This is a revolution in UPI payment to use a credit card for UPI payments and pay afterwards

UPI (Unified Payments Interface) has been a game changer in real time payments in India and has changed our habits completely. It was lunched at the right time, when we needed it most - Covid. Everyone wanted a contactless payment, and UPI was an instant hit. Definitely they built a solid infrastructure to deal with very very high no of transactions - so kudos to NPCI (National Payments Corporation of India) for that.

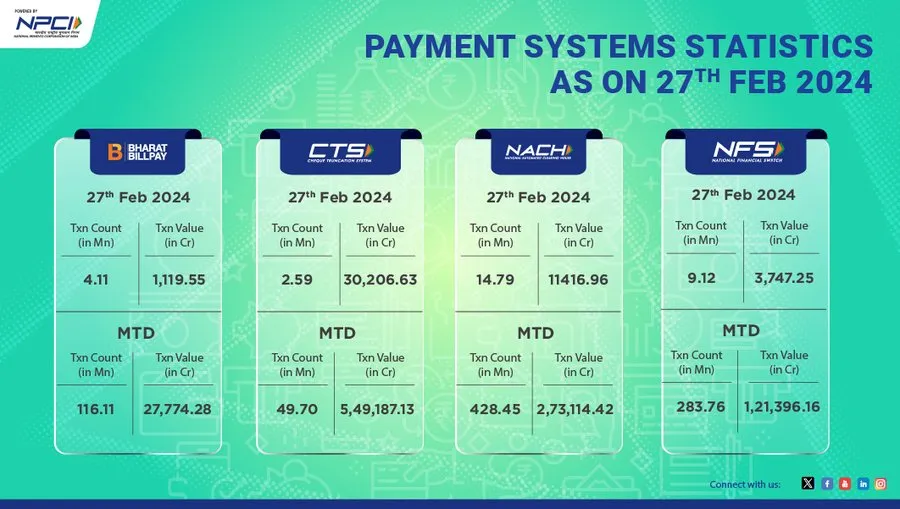

If you look at the statistics from yesterday, then you can imagine how robust the system is. Now usage of Cash is very limited which is good for economy . But from a consumer perspective , we always paid from our linked bank account, for UPI payments. My bank was teasing me with this new offer from quite some time - use the RuPay Credit Card for UPI.

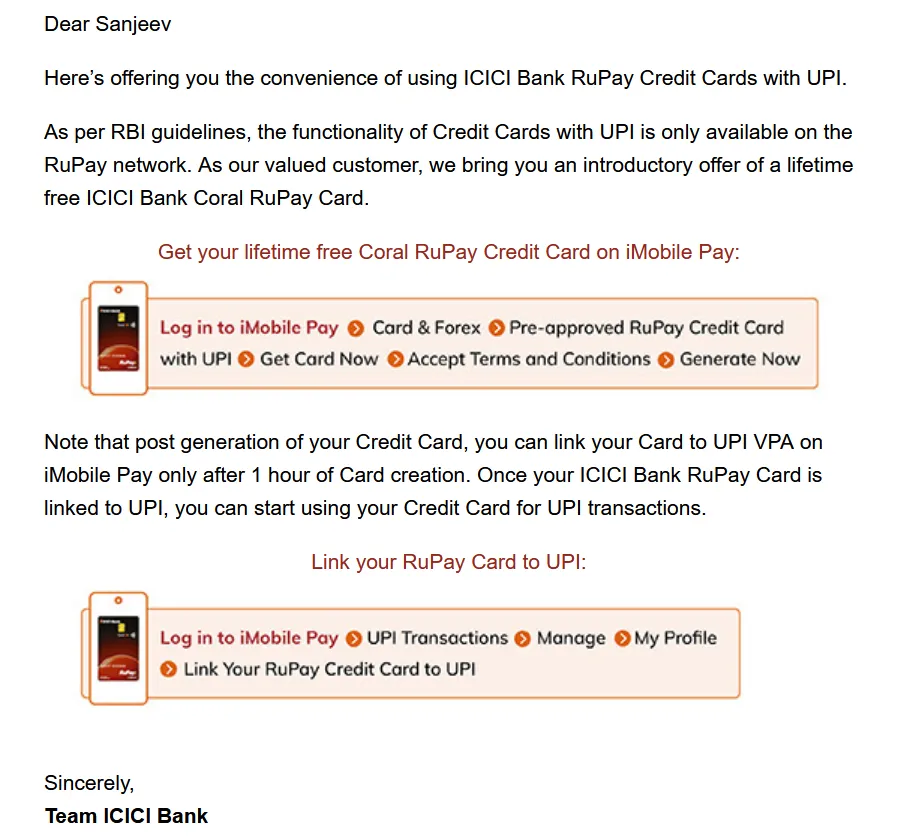

It's a lifetime free Credit Card with zero joining and annual fees. So finally yesterday, I signed up for this, because using a credit card allows me to spend from credit and pay almost after 50 days. And it's linked to my primary credit card, so limits remains same. And there is a reward system, where they reward points based on transaction amount, so this will earn me some extra money on that front, and also contributing to the Credit Card Annual Spend ( its free as long as you hit that limit).

I did tested after one hour and it worked pretty smooth, except for the fact that they keep a limit of 5000 rupees on the first day as a safety measure. So if you have not set a Credit Card for your UPI payment, then this is high time to do that, to take the extra benefit of using your cash for 50 more days and even earn some interest out of it.

And everything is not rosy with UPI, its also the biggest source of fraud, because people easily get trapped by scammers, so take some extra precautions, to set a lower limit of that particular card as you won't pay a big amount in UPI usually. Also set up a different PIN (other than your debit) to authenticate Credit Card transactions on UPI - you will have to remember two passwords, but that's safe. Also do remember to use some anti-virus software on your mobile - licensed versions are better, but if you don't want that, then at least install some free version.

Do let me know, if you have set up and see benefit using a Credit Card for UPI Payments ? I installed the bank's mobile app to use this but most apps support this feature, you can check it here : https://www.npci.org.in/what-we-do/rupay/rupay-credit-card-on-upi .

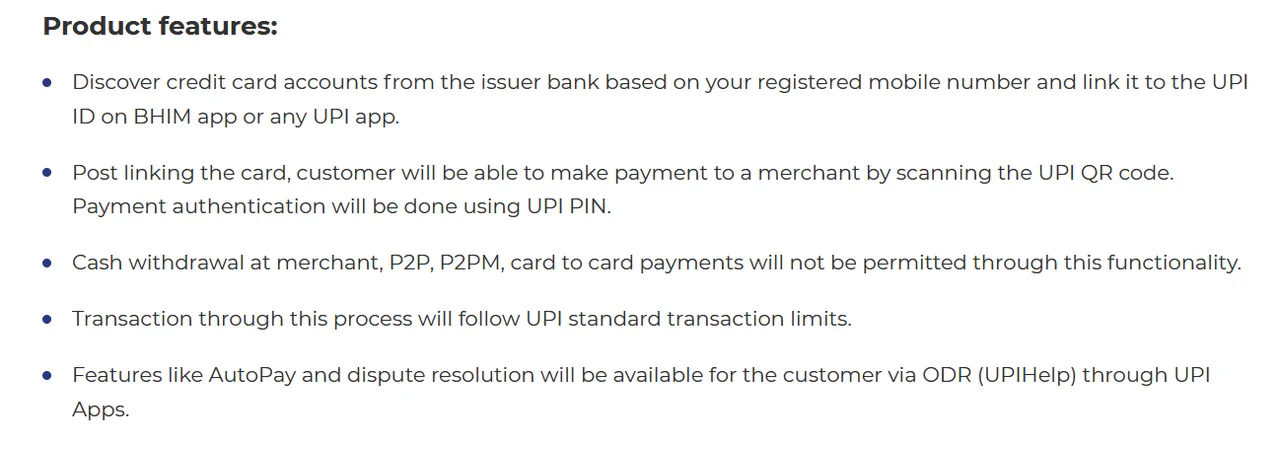

And looking at the product features, I can see Cash withdrawal at merchant, P2P, P2PM, card to card payments are not permitted through this functionality but that's better for our safety.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.