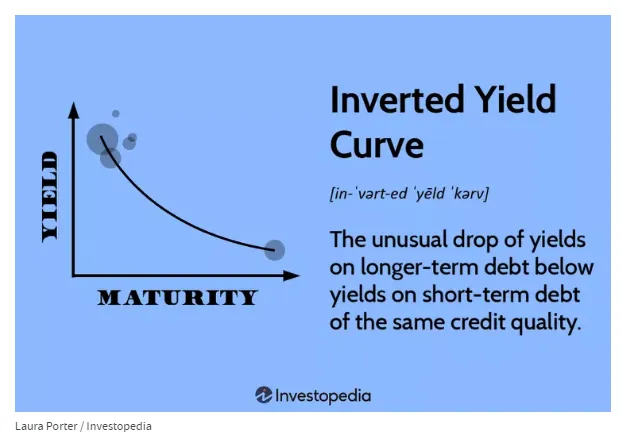

Coming Recession? Inverted Yield Curve

Do we have a recession coming soon? The data is based on the Inverted Yield Curve (where the 2YR note makes more than the 10YR note). On top of that, we have student loan repayments, high credit card debt and large car payments. Is this a sign of a painful correction that is coming?

What do you think?

Have a profitable day,

Solving Chaos