Week 44 - Oct 30 Investment Moves

- US markets at 11:30 am (EST)

- Oct 30 Investment moves

- Added JEPI Put credit spread.

- Added EA Put Credit Spread

- Rolled AMD covered call up and out.

- Adding more "Bitcoin" Exposure.

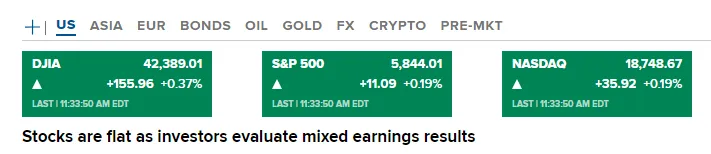

US markets at 11:30 am (EST)

Here are the US markets are trending now:

Oct 30 Investment moves

Here are my investment moves as of 10:40 am (EST):

All are adjustments to my #options position (with no buying or selling of any stocks). Earlier this week, I added more "#BITCOIN" exposure.

Summary:

- Added JEPI Put credit spread.

- Rolled EA covered call OUT one week.

- Added EA Put credit spread.

- Added ALLY Put credit spread.

- Rolled V covered call OUT 3 months.

- Rolled V covered call OUT 2 months.

- Adjusted PUT credit spread for more risk.

- Rolled AMD covered call up and out.

Added JEPI Put credit spread.

Why add a PCS to my JEPI position?

JEPI is used in my portfolio as a test for whether I should own it in retirement 10-15 years from now.

I have a covered call at $57 (which is ITM).

JEPI is trading at $59.25 (so my covered call is limiting my upside right now).

By adding the JEPI Put credit spread under the covered call strike price, I collected $24 in premium today.

The goal is to roll the ITM-covered call up in the FUTURE using the premiums I collected from the PUT to OFFSET the cash I need to do this adjustment.

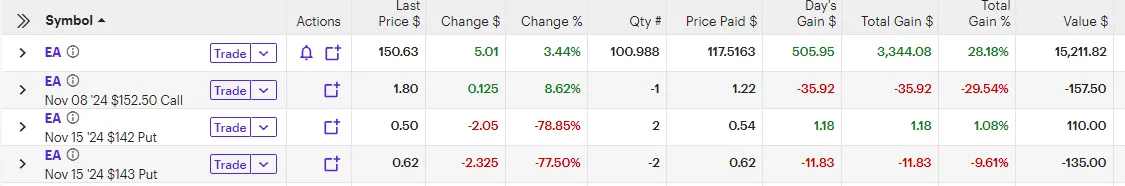

Added #EA Put Credit Spread

Why add a PCS to my EA position?

The first thing I did was roll the EA-covered call to NOV 8 because the NOV 1 option was nearly worthless. I collected $78 to do that. Now my risk is EA can go above $152.50 and turn this trade into a losing position.

So I added a put at $143 (PCS - Put credit spread), collecting $14 today. So the range of EA needs to stay between $143-$152.50! Depending on what happens next week, I will most likely need to adjust the EA-covered call. At that point, I would ROLL UP (in strike price) and OUT in time.

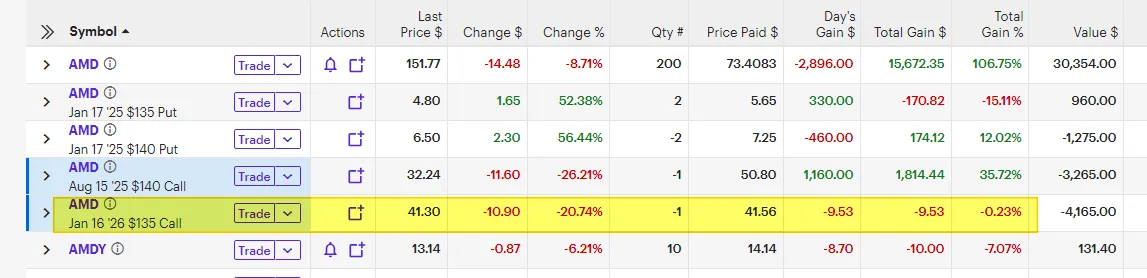

Rolled #AMD covered call up and out.

Why spend $165 in cash to adjust this COVERED call when AMD dropped after its earnings last night?

You need to see that I have two covered calls "Deep In the Money (ITM)". My Put Credit Spread is OTM and it is okay for now. The goal is to have PCS (Put Credit Spread) under the current market price and have the covered call ABOVE the market price. AMD has moved UP too fast, so I'm up 100% on the underlying, but my covered calls are ITM.

So the adjustment to my position can be explained like this:

- Option Cost $165 (cash today)

- If AMD stays above $135 (Jan 2026), I gain $500 (in case of early assignment).

- If I did nothing, my strike price was $130 (so I limited my side to $130).

- Spending $165 to gain $335 is a fair trade.

- If AMD were to go below $140, I would adjust my Put Credit spread

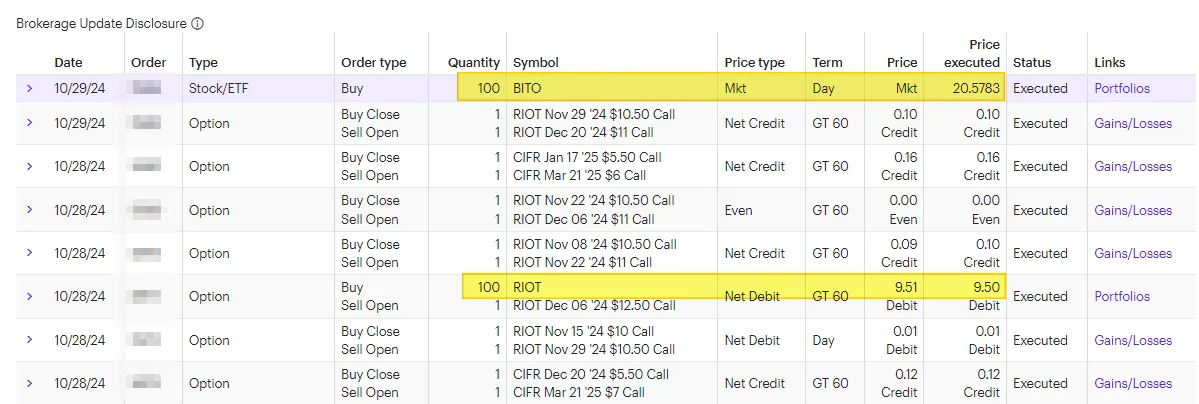

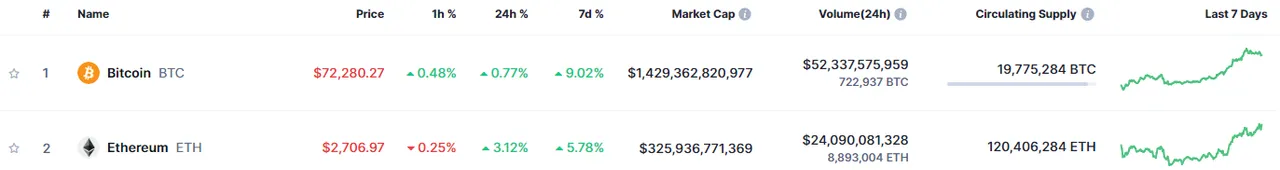

Adding more "Bitcoin" Exposure.

Last week, I mentioned I added new cash into my ROTH IRA for the first time in over a decade. I deployed some of that cash this week buying things with BITCOIN exposure.

Whether my timing is perfect or too late is NOT the point. I believe that #BITCOIN will be worth more in the FUTURE, so I was willing to add more even if it was at $70K. I believe that my investment will reflect gains in the future.

By using #RIOT, I can use #coveredcalls since I added 100 shares at around $10.15 (and I collected $66 from the Dec 6 $12.50 covered call using the #BUY-WRITE to open this position).

Now, for those that are super detailed, you will notice that in 2024, I did most of my BITCOIN moves from JAN-MAR, adding more exposure before the April Halving. Some of you might notice that I have been doing this even in 2023 and 2022.

If I did not believe in BITCOIN, I would never have added new CASH into my #ROTHIRA. I have not added any new CAPITAL to my ROTH IRA accounts in over a decade. I saw an opportunity to take MONEY that would have been USED for other purposes (like paying down BILLS or spending on EATING out) and invest into BITCOIN. If Bitcoin averages 30% returns, then I can say that the bet was even better than not using that cash to pay down #DEBT!!

Debt is bad. An asset is good.

When assets grow FASTER than your debt, that is even better.

The ratio between your debt and asset matters. Most people have DEBT that is larger than their total assets (because of their home mortgage, car loans, etc). But what if your assets are 10 times the size of your debt? If I have $100K in assets and 10K in debt, do you think the 10K is "bad"? Often the context of how one asset can generate income or value in relationship to the cost of servicing the debt is not looked at. In this example, even if the debt was at 30%, that is only 3K in interest for the year. To make 3K from $100K in assets is fairly easily using a dividend ETF like #SCHD. The market returned well over 20% in 2024!

If you want a financial coach to help you, reach out to me!

Have a profitable day!