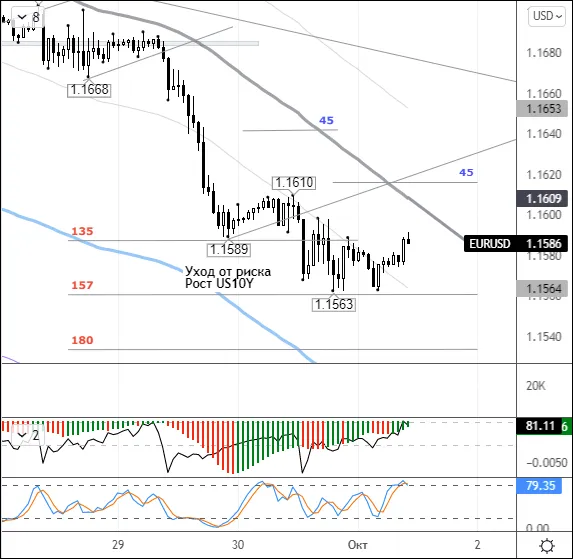

On Thursday, September 30, by the end of the day, the euro fell by 0.17%, to 1.1578. The single currency traded steadily before the opening of trading in Europe. With the fall of the EUR/GBP cross-pair and the growth of the dollar index, the rate declined to 1.1568. In the American session, sellers pushed at 1.1563 low.

Despite the fuel crisis in the UK, the GBP/USD pair managed to recover 102 points to 1.3517 after the release of US statistics. Traders have been taking profits from short positions and declines in the pair over the past few sessions.

According to the data presented, the number of initial applications for unemployment benefits in the United States increased by 362 thousand for the period ending September 25 (the forecast was 335 thousand applications).

US GDP accelerated to 6.7% in the second quarter thanks to government money to fight the pandemic, which boosted consumer spending. The third quarter ended on Thursday, so the final assessment for the second quarter was not interesting to traders and investors.

The statistics weakened the dollar a little. The dollar index recovered to 94.42 after falling to 94.12. The dollar was supported by high values of US Treasury yields, as well as falling stock indices.

Scheduled statistics (GMT +3):

- From 10:30 to 11:30 PMI indices for the manufacturing sector for September will be released in Switzerland, France, Germany, the eurozone, Britain.

- At 12:00 the eurozone will release the consumer price index for September.

- At 15:30, the US is to publish the main index of personal consumption expenditure for August, and will report on the change in the level of spending and income of the population in August.

- At 16:45, the US will present the September manufacturing PMI.

- At 17:00 in the US will be released the ISM manufacturing index for September, data on changes in the volume of spending in the construction sector in August, as well as the consumer sentiment index from the University of Michigan.

- At 20:00 Baker Hughes will release a report on the number of active oil rigs.

Current situation:

At the time of writing this review, major currencies are trading in the red, except for the yen and franc. The greatest losses are incurred by the Australian (-0.42%) and the Canadian (-0.40%). The EUR / USD pair is trading at Thursday's closing level. Buyers are trying to raise the price against the background of the EUR / GBP rise after yesterday's fall, but there is not enough motivation.

Market participants focus on PMI indices in the EU countries. The US will release the ISM manufacturing index for September, as well as the consumer sentiment index from the University of Michigan. There is a lot of important data, so volatility will rise ahead of the weekend.

Technical analysis:

In the last hour, the price went up. The yield on 10-year US government bonds and the SP500 is declining. On the one hand, the euro has support, on the other hand, the stock market creates hindrances.

Monthly and quarterly candlesticks closed lower. Buyers were unable to defend the 1.1600 level, so they lost control of the situation. Sellers opened levels in the area of 1.12 at the older TF. Euro sales may resume at any time.

From a technical point of view, the hourly timeframe at 1.1563 has a “double bottom”. Recovery is supported by allies in cross pairs. At the end of the week, sellers can take a break. If the news background is negative for the dollar, the price may return to 1.1610. In the worst-case scenario, the euro should be expected to fall to 1.1535.

Summary: the euro closed lower on Thursday. Buyers lost key 1.16 support. The road to the level of 1.1200 has opened for sellers. Considering that today is Friday and the euro crosses are growing, it is likely that sellers will take a breather. If the news background is negative for the dollar, the price may return to 1.1610. In the worst-case scenario, the euro should be expected to fall to 1.1535.