In finance, an investment strategy is a set of rules designed to guide your choice of an investment portfolio. We will have different goals of course, and our skills make different tactics and strategies appropriate. It is very important to have rules, a strategy, and a plan for your investments. On top of that you should be able to design yourself a portfolio of assets you can rely on. Please have a look at mine for inspiration. I will give no financial advice, just a quick look on how my assets are allocated and what strategy I prefer.

I have earlier written about my portfolio allocation here: @olebulls/show-me-your-assets and if you have read it you probably notice that back then I did not want to have more than 10% of my investments in the crypto market.

That has really changed this year, cryptocurrency has really been one of the biggest investment stories of 2021. I have been here on HIVE for the last six months and used many of the dapps and it has come to my understanding that this has a huge potential, changing for instance the entire money system that we know today – and it is ridiculous few that understands this. When I am having such fun on the blockchain and are really looking forward to do stuff here, why not millions of others people?

Nevertheless, you will find my old and new asset allocation beneath. Note that Crypto is now 20% of my portfolio allocation and not 10% – and with good reasons!

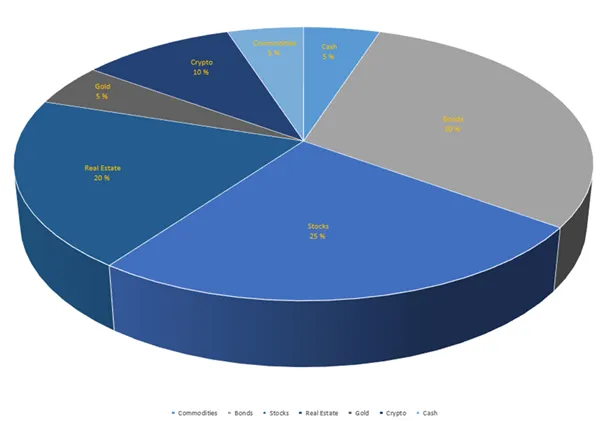

Old Allocation

The old allocation is already starting to get a bit conservative, with it’s 10% in crypto. I will expect this piece of the cake to grow even further in the future because of all the different opportunities that comes from crypto, smart contracts and ze blockchain.

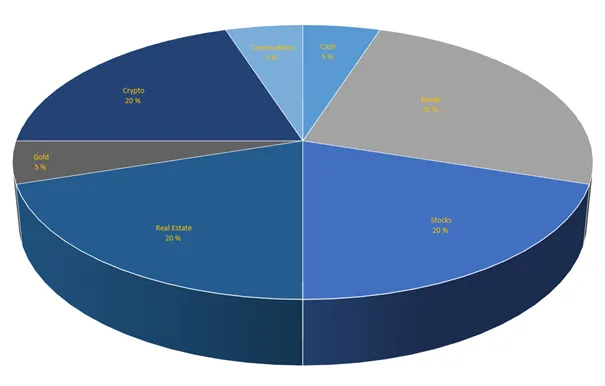

New Allocation

As one can see my new allocation looks a bit more modern. Many would not agree of course but in the era, that we are in now, and if you have witnessed the potential of crypto and what they are built upon you would probably see this allocation as very good (that if you are a Hivian, lol). I mean, it is still a “all weather portfolio” – I have only increased the crypto asset part. Another reason why I have also increased the crypto asset allocation is because there is not only BTC, ETH or LTC. You also have a huge market of other crypto assets like ALTs, BSC, polkadot, and DeFi with NFTs – just have a look at Splinterlands, as a NFT based game, and games are some of the fastest ways to get people into crypto – imagine the potential! Just have a look at hearthstone, in 2020, there were 23.5 million active Hearthstone players worldwide, and that without “being paid”, other than having fun of course. In Splinterlands you get the best from two worlds; having fun and earing crypto. All this will put the word of mouth on the agenda, and we will have even more and more people looking into the “World of crypto”. So based on the latter, If I wanted to invest in Hive with it’s dapps like Peakd, Leofiannce, POB and now Splinterlands (and many other dapps) you could understand that I did not need to expand my crypto piece of cake - I f***ing needed to change that piece of cake!

I invest a lot in Stocks as well. I am always looking for the stocks that has a low price relatively to it’s earnings and that, based on my analysis, have a potential to go three times it’s value within five years. So far, I have really had some great success with this. I can tell that, green stocks in combination with technology has been very lucrative the last 10 years. However, when I pick a stock I have five years perspective. Regardless of what is happening to the stock it will be mine for five years. That is of course risky, but I am very consistent that the companies that I pick should be large (with great cash flow) and should withstand one or two crises without any problems.

Bonds are funny, especially index funds, just wait for five years and most likely you have doubled your money. That is really my philosophy here. It is a “no-brainer”.

As of Gold, I have always wanted to own a little of “the secret of God” – as the Aztecs once considered it. It is also good to have a little of gold because history shows that when the market crashes the precious metals rises.

Commodities, just because it is recognized as one of the few asset classes that tend to benefit from rising inflation. I have seen that commodities often rise in value during unstable economic times – which we will probably encounter very soon. Look at it as a better hedge against inflation than stocks and bonds are.

Real estate - I do not want to say more than that I just need some passive income to pay for my car and school loan! ;)

Cash is king! Why? Use it to buy when everything drops low!

However, the most important change to my investment strategy was the change of the size of my crypto holdings, this needed me of course to reallocate the other asset classes as well, meaning sell of. As you probably understand I really needed to rearrange my portfolio allocation since it has been, yes, five years since last time. I did not believe the crypto market to develop that fast, but I had some suspicions from time to time. 10% in crypto for five years – It needed a change. A lot has changed the last five years, and I bet that there will be a lot of changes for the next five years as well. Then I suggest you go change your investment strategy every five years and reallocate your present portfolio to the new world. I will definitely do that as long as I live.

Thank you for reading today Hivians!

Cheers

-Olebulls