After a few weeks of no significant price movements earlier this year, unsurprisingly following the Silicon Valley Bank collapse which held around 8.2% of Circles reserves, we are taking the elevator down again. While doing so we quickly dropped below the crucial support-areas of $22k and even $20k and also some indicators, like the Supertrend, flashed red again.

Obviously one class that is often affected by such drops are simply the buyers and while we may assume that long-term holders wouldn't sell, this is usually not the case when faced with extreme FUD or bearish economic events. In reality, many investors choose to sell their BTC to cover their other assets from liquidation hence why crypto usually reacts the most violently amongst financial sectors to abrupt changes in economy.

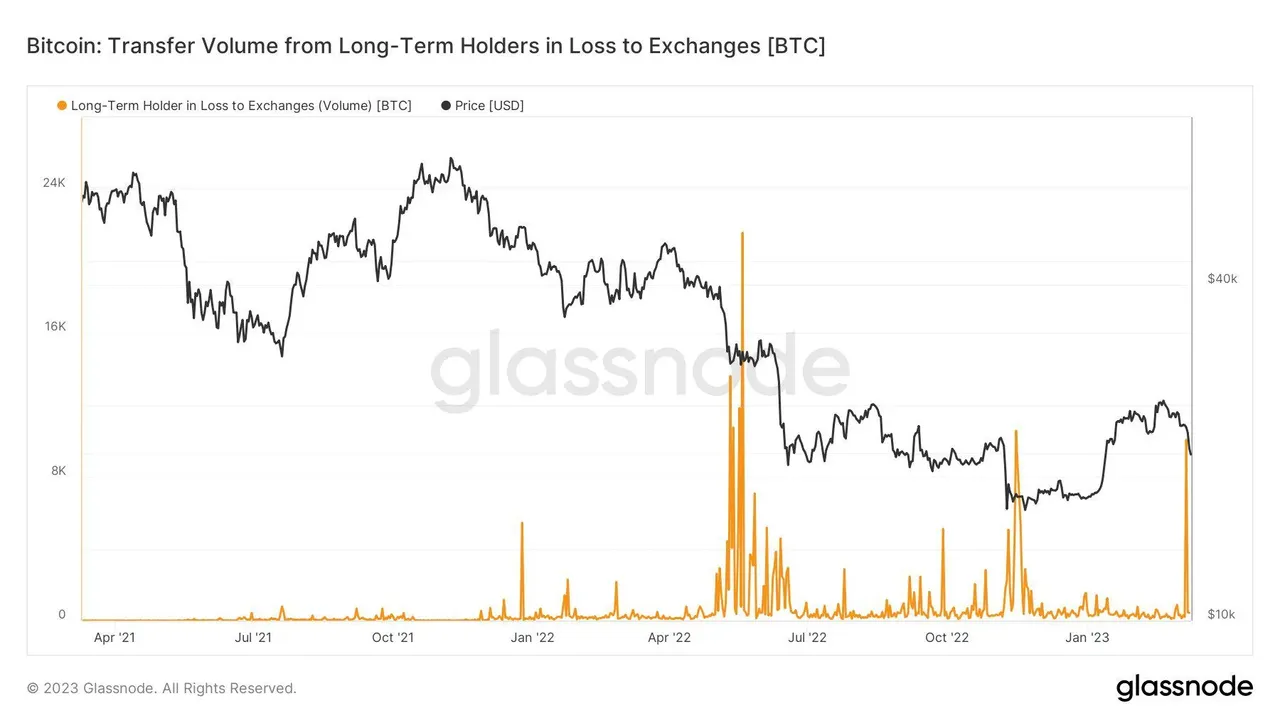

As those are long term holders dump their BTC bags, this can be a great evidence of how brutal or unexpected a move is.

The following graph here shows the selling of long term holders, more specifically, the amount of BTC being deposited to exchanges from other wallets. There is a very high possibility that those are going to be dumped onto the market.

Now we have just hit a new high of long term holder selling due to the Silverbank and SBV collapses respectively. This selling is at about 12k BTC right now per day, which is about $240M of long term holders' BTC thats been panic-sold.

Now I am no financial advisor but if you have managed to hold on to your crypto despite all the recent events and FUD I congratulate you on having bigger diamond hands than the vast majority of even long term holders. The whole debacle about USDC depeg is yet to unfold completely and we can only hope that the markets dont proceed to bleed further