If you're reading this, you either got fucked by the market, or you want to prevent getting fucked by the market. Either way, bear with me, you'll get at least a slightly better insight into market cycles and what drives the market other than apparent FOMO/FUD cycles from bipolar Elon Musk - Btw, he's a piece of shit anyway.

God, it's so frustrating to see how easy it is for the elite to shift the narrative from extremely bullish to bearish. Just yesterday the market looked bullish as fuck, and today... well... it doesn't haha.

Nevertheless, let's talk about Wyckoff and why he matters.

Who the Fuck Is Wyckoff?

To begin with, Wyckoff has developed a method that contains a series of principles and tactics designed to help both investors and traders. After becoming rich, he spent his life teaching and researching the market cycles, hence became one of the intellectual building blocks of technical analysis. And while his studies were mostly related to stocks, it didn't stop people from applying the same principle on different assets - including crypto.

Most Important Theories:

Three fundamental laws;

The Composite Man concept;

A methodology for analyzing charts (Wyckoff’s Schematics);

A five-step approach to the market.

I'm not sure if I'll cover everything, it seems likely I'll cover two at the time - just to make sure there's no too much text to consume.

The 3 Fundamental laws of Wyckoff

1. Law

I'm genuinely convinced most of you have a fair understanding of how supply/demand work, but for the sake of argument I'll write it anyway.

The first law actually states that prices rise when demand is greater than supply, and drop when the situation is opposite.

It's not something Wyckoff innovated, but it goes into the same equation, thus is relevant to the topic.

Demand > Supply = Price Rises

Demand < Supply = Price Drops

Demand = Supply = Nothing (the price doesn't change, mostly implying low liquidity and trading volume.)

To put it outside the equation, the first law suggests that if there an excessive demand for a certain stock, and when it passes the supply ratio, the price should go up because there are more people buying than selling.

If the scenario is opposite, if supply exceeds demand, it's likely for the price to drop.

The third scenario is definitely the most boring one. Decreased volume indicates "equilibrium" between supply and demand. Meaning that there are no buyers to pump the price, and there are no sellers to dump the price.

Second Law

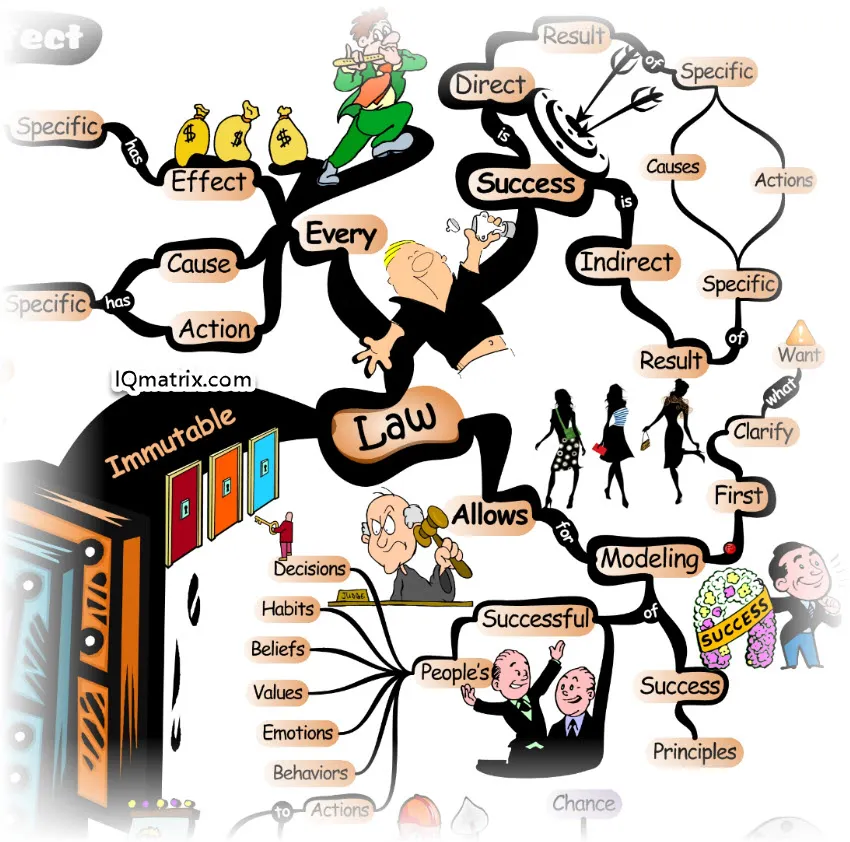

The Law of Cause and Effect

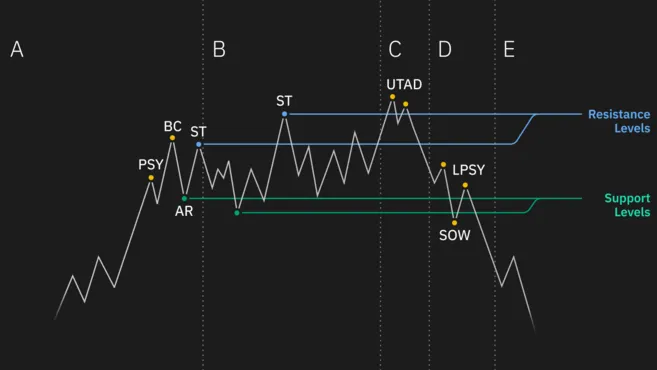

The second principle in the first law (lol) states that the differences between supply and demand are not random. Instead, they come after periods of preparation, as a result of specific events. In Wyckoff's terms, a period of accumulation (cause) eventually leads to an uptrend (effect). In contrast, a period of distribution (cause) eventually results in a downtrend (effect).

It make sense though, there have to be periods of both. The accumulation period necessarily pushes the price up as the strong hands take over, whilst the distribution phase begins once strong hands become weak, or in other words, why wouldn't you sell 600% profit?

Third Law.

The Law of Effort vs. Result

The third Wyckoff law states that the changes in an asset’s price are a result of an effort, which is represented by the trading volume. If the price action is in harmony with the volume, there is a good chance the trend will continue. But, if the volume and price diverge significantly, the market trend is likely to stop or change direction.

For the sake of argument, before alts exploded, #hive experienced a sharp increase in trading volume(around $30Mill as opposed to $1mill), while the price hasn't moved much.

After a few weeks/month, the price started following the trend. There were a few more indicators, such as a golden cross, but you get the point.

The Composite Man

This one's actually most relevant to understand as it might help you get a grasp of the market as a whole.

Basically, the idea is to imagine the market being a singular entity. He proposed that investors and traders should study the market through the lenses of one single abstract figure capable of acting in harmony - and by the entity, he's referring to market makers and liquidity providers who have the most to gain or lose.

Or to put it simply, they have the power and funding to change the whole narrative, hence allowing their clients to take a good position before the cycle repeats.

#Final Thought.

Here's the tweet you might find interesting.

It's from a guy that claims to be involved in similar practices, at least prior to YOLOing into crypto.

https://twitter.com/twocommapauper/status/1397106939193085952

- twocommapauper

If anything, current market behavior definitely implies there's something, or someone behind the scene pulling the strings.

I know, we were silent when things went good and now we bitch around?

Well... hahaha

Nevertheless, I hope you learned anything that could save you from your future self.

Keep grinding, our time is coming.