BTC continued to grow in the last week of this year, reaching a new high of more than $28,000. The on-chain signals are still bullish, indicating that Bitcoin has a serious supply-side crisis.

Bitcoin market health

BTC has continued to rise rapidly in the past week, continue to hit a record high, and quickly climbed to more than 28,000 US dollars. After starting this week at $23,480, it continued to rise, reaching a high of $28,289. However, on Sunday, it started to decline slightly, ending at $26,390.

Bull market

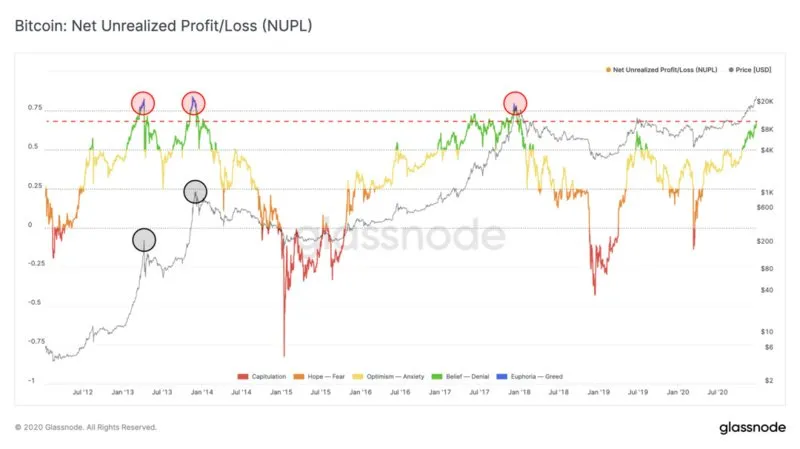

Although the price of BTC has risen sharply in the past month, its unrealized net profit and loss (NUPL) is still relatively low, only 0.67. This means that it is still in the green "confidence" range and has not yet reached the blue "excitement" range that usually represents the top of the market.

This relatively low NUPL value indicates that BTC has more room for growth before the top, although it is already much higher than the previous historical high. In contrast, when the current value of NUPL in the bull market in 2017, BTC was only $5,622 and still rose 248% before the top. If Bitcoin follows this trend again, it will translate into a market top of $65,500.

This makes Bitcoin's low NUPL value a bullish signal because it shows that Bitcoin has a lot of room for growth before the market peaks.

Upbeat comments from Willy Woo

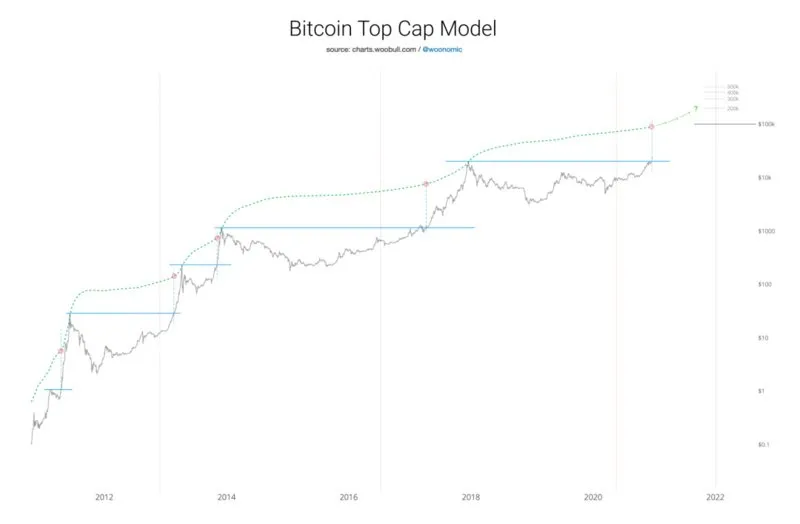

Willy Woo's income: May reach more than $200,000 in 2021

We have now passed the high moment. Although this model cannot predict the price, it can estimate the price ceiling at a certain point in the future, and it has reached the top of every macro market in Bitcoin's history.

Assuming that oil prices peaked in December 2021, based on the previous market cycle, the $100,000 target was too conservative, and the $200,000-300,000 target was considered realistic.

Altcoin function: The ETH balance of the exchange is increasing

After a decline for most of the year, the ETH balance of centralized exchanges began to increase this month.

This year, both BTC and ETH's foreign exchange balances have seen a significant decline, because people's trust in centralized institutions has declined, and more investors have withdrawn assets from long-term holdings. However, as of mid-December, the number of ETH exchanges began to increase again.

Although this may be seen as bad for ETH (as it may indicate an intention to sell), there is another explanation for this rise. Most of the increase in Ethereum's foreign exchange balance occurred at Bitfinex, which launched loans for Bitcoin and ETH on December 18.

Therefore, this increase may be due to investors using Bitfinex Borrow to borrow ETH, and the number of Bitcoins on Bitfinex has also seen a similar increase. This means that investors are holding long positions rather than preparing to sell, which is a bullish sign for ETH.

Weekly feature: Bitcoin's supply-side crisis

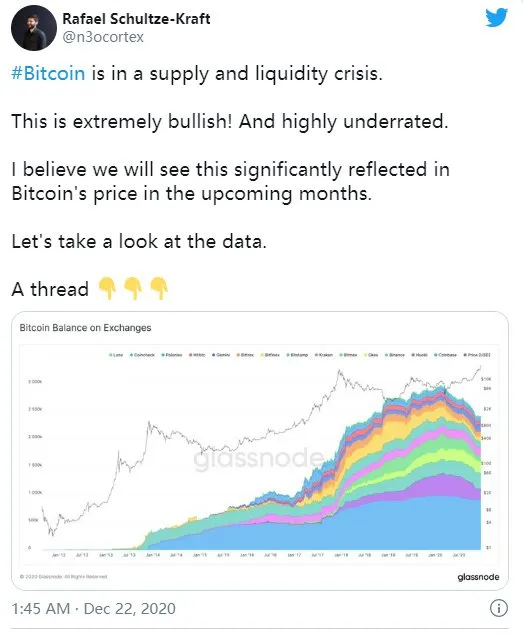

On-chain indicators show that the signals surrounding the available supply of Bitcoin are very optimistic, indicating that demand far exceeds supply. This has been reflected in the recent price increase, as more and more buyers push up the price, and the price of Bitcoin has reached an all-time high.

Our co-founder Rafael Schultze-Kraft recently identified some core indicators that reflect this supply and liquidity crisis.

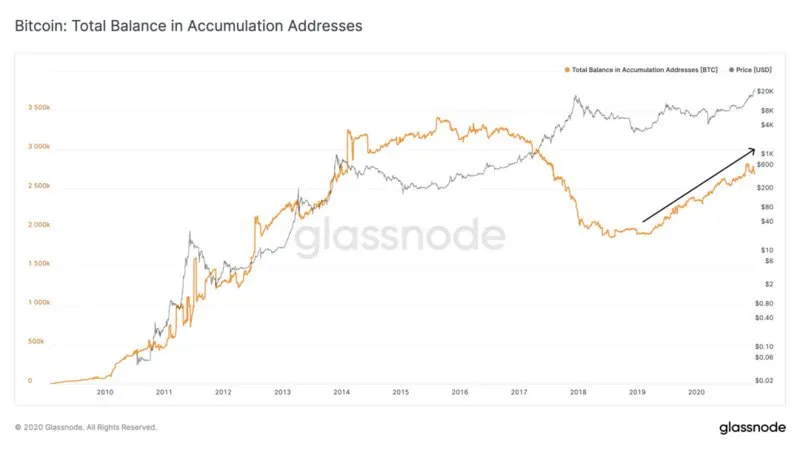

For example, the number of bitcoins in accumulated addresses is steadily increasing. The accumulation address is an address that has only received bitcoins and has never used bitcoins.

The number of bitcoins in these addresses accounted for 14.5% of the total supply, which is one of the many factors that cause massive supply constraints.

In addition, the adjusted circulation supply of Bitcoin shows that due to the loss of Bitcoin, the total supply of Bitcoin will only be around 16 million (instead of the expected 21 million). As demand from institutional investors is also high, the supply of BTC may continue to be restricted, paving the way for further price increases.