Are you worried about sticky inflation and rising interest rates?

Do you think that global macroeconomic conditions may impact your investment in the next year or two?

If you answer yes to these questions then you are not alone.

A recent survey conducted by a research firm in Canada suggests that 61% of the respondents consider economic recession could negatively impact their portfolios in the next two to three years.

The research was conducted by Scotia Bank, one of the big banks in Canada, and suggested that more than 55% of the Canadian investors think that their retirement plans are negatively impacted by current economic conditions.

The survey provides us with the current mindset of retail investors. Surveys are never accurate but it provides a window to the current mindset of the population when it comes to investment and retirement. The results could have been pretty different had the recent bank collapses happened before the time of this survey.

Right Time to Invest?

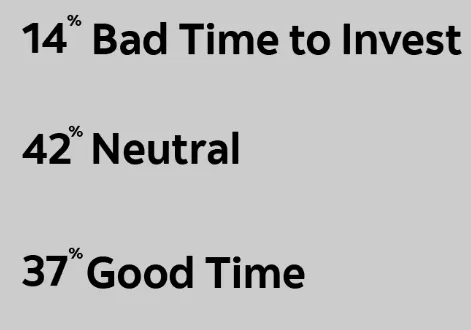

Investors’ confidence does not look to be at the right place when it comes to long term investment lately. Despite this, 37% of the survey respondents think that this is the right time to invest. These must be the degens who like to take risks and get in when the market is down.

42% of the respondents are neutral when it comes to investing and that could be the right approach as these are uncertain times. If you are someone who wants to get in for the long haul and are not worried about the market going further deep then it may be a right time to invest. Otherwise, it may be wise to watch from the sideline.

Top 5 perceived risks

What do you think the top 5 perceived risks are for Canadians now? Here is a list

- Economic Recession - 61%

- Rising Inflation - 58%

- Stock Market Volatility - 46%

- Rising Interest Rates - 40%

- Global Geopolitical Risk - 37%

These variables make sense. I also consider these the top 5 risks to my investment. It is funny how both rising inflation and recession could impact our investment at the same time. The sticky inflation that is not going away is forcing governments to raise interest rates slowing the economy which then could initiate economic recession. The global geopolitical risk - Ukraine war- is contributing to the supply chain issues and inflation. All these are connected to each other.

Out of these four, I am not that much worried about stock market volatility. The reason for that would be my involvement in crypto which is more volatile compared to the stock market.

Investment Feeling

Sixty percent of the respondents are feeling negative about their investments which was 33% in 2021. That’s a significant jump. It all boils down to the QT that happened in the year 2022 which raised the borrowing costs including mortgage and credit card payment.

The funny variable

It is funny how the interest of the surveying bank was displayed in the survey 😛 The survey suggests that 83% of the respondents who met with their financial advisors are more confident about the financial outlook. It is funny how banks and investment firms influence the data and bend the narrative. Looking at the survey anyone would think it is better to talk to the bank or the financial advisor.

Do you agree with the result of this survey? What do you think?

Survey source

survey source- Scotia Bank