Week 42 - Oct 14 Investment Moves

- Current US Markets @ 11:40 am EST

- Oct 14 Investment Moves

- SP500 Hit New Highs ; American feeling Wealthier?

- Bitcoin Price and Bitcoin Proxy (MSTR)

Current US Markets @ 11:40 am EST

GREEN. GREEN and more GREEN!

The markets are hitting new highs!

Did the FED pull off a "soft landing" and the 2% inflation target will be back shortly?

Oct 14 Investment Moves

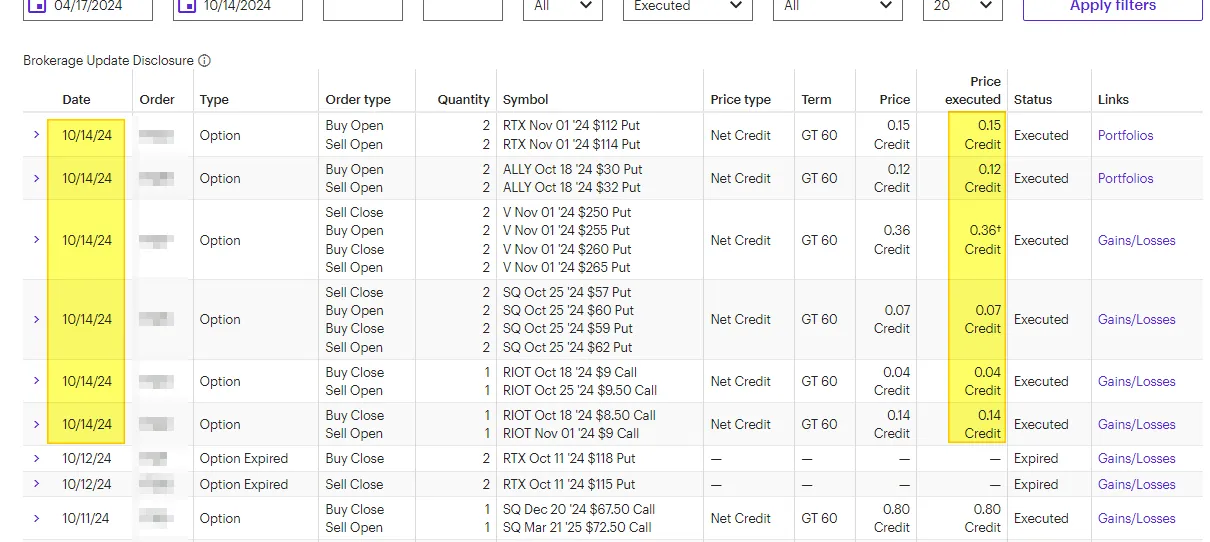

Here are my options trades for Oct 14:

Today Summary:

- Added Put Credit Spread for RTX (Nov 1) for a $15 premium each.

- My RTX (Oct 11) expired worthless.

- Added Put Credit Spread for Ally (Oct 18) for a $12 premium each.

- Adjusted V Put Credit Spread for $36 premium each (adding risk into the trade).

- Adjusted SQ Put Credit Spread for $7 premium each (adding risk into the trade).

- Adjust RIOT covered up and out (since Bitcoin was moving up).

SP500 Hit New Highs ; American feeling Wealthier?

The markets are hitting new highs. Are Americans feeling wealthier? If not, why not?

The answer is often found in what type of asset you have.

Housing / Homes: While home value has risen over the last decade, the cost of property tax, insurance, and repair is growing as a percentage of one salary. From a short-term point of view, housing pricing has dropped recently as inventory has grown and some investors are dumping their rentals (even at a loss).

Stock Market: New highs, but only 62% of Americans own stock. However, the weight of the holding is very skewed into a few hands that own the majority of the shares.

Due to this many low and middle-class Americans are living paycheck to paycheck. They don't feel the "wealth effect" if their 401K went from 10K to 12K this year while debt is growing. Not counting housing debt, most Americans have over 20+K in non-mortgage debt. I think the data is skewed down because I have a car loan for over $20K so I believe it is much higher than what the survey said (Northwestern Mutual's 2021 Planning & Progress Study).

Bitcoin Price and Bitcoin Proxy (MSTR)

Bitcoin has gone up this year (~150%), but Bitcoin proxies like MicroStrategy are up 600%.

Why is that? MicroStrategy is not using its FCF (Free Cash Flow) to purchase Bitcoin, but it is often funded by debt instruments (like Bonds). That should add some overhead (the cost of borrowing) and therefore why are MSTR returns better than GBTC or Bitcoin itself?

This is a question investors should look into. Why is MicroStratgey doing better than say the Bitcoin Miners like Riot?

If a miner is borrowing money to purchase equipment to mine Bitcoin, is that worse than buying a Bitcoin in the open market? From a cost POV, if it is cheaper to buy BITCOIN then you should just do that. However, if it is more profitable, then you should mine the BITCOIN. Now there are many factors to consider.

Most Bitcoin miners, use cash to buy new equipment. The cash comes from selling off BITCOIN that they earned. As long as Bitcoin continues to hold value, Bitcoin miner should be able to add more assets to their balance sheet over the years. This is what RIOT does. It can mine 200 BTC in a month. They might sell over 50 BTC to pay down debt, pay salaries, and fund other business expenses. The total BTC holding grows month over month. Should a company like this be viewed as the same Bitcoin Proxy as Microstrategy?

I can tell you the market does not price the stock the same way. This is why I believe Bitcoin miners are undervalued compared to MSTR and that I think over time, the market will see the growing BTC on their balance sheet. This will drive the value of the business upwards.

Have a profitable day!