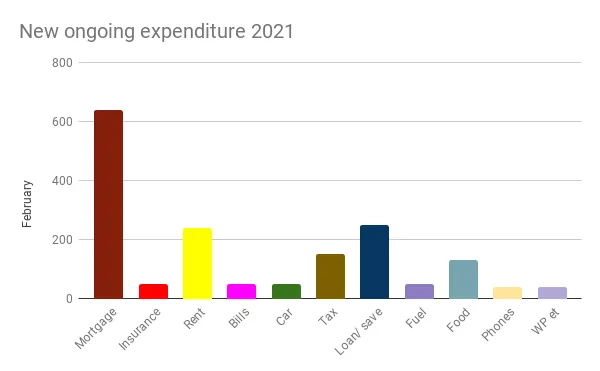

I've picked up a couple of new fairly hefty expenditure items for the coming year, thanks to having to take out a small loan to purchase my land purchase and batting my tax payments into ongoing monthly payments rather than taking the hit in one go.

New monthly basic cost of living expenditure = £1690

Anticipated monthly expenditure on 'the basics' for the rest of 2021 now stands at just under £1690.

This is NOT including spending on anything fun like beer and coffee or convenience spending such as take out meals, or factoring in any items I might need like new clothes or tools.

These really are my personally constructed needs....

The breakdown...

Mortgage and insurance

This remains the main outgoing, at almost £700 a month, but the house brings in £550 a month, so that's OK. I need have a serious sit down analysis session and decided whether I sell the house.

Rent and bills

This is the rent I pay on my cabin, and bills included - includes leccy and the gas bottles - even though I'll be spending hardly anything on gas from March until October, I'm still averaging it out!

Even though I've bought land I'm still going to keep the cabin on for a while, I like it here! And I've got access to grid electricity and a washing machine. I mean they're not worth £270 a month all in, but they do make life a LOT easier.

But really it's the fact that I just like it here!

Car and fuel

I factor in £60 a month for the car - insurance and tax and a little for fix-ups and then £40 for fuel - that's maybe a bit tight, but not too unrealistic.

I've already paid the insurance up front.

Food, phones and WP

These are my only other 'regular expenditures - they pretty much speak for themselves. I think I've done pretty well with the phone - unlimited data for £30 a month, actually it's less because its 30 EU - and then £10 for a basic UK phone SIM.

Tax

Thankfully it was easy to bat my £2K tax payment back into monthly payments - I paid a bit up front to bring the monthlies down to £150 a month. Not too bad.

Given that my income has reduced since due to Covid, this should remain stable going forwards into 2022.

The loan repayment

I took an £8K loan out - the rate was only 2.9% and it was in my account within an hour - it's a bit more than I needed, and it gives me a bit of a buffer which is nice.

It's not even really new money - I can pay most of it back as I gradually withdraw money from my P2P lending account as the loans mature (It's just the loan parts the've frozen for selling).

This is what happens when you buy more land than you need!

I'd planned to spend around £10-15K on the land purchase, I've ended up spending around £23K - basically twice my mid-point.

To fund this I've had to bat my tax payments back rather than pay it all up front, and take out a loan, meaning I'm looking at another £300 a month on my expenditure for a year or two.

I figure I can pay the loan off quicker than the five years I've got on the term. Of course I might not, it might not be rational given the low low rate.

And the land is perfect, so I'm not going to beat myself up. And the repayments aren't that bad.