We are one year into the Covid-19 pandemic and our lifestyle changed forever. Due to the Coronavirus outbreak, the way we live our life changed, from the way we shop to how we spend our time. But what will be the long term effect on the use of cash?

Since the start of the Covid-19 pandemic, people had to adapt in many ways, including the way they spend their money. Most shops are encouraging online shopping and in store the contactless payments are almost mandatory. Coronavirus will hasten the decline in the use of cash as people make a long-term switch to digital payments.

The lock-down and "Stay at Home" governmental guidance has led to a 60% fall in the number of withdrawals from cash machines while card payments has risen with online shopping, particularly for groceries. Experts say the long-term future of cash could be at risk, and only an estimated of 20% of the population will rely on cash. Following a survey, Link suggested that 75% of people were using less cash, and 54% of those asked said they were avoiding cash payment on purpose as a safety measure against Covid-19. Shoppers are now more suspicious of handling cash, worried by the fact that another person have touched them. The use of online orders for groceries surged during the summer and online shopping was the only alternative for countries under lockdown.

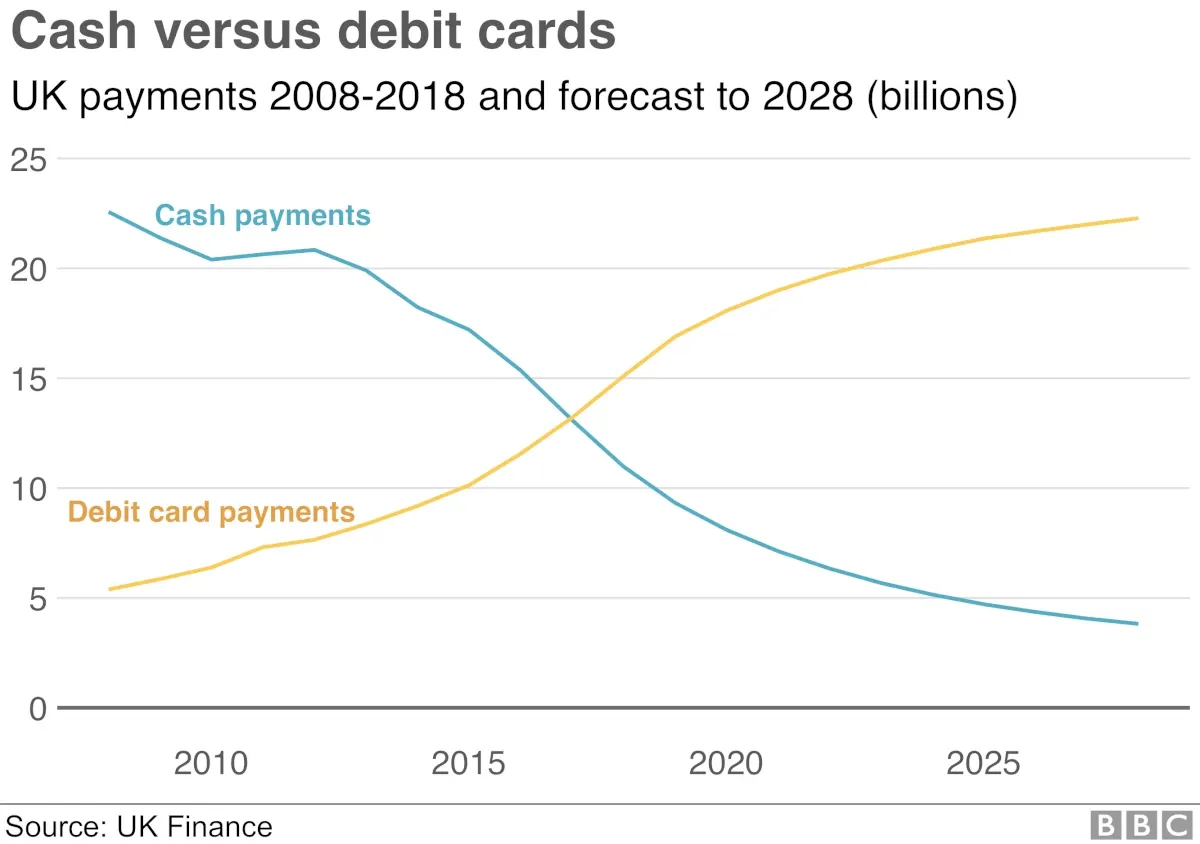

Will this be seen in future years as the crisis which finally ended the use of cash? According to The Bank and England and BBC business reports the cash use is falling, with predictions that fewer than one in 10 transactions will be completed with notes and coins 2025. Cash use will drop in the following years will card payments or the use of phone apps will trend.

Contactless technology is now used in all debit and credit cards, and customers using digital cards, PayPal or Apple Pay is on the rise. Innovations such as paying people using by sending a text to their mobile phone number is making transactions easier to handle. The use of cryptocurrencies, tokens and virtual coins has the potential to fill the gap in the market, giving an alternative option to the demand.

Increasing financial inclusion rates globally, widespread adoption of contactless cards and the spread of cashless mobile payment systems in developing and emerging economies mean this trend is predicted to accelerate.

Reasons for the cash use decline

The rapid proliferation of cashless technology, contactless cards and apps, leaded to quicker transactions, improved safety and control over finances.

The massive growth of e-commerce has transformed Amazon, eBay and online retailers into a reliable way to buy from a laptop or smartphone.

Supermarkets implement only orders and home deliveries which more and more are using now since the Covid-19 pandemic. Home delivery and online shopping will replace a trip to the supermarket, shuffling through ailes, queuing at the till and wasting time to pack your shopping, making the whole process more efficient and maybe less time consuming.

The use of "mobile money" is spreading like wildfire. In some countries more people now have a mobile money account than a traditional bank account.

In light of the above changes and the continuous improvement of technology, its not hard to see why the use of paper and coins is losing popularity.

Disadvantages of cashless transactions

Globally, some counties, regions and places are lacking of the widespread or accessible cashless infrastructure. Some communities are affected by few or no point of sale terminals in stores, slow internet connections, the unavailability of broadly accessible financial products. In poorer regions, and where large numbers of people work outside the formal economy, paper money is still king. In Africa, the region most dependent on hard currency, only 1 per cent of transactions are by card. In Egypt, Peru, Saudi Arabia and Malaysia only around 1 per cent of all transactions do not involve cash.

We are now one day away before we can archive 2020, and all the catastrophic events that happened in the last 365 days. Will 2021 be the year when the humanity will move into a cashless society?

Join Publish0x to earn Crypto for writing and reading