Week 40 - Oct 2 Investment moves

- Current US markets

- Oct 2 investment moves

- Continue with my plan

- Bitcoin / ETHER.

Current US markets

Here is how the US markets are trending right now at 12:30 pm (EST):

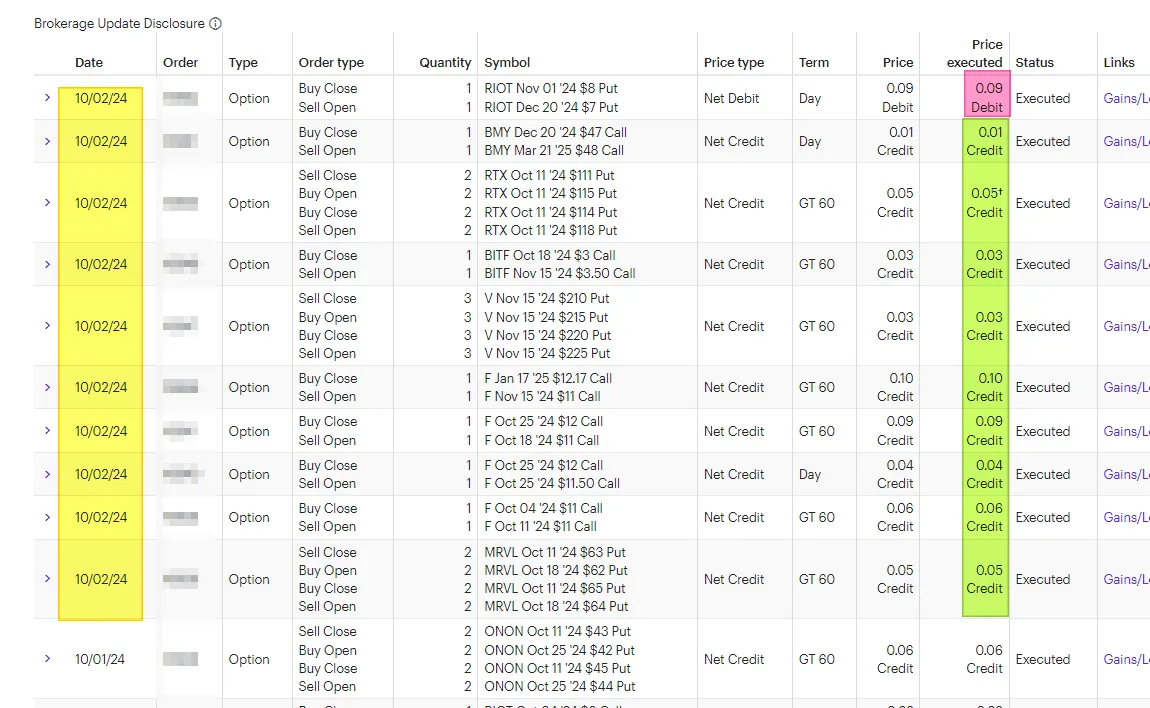

Oct 2 investment moves

Here is my brokerage confirmation of my trades today (@ 11:53 am EST):

Summary of what I did:

- Rolled a Cash Secured put down $1 in strike price for $9 in cash today. This will release $100 back to me for the cost of $9. I also expect RIOT to move up at some point in the future.

- Rolled a BMY covered call up $1 in strike price and out 3 months for $1 premium. My CC is ITM; if I can get any credit, that is fine. You gain more from the strike price adjustment than from the premium you get.

- Rolled RTX put credit spread for more risk. Getting a $5 premium. With missiles being fired, defense stock has been moving up in the last 2 months.

- Rolled BITF covered call up $.50 in strike price and out 1 month for $3 premium.

- Rolled V Put spread (part of an Iron Condor) up in strike price.

- Rolled 1 F covered call down and IN (two months) for a $10 premium.

- Rolled 1 F covered call down $1 and in one week for a $9 premium.

- Rolled 1 F covered call down $.50 for $4 premium

- Rolled 1 F covered call OUT 1 week for $6 premium.

- Rolled 2 MRVL put credit spread for $5 premium each.

Continue with my plan

What am I going to do going into Q4 of 2024?

Currently I will continue to do what I did all of 2024:

- Rolled any covered call to be OTM (or above the market price)

- If any covered call is ITM, roll up one strike price and out in time for a small PREMIUM if possible.

- Rolled any Put credit spread to be OTM (or under the market price).

- Use Put credit spread on underlying where I have a covered call. This reduces the risk of my total position.

- Use Iron Condors on selected Tickers (Visa and SPY).

- Reinvest all dividends (default setting).

- Sell off some boring dividend stock (after the dividend was received). This is to reduce the size of that holding.

- Use that cash to buy high-risk growth stock/ETF. I have been adding QQQM, PLTR, WING, UTHR, HALO, etc. I started the QQQM in May 2024 and so far I have that holding up to $2500 (mostly from dividends payments). I will continue to do this for the next 3-5 years since I believe I have too many dividends in my portfolio and not enough growth stock. For me to do this without TIMING the market, I ended up using this concept of waiting for dividends to be paid out before I "sell" and "rotate" into QQQM.

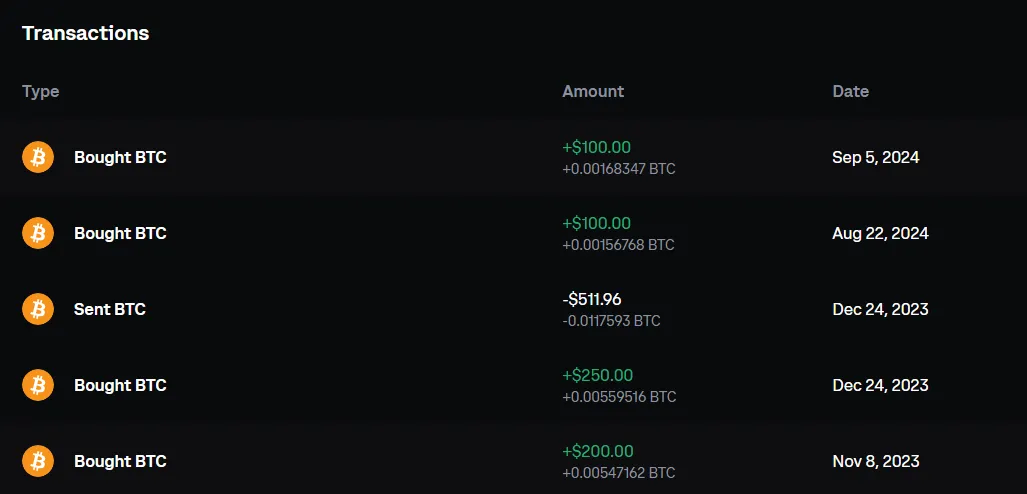

Bitcoin / ETHER.

I don't use an automatic schedule for purchases of BITCOIN. I buy when I have extra cash from my paycheck. Like many American families, that might only be two or three times a year.

Currently, I'm in a waiting and see mode and I buy when it drops. My last two purchase was back in Aug for $100 when BTC was at 61K. Then I made another purchase for $100 in Sept when BTC was at 57K.

I have VERY little Bitcoin that is not going to change my life if BTC hits $1M or $10M for each coin. I have such a small faction of a Bitcoin, that it will take years of me adding to my bag before it is meaningful. This is part of the problem of a fast-growing asset, where I can only afford to buy smaller and smaller pieces of it.

This is why I'm a fan of BTC spot ETF. I still believe we need access to BTC via our 401K plans. I know if that is available, I would allocate 5% of the new cash contribution into BTC. Because I don't have that option today, I'm often left with using whatever free cash I have left at the end of the month to spend on what I like. But that means BTC is competing with all the other needs like a weekend getaway, eating out, going out with friends, treating the kids to something special, etc.

If other families are like me, that just means the BTC adoption rate will take years to get many people's portfolios to get to 1% or 2% of BTC exposure. I'm still bullish and I looking forward to the day when the 401K/403B plan will allow BTC/ETH spot ETF as a choice.

Have a profitable day