Week36 Sept6 Option Trade: Open '6' Dec 15 Iron Condor

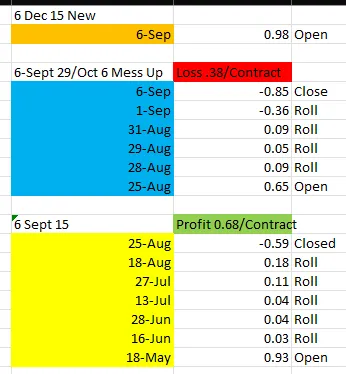

- History of each trade

- Closed 6-Oct6 (Mess Up trade)

- Open 6-Dec15 (New Trade)

- RISKY calls on Iron Condors.

History of each trade.

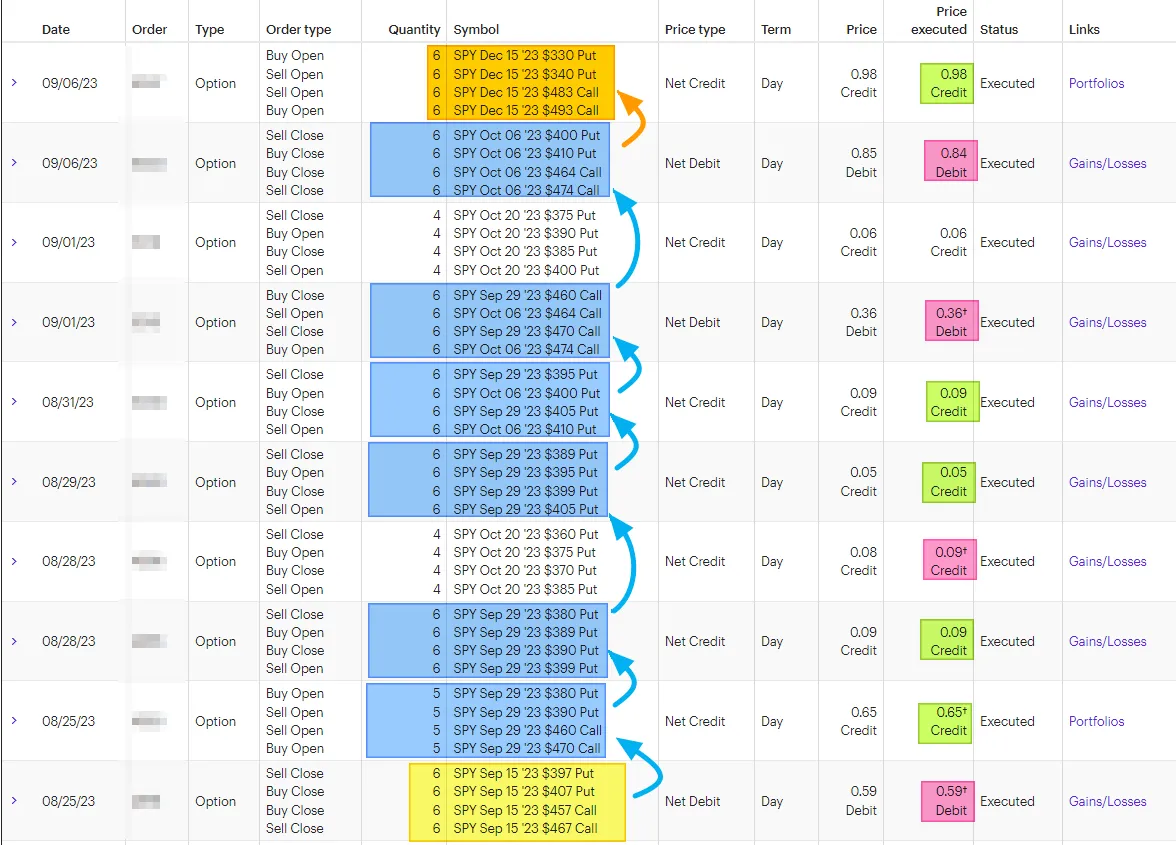

I show the data in an Excel Spreadsheet to match the ETRADE screen.

The Color matches between the two (Orange is the new DEC Trade, Blue is the MESS UP trade, and Yellow is the Sept 15 Iron Condor). I did not display the history since it would not fit on a single screen with today's trade).

Closed 6-Oct6 ("Mess Up" trade - Closing EARLY for LOSS).

Sept 29/Oct 6 trades had a human error (mine error) that caused me to roll from Sept 29 into Oct 6. This trade had ETRADE saying I started it with only 5 contracts, which is also a mistake on ETRADE's part. Since this was SO confusing, I just decided to close this trade EARLY and take the LOSS now. Track this trade history is not pretty.

I'd rather have a clean start since it makes it easier for readers to follow my moves.

Open 6-Dec15 (New Trade).

Today, I opened 6 Iron Condor for Dec 15, collecting $0.98 in premium for each contract. The delta is .04 on the PUT side and .10 on the CALL side. The "high" risk on this trade is for markets to turn around and surpass 4850 on the SP500 (SPY). Now, September and October are normally bad months for the STOCK market. If the markets reverse, I need to watch the CALL side. I do not worry about the PUTS legs until we break under 4,000 in a few days.

I would rather have MORE risk on the CALLS side than the PUTS side because I have a large 401K balance that is all LONG on STOCKS.

So, to lose, I would rather have the SP500 go up. What I lose in OPTION trading would be offset by my 401K plan gains. The reverse is not true. If SP500 drops to 3600, I lose lots of value from my 401K. So the goal is to make money using OPTION if this was to happen. You don't want to lose TWICE (401K going DOWN and Losing on the OPTION trade).

RISKY calls on Iron Condors.

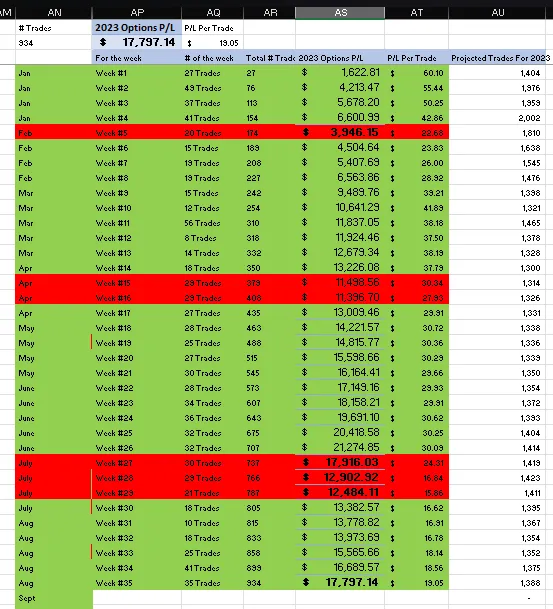

You must also understand that I have been using this method all year long for 2023. In July, I had to close my LOSING position because the market went UP for 8 or 9 WEEKS in a row. That caused my RISKY CALLS on Iron CONDORS to lose money. That was a PAINFUL 9K LOST that I had suffered, or nearly 50% of my 2023 ROI.

The one thing I don't want to do is for an EARLY Santa Claus Rally to cause me to LOSE again in Nov/Dec. While adding more risk on the CALLS LEGS is FINE, I need to ensure I don't suffer 3x or 4x of the PREMIUM I got from those Iron Condor. So, I have to be better at taking my losses sooner!

How are you doing so FAR in 2023?

Let me know.

Have a profitable day,

Solving-Chaos