Week 38 - Sept 22 - Option Trades

- Down two weeks. Down two months (SPY)

- Sept 22 Option Trades

- What to do when markets go down?

Down two weeks. Down two months.

As of the market closed on Sept 22, 2023, the markets gave up it gain and ended on weakness. The Fed will hold higher rates for longer than people would like. This will hinder real estate, car sales and any significant purchase or the cost of service DEBT (Credit Cards, Loans, Adj Rate Mortgage, etc.).

Today:

Two weeks down:

And two months down on SPY:

If you were using deltas of 16, 20 or 30 on Iron Condors, I think the two weeks/months down can hurt your position on the PUT SIDE. The 70-point down on Thursday did cause some issues on my Iron Condor. The only thing that protected me was I had "4" or "5" deltas, but I noticed how the prices changed on the PUT OPTIONS.

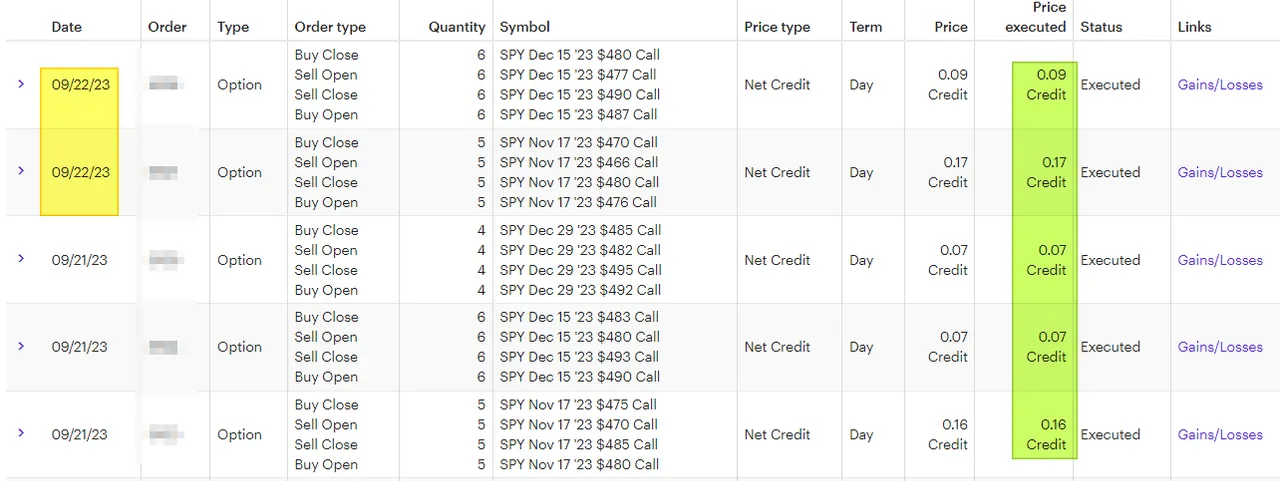

Sept 22 Option Trades

Here are my trades on Friday (Sept 22).

Here is part two of my trades:

What to do when markets go down?

Over the last two days, I had to re-evaluate my options positions and adjust them based on what I see happening. The feeling has changed, and it will likely experience more RED days than GREEN days in the coming weeks.

What I ended up doing:

- Covered calls

Any covered calls I had open under 10 cents had to be examined. Often, I will add more risk back into the trade by lowering the STRIKE price. I am willing to do this when the profit is already made if I did nothing and let the covered call usually expire. I can often add 5%-15% more profit to the trade by adding risk. - Iron Condor

Before Thursday, I added risk on the PUT side to bring the delta back to 4-7 range. Sometimes, the position risk changes without noticing, and I must add some risk back into the trade. On the CALL legs, I only lowered the STRIKE price on any Iron Condor that expires in Nov or Dec. For any position that I have for 2024, I have not adjust those yet. - Put Credit Spread.

I only have a few of these open. ROKU burned me, and I took a big LOST because it went ITM. Tesla was fine, as I could roll out and down in strike price. Is it possible that TESLA can will be painful in the future if the price continues downward! If Tesla can stay above $250, I will be OK.

Some people lost money during the last two weeks since the markets were RED. I believe that I have done reasonably well in the previous two weeks. I know I have made money trading over the last two months (Aug/Sept). I will wait to analyze all my trades (I usually do this on Saturday).

Note*: I did lose money on a few key trades, and I don't know if I am profitable in week #38 until I do my full summary. I also make several trades that cost me $50 or $100, and I hope I did enough to net me a profit for the week.

Have a profitable day.

Solving Chaos