With the price of hive flying up over the course of the last week or so I've been watching my holdings in this pool closely, and especially the changing distribution of hive and DEC.

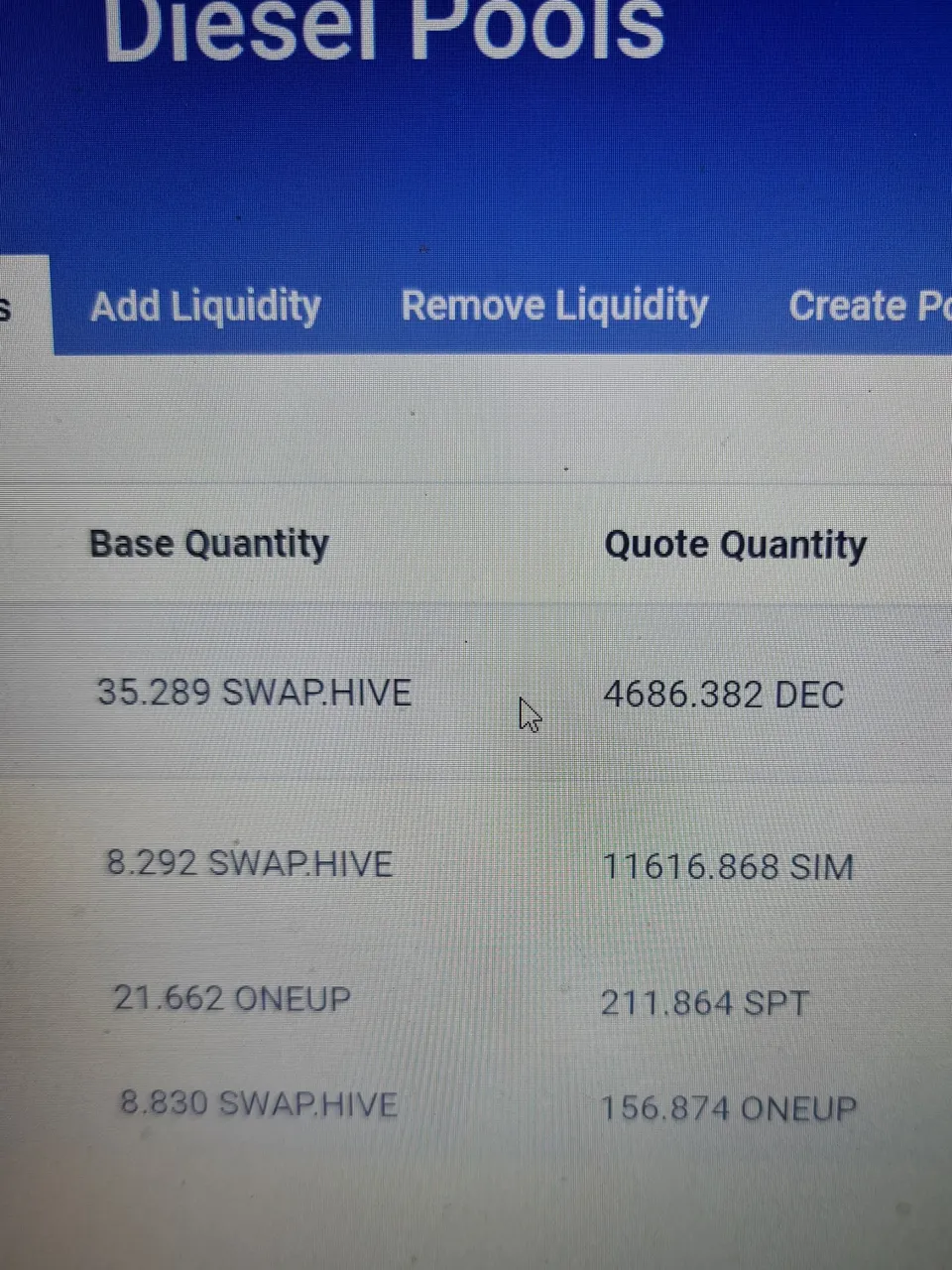

The image above was taken on the 24th November when I first started to notice a shift in the distribution of the liquidity. Please excuse the poor quality image it was taken for my own reference with no original intention of sharing.

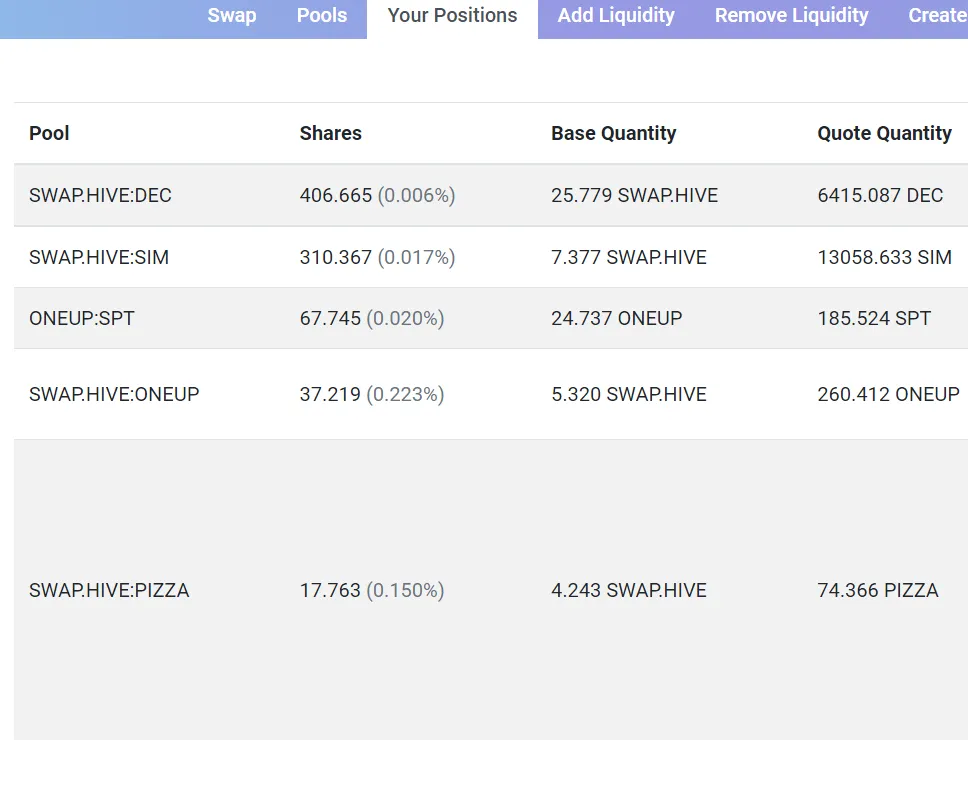

At the time of taking the first image Hive was priced around £1/$1.30, if we then fast forward a week to today the 30th and the distribution in the pool is a very different story with hive now around £2.10/$2.80 each as shown in the second image.

As you can see in the space of just a week I have added around 1800 DEC and lost around 10 hive. As someone participating in the Splinterlands airdrop this is working very well for me and translates to roughly 3200 airdrop points, when you then consider that my total points at the time of writing are around 15k it means 20% of my airdrop points have been gained in a week solely from holding liquidity in this pool and the higher hive goes the more this increases effectively pegging a portion of my SPS earnings to hives value...how incredible is that if it keeps rising at its current rate!

Of course we cant talk about liquidity pools without discussing the elephant in the room...impermanent loss.

I've been reading a lot on this subject the last week and I'll admit when I first started to notice the changes I did worry a little but the fact of the matter is that impermanent loss is a Theoreotical loss, it doesn't actually exist.

What you are doing when you calculate impermanent loss is comparing what your holdings would be worth If you had kept them liquid or held them in the pool, its the same as selling a coin/crypto and then a week later it moons, you don't then go and calculate the lost earnings from the sold coin into your portfolio. You would never do this you would just write it off as a choice you made and move on and this is exactly what you have done when you Chose to deposit into the pool.

Another aspect not taken into account when calculating impermanent loss are the rewards that are provided by the pools that can be quite lucrative and the payouts will often offset any fictitious losses while giving a steady income stream that can be used to boost other holdings. I use the word fictitious because that is exactly what impermanent loss is, it doesn't exist. you made a choice to invest in a different manner and therefore you no longer hold the original investment you are making a comparison with. I chose not to hold liquid hive and invested it and I am happy with my choice so I lost nothing.

My take from this and what I would like to say to any readers is if the concept of impermanent loss is putting you off using liquidity pools then dont let it, do your research, look at the returns and if it works for you then make a choice, personally Im more than happy with my decision and regret nothing.

Not financial advice

Thanks for reading.

Anyone else out there loving this pool right now?