The evolution of DeFi Projects called Yield Farms.

Background: Total Value Locked

- Total value locked: this is the amount of value, as measured in USD of the liquidity deposited in the trading pairs on a project, such as an exchange like Uniswap or a Yiekd Farm like PanCakeSwap.

Renting Liquidity

In traditional decentralized exchanges incentivize investors to deposit liquidity by paying them rewards. This is now called renting liquidity.

- For example Cubfinancehas 16 million dollars USD worth of various tokens like BNB, BUSD, Cub, BLEO and others like Dec and SPS deposited in trading pairs and these deposits are called liquidity pools.

- Cubfinance doesn’t own the liquidity, the liquidity belongs to the investors called liquidity providers.

- Cubfinance provides rewards, in the form of Cub to these liquidity providers. And as long as the liquidity providers can sell Cub for a good price, they leave their liquidity in the protocol called Cubfinance. But as the price drops, they sell all their tokens, and remove their liquidity or capitol, and move to the next project, in search of high yields.

- ‘Because the reward tokens are normally sold to make immediate profits, thus driving down the token price, and disincentivizing Liquidity Providers, this is commonly called a disadvantage of liquidity pools.

- An alternative to renting liquidity is to buy it.

Buying Liquidity

An alternative to renting liquidity by providing reward tokens for everyday the liquidity stays deposited, is to buy liquidity with the tokens. This means that once the project pays for the liquidity, it owns the liquidity and doesn’t have to pay liquidity providers for that liquidity. So overtime the project accumulates liquidity, and eliminates the constant selling pressure on the reward token price, by one time payments and with so called Lock-up periods, during which the token can’t be sold. The expiration of the lock up periods are staggered to avoid too many tokens being sold on the same day.

- For Example: Cubfinance wanted to own its liquidity or total value locked, an investor would buy $500 worth of Cub and $500 worth of BUSD, then deposited them in the Cub-BUSD liquidity pair, and the smart contract would give the investor $1000 worth of Cub-BUSD liquidity provider tokens, sometimes called LP tokens.

- Then, instead of depositing them in the Cub-BUSD yield farm, to earn 20 Cub a day, the investor sells the $1000 worth of LP tokens for $1100 worth Cub.

- And the smart Contracts restricts the ability of the investor to sell the tokens for 7-14 days. This prevents the immediate sale, and pushing for down the price.

- Thus the project owns its liquidity and accumulates more over time.

Summary:

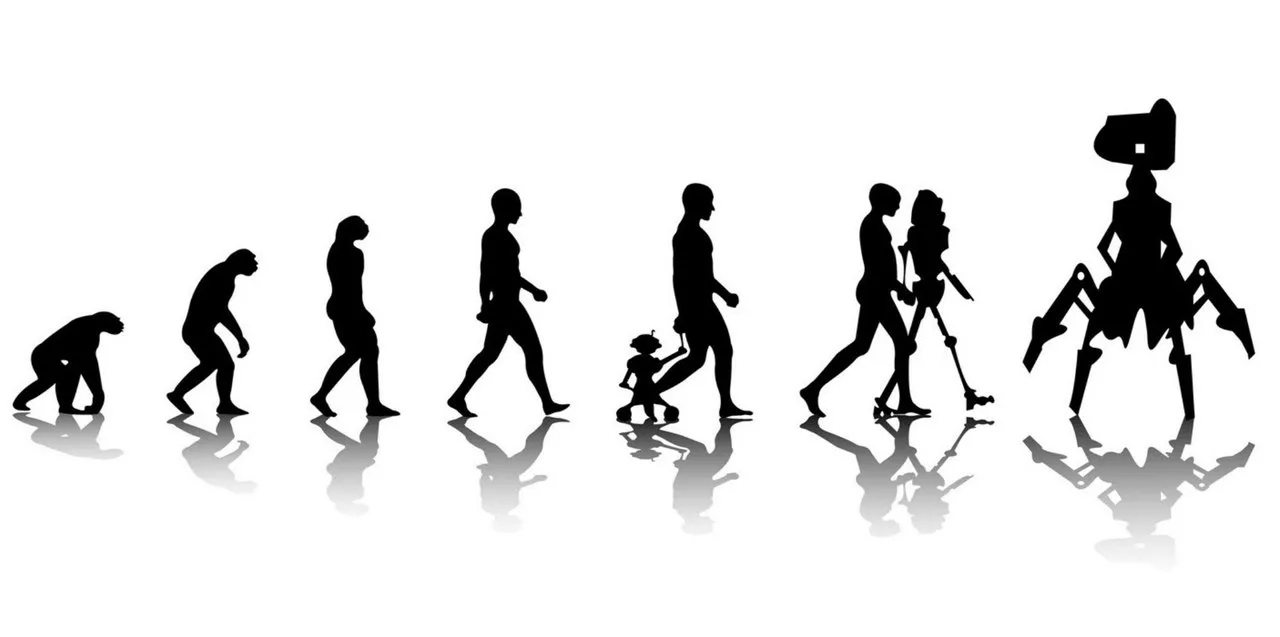

Renting Liquidity via token incentivized liquidity provision, is a DeFi 1.0 mechanism. Owning Liquidity via a token purchased liquidity provision mechanism is a DeFi 2.0 mechanism. It is a new mechanism for of holding liquidity, that represents an evolution of DeFi projects.

.

.