This trade on Ford I plan to sell cash backed puts to buy 100 shares of Ford at $5.00.

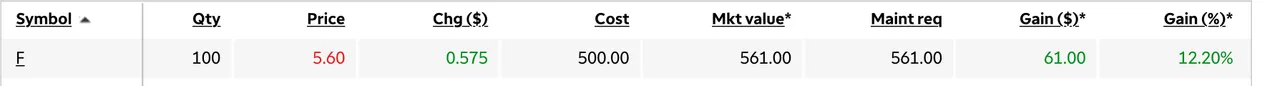

I own Ford stock, an American automobile manufacturer.

The is a dividend stock paying a good 4.4% dividend.

I bought it for $5.00 on a dip in March, so It am blessed to be up 56 cents per share.

Today the stock is trading at $5.56 and I am thinking of adding to my holdings, but the price isn’t $5.00 per share and more.

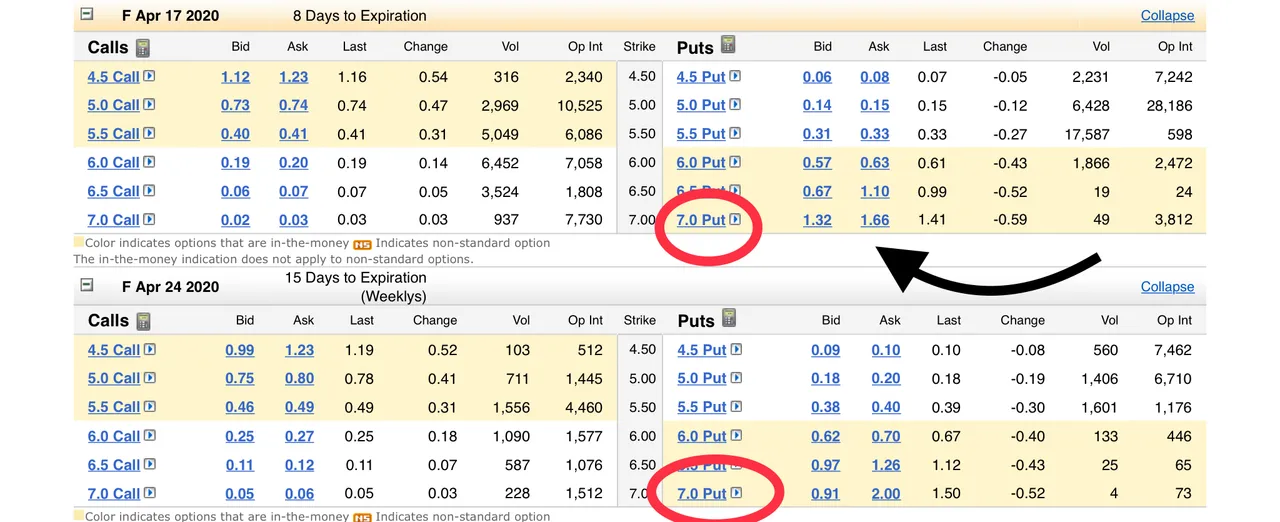

But I noticed the April 24th $7.00 puts bid/ask 1.32/2.00.

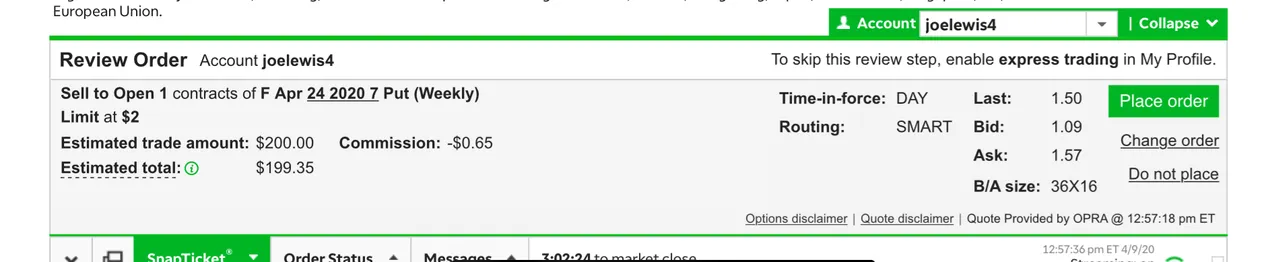

So I will try sell the April 24th, puts for $2.00 per share.

This means I take in $2.00 premium x contract multiplier of 100= $200 spendable cash.

Now I have agree to buy 100 shares of Ford at $7.00, which is currently selling at $5.56

Why would I agree to buy it for $7.00?

The premium of $2.00, if I can get it, lowers my cost basis from $7.00 to $5.00, which is a bargain since its selling for $5.56 today.

It is doubtful that Ford will be above $7.00 by April 24th, so I should have 100 shares of Ford put to me on that date, and happily own those shares with a basis of $5.00, if Ford is selling at 5.56 or more I will have an instant gain of 56 cents per share or $56 dollars on a $500 dollar investment, which is over 10% gain in one 14 days. I will be happy with that.

The Math

Ford price 5.56

Ford APRIL 24TH PUT $2.00

One contract sold at 2.00 equals 200$ premiun.

I buy 100 shares for $700.00

I subtract premium to calculate the basis of $5.00

This is called “Selling Puts to lower your basis.

Stay thirsty for knowledge my friends.

✍🏼 Shortsegments.