Introduction

There has been a lot of talk about decreasing the inflation of HIVE lately. The latest contribution was @aggroed's suggestion to slash the inflation rate from roughly 8% to 1% with the distribution heavily favoring witnesses. You can check out his post here:

@aggroed/hive-inflation-reduction-thoughts-on-the-next-hard-fork

He's not the only one who has suggested something along those lines. Many of the old guard and some of the top witnesses also talked about reducing the total inflation rate and/or doing away with author and curation rewards altogether. Even Blocktrades once threw the idea that curation rewards should be done away with in the air, which would predictably restart the vote selling industry or lead to slashing the author rewards, too.

I think the rate of inflation is much less important than how it is allocated and the token price is also much less important than what we should really be focused on, which is the market cap.

Most HIVE is liquid

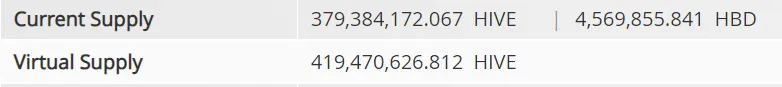

This data is from hivetasks.com. Current Supply is the total supply of HIVE plus the total supply of Hive Backed Dollars (HBD). Virtual Supply is the same as Current Supply but with the HBD supply converted into HIVE at a price of one USD per HBD.

This is the current Total Vesting Fund (also from hivetasks.com). The latter figure is the number of millions of Vests currently in existence. The blockchain keeps track of Vests, which is what Hive Power is under the hood. The former figure is the total number of Vests converted into HIVE at the current price, which goes up programmatically at a slow and steady pace.

Despite missing out on content rewards and the gains in terms of HIVE when liquid HIVE is swapped for Vests by powering it up (a built-in smart contract does this on Hive), most of the HIVE in existence is kept on exchanges as liquidity to be traded back and forth. This is a very rational thing to do because, historically, the price swings of HIVE and STEEM have been massive, which is very lucrative from a trading point of view.

The flip side of this is, of course, that while those who hold Hive Power can make steady gains over time by participating in the network and doing all the work, the holders of liquid HIVE stand to gain enormously from selling high and buying low.

Increase the rate of inflation to help vacuum liquid HIVE from the exchanges

It may seem counter-intuitive but since Hive Power holders are the ones who control the token inflation, they must be adequately compensated for taking the risk associated with staying powered up and also for curating content. It's precisely the opposite of what has been proposed by some people that may actually help grow the market cap. Liquid HIVE holders who speculate on the token price couldn't care less if the rate of annual inflation were 1% or 8%. When the token price has fluctuated 1-2 orders of magnitude in very short periods of time, any single digit inflation rate starts to look like utterly insignificant.

DPoS is vulnerable to stake centralization

If you mined STEEM back in the day, you only had to set up a witness server and vote your own witness and those of your buddies' and you were set to earn to the north of 100k STEEM per year indefinitely. If you are a large stakeholder, you can tap into an additional source of inflation by voting your own witness, which will help you cement your position.

The number of consensus witnesses is small, only 20, and they are the ones who get the lions share of the witness rewards. This is a price HIVE has to pay for high throughput and is thus understandable. But without it being compensated for by other major streams of token inflation, the chain will ossify and gradually die.

Conclusion

The purpose of this post was to present arguments supporting a higher level of inflation to encourage HIVE holders to power up and to suck liquid HIVE out of the exchanges, which could increase the token price. In turn, these arguments essentially demonstrate how futile tinkering with the rate of inflation in small way is. Investors don't like instability, which is why the politics of inflation is potentially a repellent against investors. But if I had to choose between a higher and a lower rate of inflation, I'd pick higher because ultimately token price is irrelevant. What's relevant is the growth of the value of our holdings and that is the sum of the products of the token prices and the numbers of the tokens that we hold. The token price is but one variable influencing the value we possess.