Week40-Oct2 Options Trades

- Week 39 Summary (YTD/Weekly)

- Week 39 Summary (Daily)

- 2023 Social Media Option portfolio (4-5-6)

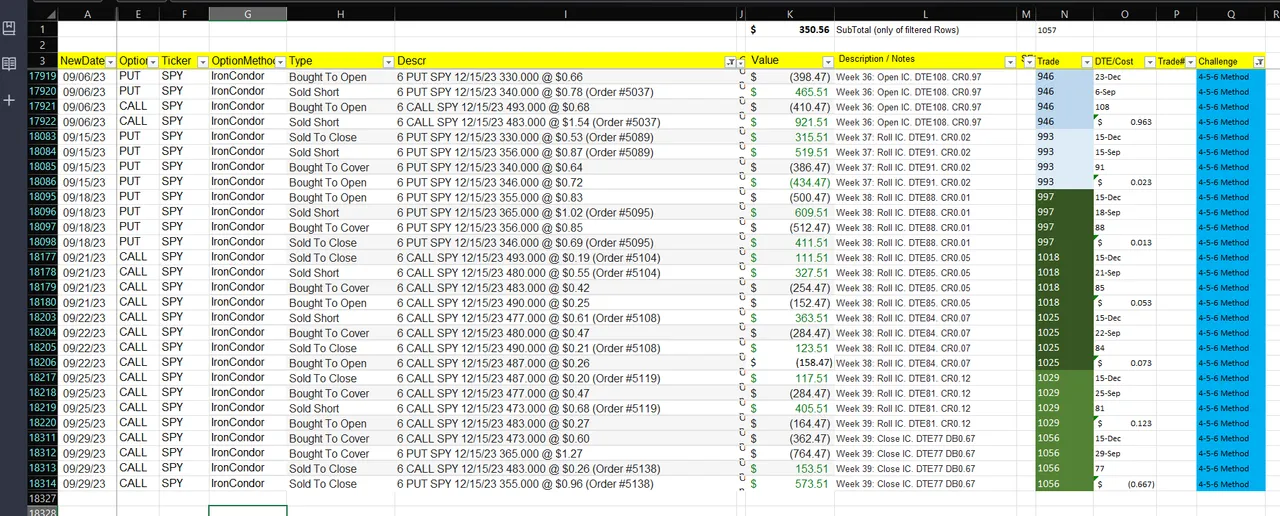

- Explaining 6 SPY Iron Condor 12/15/2023 Trade with history

- Week 40 Oct 2 Trade

- Week 40 Dividends

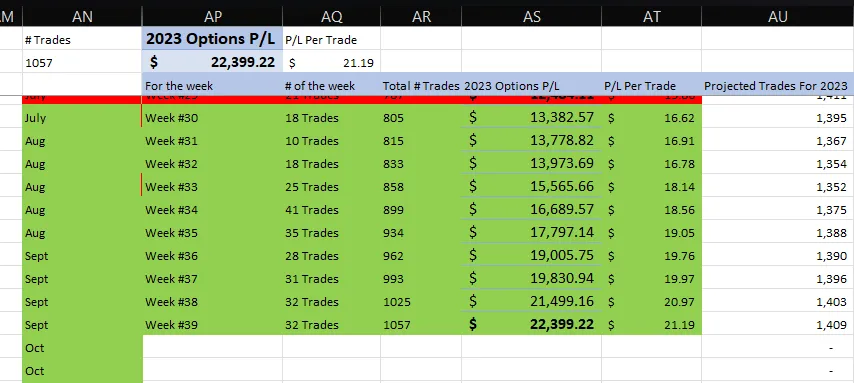

Week 39 Summary (YTD/Weekly)

Here is last week's option/dividend summary:

- 32 Option trades

- Gain of $900 ($236 from Dividend, $664 from Options Premium).

- 10 Weeks of Gains (markets are RED over last TWO MONTH).

- Average profit per trade is moving in the right direction (UP).

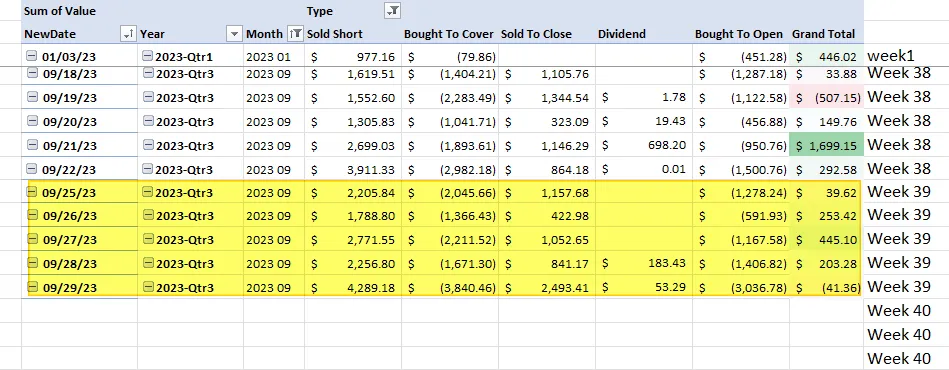

Week 39 Summary (Daily)

Here is the data from a DAILY Tracker (Pivot Table):

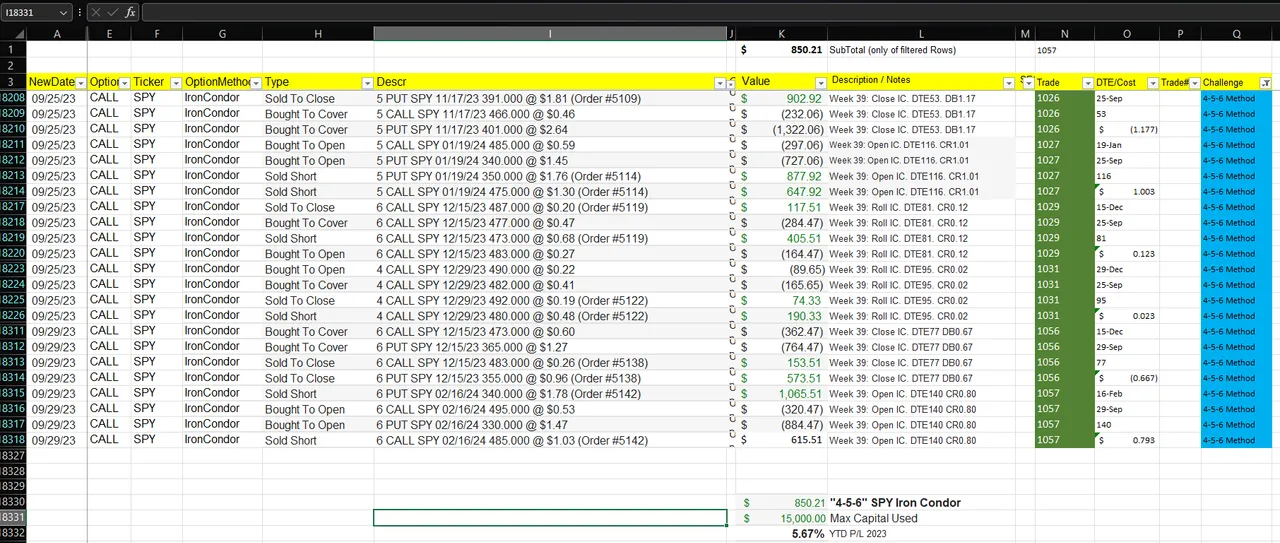

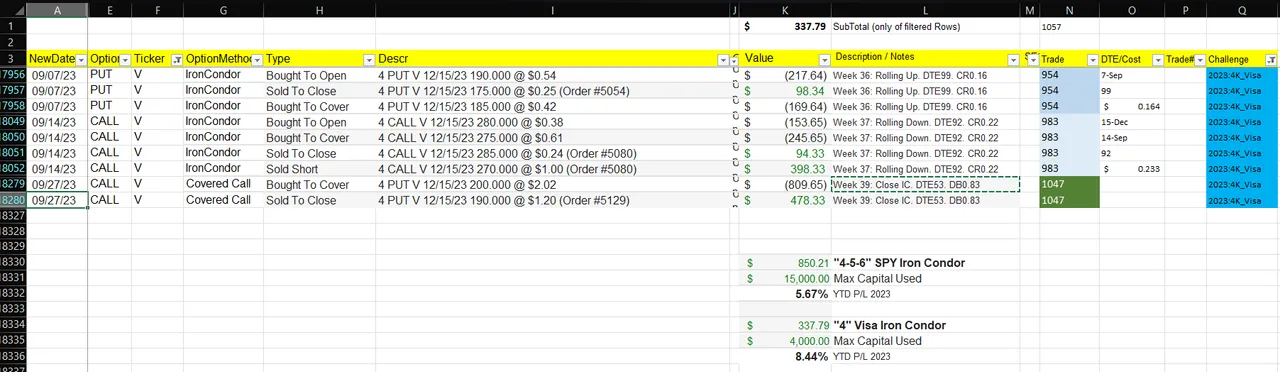

2023 Social Media Option portfolio (4-5-6)

I post my trades within the same day (usually within the hour) of making my trades. This provides transparency and helps prevent anyone from assuming I only post my WINNING trades (after the transactions are closed).

- "4-5-6" (15K max) Iron Condor SPY - YTD $850. It moving in the right direction, but it is still at 5% YTD gain (which is a far fall from the 20% return I had in June 2023 --> before the JULY trades).

- 4 (4K max) Visa Iron Condor - YTD 8.44%

I converted the Iron Condor into just a CALL credit spread because VISA moved from $250 to $230 in the last two weeks. The PUT legs were losing money and I ended up closing that side of the trade. That caused a RED week for the 4 Visa Iron Condor trade.

While we are still positive for the year, I must aim to continue making a profit with only one quarter left (3 months).

Explaining 6 SPY Iron Condor 12/15/2023 Trade with history

Here is the trade history from Opening to closing.

- Open on Sept-6 for $0.96 per contract

- Roll on Sept-15 for $0.03 per contract

- Roll on Sept-18 for $0.02 per contract

- Roll on Sept-21 for $0.06 per contract

- Roll on Sept-22 for $0.08 per contract

- Roll on Sept-25 for $0.13 per contract

- Closed on Sept-29 for $0.67 per contract

Week 40 Oct 2 Trade

Here is today's option trade in yellow highlight. This is rolling the CALL LEGS, adding risk back into that trade (DEC 29). If the markets stay in a narrow range, I will let TIME DECAY, and hold this position longer. But September saw some +/- 1% trading days where it increased the IV. When that happens, I like to close my positions earlier and not wait for a reversal that might never come.

If October ends up being a month where the EARNING and MARKETS are just "boring" then I can see an easy month to make money. However, we can see another explosive month going in either direction, which might cause trades to be on the WRONG SIDE of the transaction.

Week 40 Dividends

This week's passive dividend is expected to be at $168. I have been reinvesting dividends for over 10+ years and will continue to do so.

My dividend yield is less than 1% (maybe?), so it plays a small part in my overall approach to building wealth. If I were retired, I would generate over 3% or 4% yield from my portfolio. But today, there is no need for me to chase DIVIDEND returns, and TOTAL returns from GROWTH + Dividend is what I am looking for.