Week39 Sept 27 Options Trades

- Weakness in Markets

- Today Options Trades (Sept 27).

- Open and CLOSE position.

Weakness in Markets

What started as a green day is now a RED day. The market is telling us that SEPT will be a RED month and that things can get worse going into EARNING. However, if companies are growing earnings, OCT can be a good rebound month to start the early SANTA CLAUS (or year-end) rally.

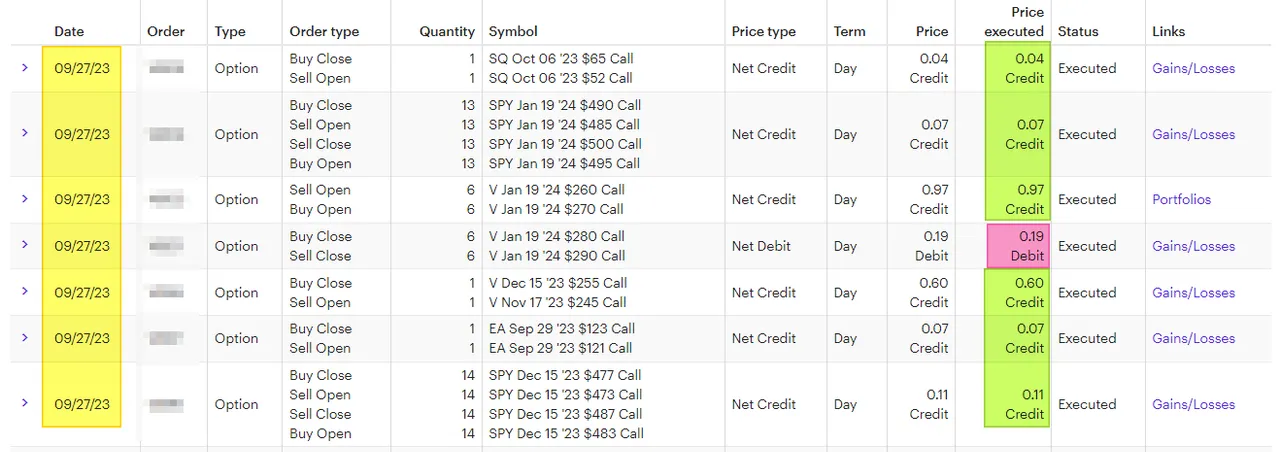

Today Options Trades (Sept 27).

Here are some of my trades. Adjustment of RISK is what is needed.

- SQ Covered call - Lowering strike price for $3 premium (each).

- 13 SPY Iron Condor - Lowering strike price for $6 premium (each).

- 6 Visa Iron Condor - Lowering strike price for $76 premium (each).

- 1 Visa Covered call - Roll Down $10 in SP and one month less in TIME for $59 premium.

- 1 EA Covered call - Lowering strike price for $6 premium (each).

- 14 SPY Iron Condor - Lowering strike price for $10 premium (each).

Open and CLOSE position.

When markets have increased IV (Implied Volatility), the winning position can be a losing one in a few days, even if there are 50, 75 or 100 days left on the option. While LONG-DATED options are "safer" than shorter-dated options, I will keep an eye on the price changes and likely close my positions earlier.

To offset some of the risk, I have been adjusting the CALL LEGS of my IRON Condors. Remember, markets are "escalators up, elevator down!" Right now, we are starting to see the FAST DOWNWARD moving direction.

There will be a FEW big GREEN rebounds, but those are often known as "dead cat" bounces. So, right now, I want to structure my trades to handle the "increased IV!"

How are you doing the last two weeks of option trading?

What adjustments did you make?

Have a profitable day,

Solving Chaos