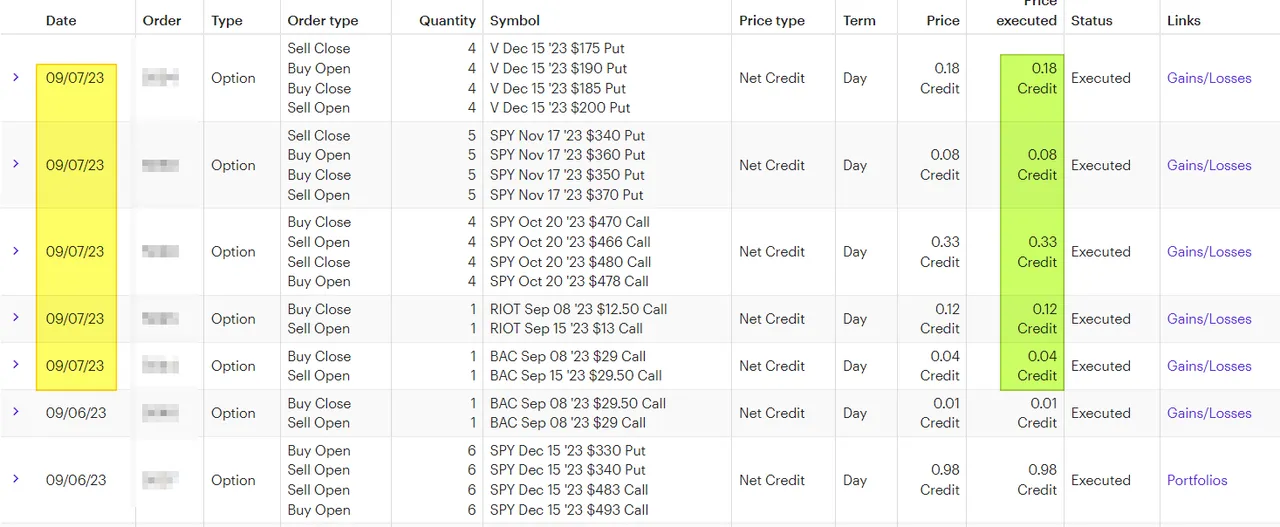

Week36 Sept7 Option Trade: Visa/ SPY / RIOT/ BAC

- Today Option Trades as of 1 pm (EST)

- Rolled PUT UP on 4 Dec 15 Visa Iron Condor.

- Rolled Put Up on Nov 17 SPY Iron Condor.

- Rolled Call Down on Oct 20 SPY Iron Condor.

- Rolled Covered call up and Out on RIOT.

- Rolled Covered call down on BAC.

Today Options Trades as of 1 pm (EST)

Here are today's options trades:

I'm excited as my son wanted to watch me do the trades. He wanted to learn how to trade.

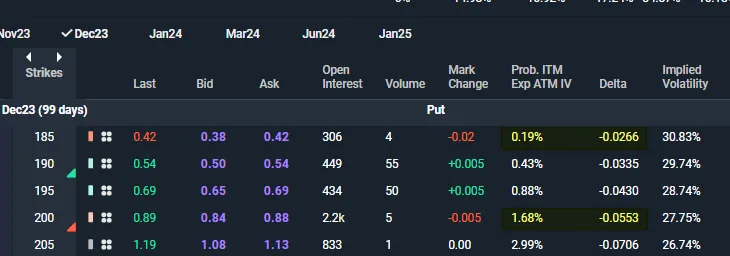

Rolled PUT UP on 4 Dec 15 Visa Iron Condor.

This Iron Condor has over 100 days left. However, VISA is showing good strength in the last 3-4 weeks. Consumer are at an ALL-time high on their credit card balance and are still using their Credit cards to purchase at the STORE. Visa will stay between the 220 - 250 range in the coming weeks.

From a Risk point of view:

I was rolling from 185 to 200, collecting 0.18 cents in premium per contract. The risk was moved from 0.19% to 1.68% or about 8x more riskier. But from a total risk, it still means I have a 98% chance of winning as of today with 100 days before DEC 15 Expiration.

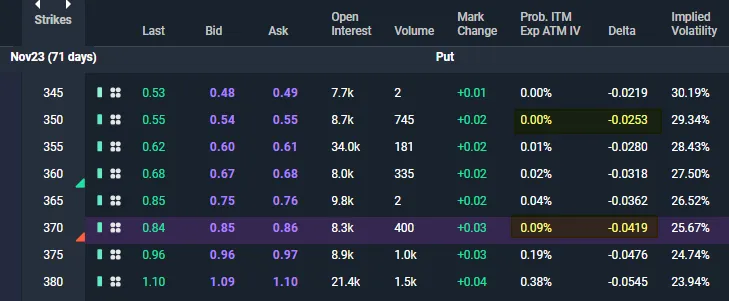

Rolled Put Up on Nov 17 SPY Iron Condor.

I was rolling from 350 to 370, collecting 0.08 cents in premium per contract. The risk was moved from 0.00% to 0.09%. From a total risk, it still means I have a 99% chance of winning as of today with 71 days before NOV 17 Expiration.

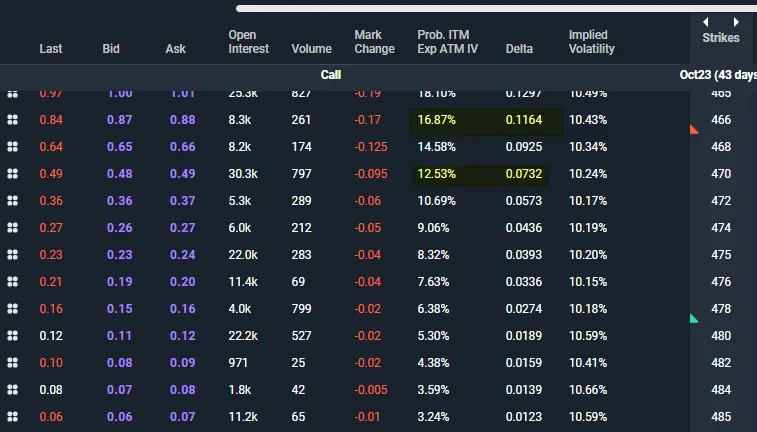

Rolled Call Down on Oct 20 SPY Iron Condor.

I was rolling from 370 to 366, collecting 0.33 cents in premium per contract. The risk was moved from 12% to 17%. From a total risk, it still means I have an 83% chance of winning as of today with 43 days before OCT 20 Expiration. However, I did MESS up the CALL LEGS (with those being 12 wide and the PUTS legs being 10 wide). I will fix that tomorrow.

Rolled Covered call up and Out on RIOT.

My covered call on RIOT was nearly worthless, so I rolled up (strike price) and out one week for a $0.12 premium. I expect BTC/ETH to move downward in SEPT, but I don't want to be ATM/ITM when trading RIOT. This is why I rolled UP one strike price.

Rolled Covered call down on BAC.

My covered call on BAC was nearly worthless, so I wanted to add risk to the trade. Tomorrow, I can roll UP and OUT.

All this was done before 1 p.m. (EST) on Sept 7, 2023.

This is not financial advice.

This is sharing what I did today and is only for educational purposes.

Have a profitable day,

Solving-Chaos