Source: Wall Street

Entering the New Year, Bitcoin has risen even more fiercely.

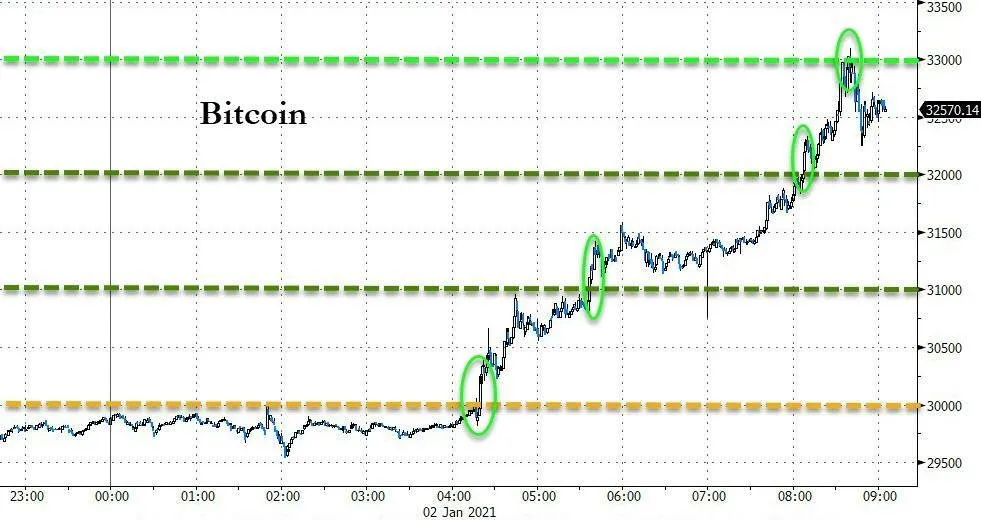

In the past few weeks, Bitcoin has been trying to hit $30,000 without success, but on Saturday, the price of Bitcoin finally broke through this barrier and continued to soar.

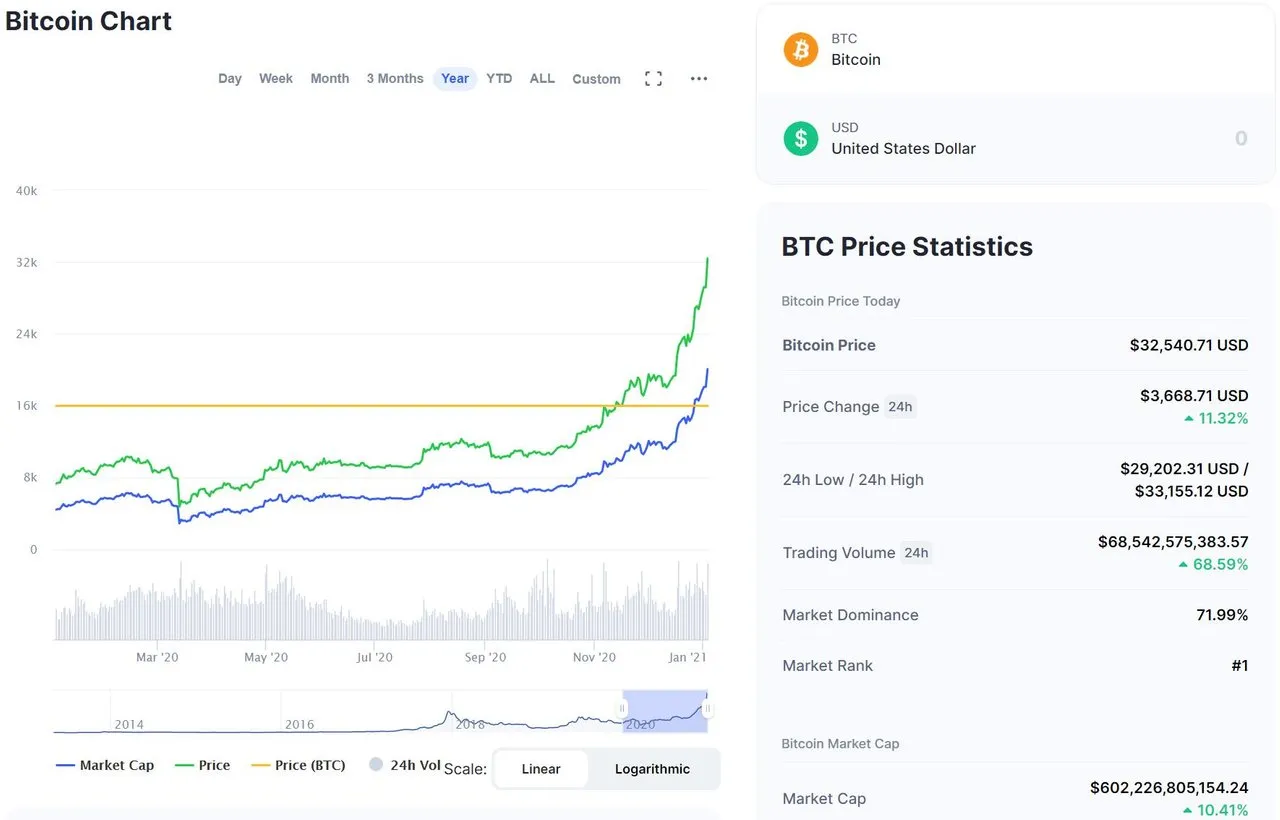

As of now, Coinmarketcap data shows that the price of Bitcoin has increased by 11% from 24 hours ago to $32,540, and its market value has exceeded $600 billion. Earlier, Bitcoin broke through $33,000 to a maximum of $33,155.

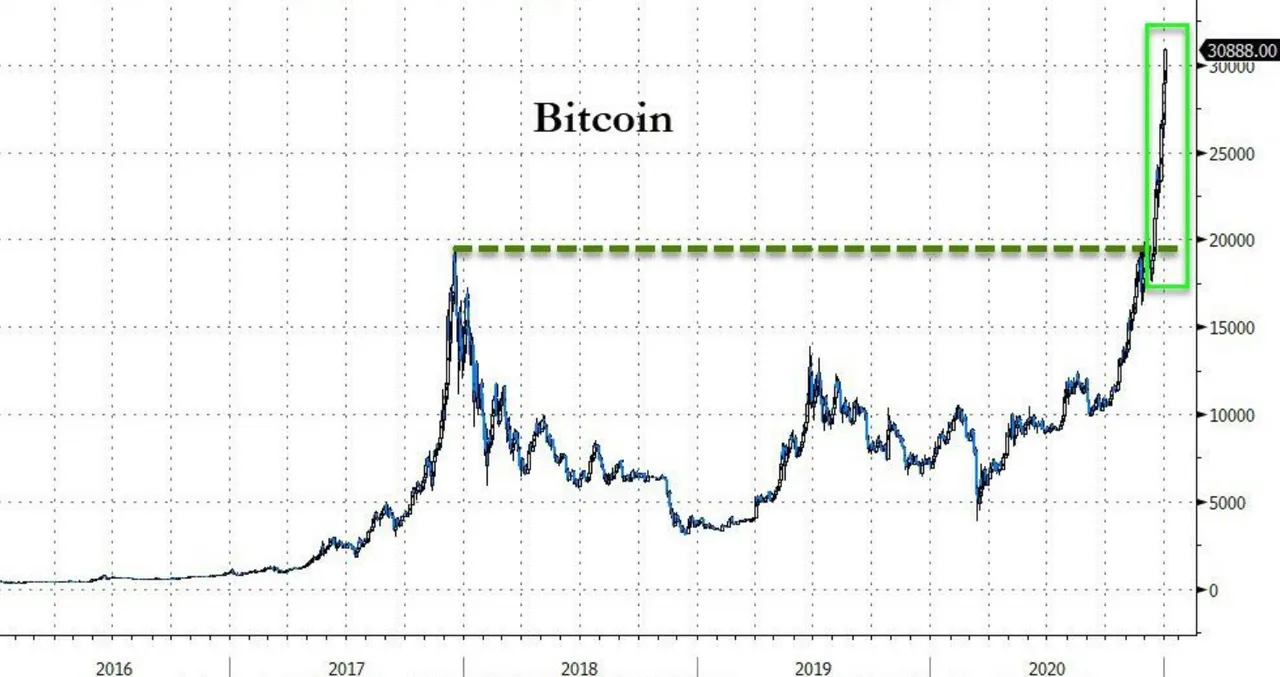

This price is already $10,000 higher than the high point set in 2017.

Ether is also rising and is currently close to $780, but the gains are far less than the leader Bitcoin. The current Bitcoin/Ether price ratio is close to 42, which is a new high since May 2020.

In the past 2020, Bitcoin has risen by as much as 300%. Even during the global market shock in March last year, Bitcoin's trend remained stable.

The most frequently mentioned macro background behind this is that the Fed may continue to maintain the current level of interest rates close to zero in the next few years, and institutions including BlackRock and PayPal are optimistic about Bitcoin, triggering a large number of other investors Follow suit.

So in the short term, what are the factors that contributed to this rapid rise?

One of them may be directly related to the holidays. Before Christmas, the price of Bitcoin was trading at around $23,000, which was also a time when market transactions were more active.

With the Christmas and New Year's Day holidays approaching, when the mainstream financial market is in the closed phase, Bitcoin's upward breakthrough ushered in a favorable time.

At the same time, the number of bitcoins circulating in the market has decreased due to the entry of large institutions, resulting in a structural imbalance between supply and demand in the short term.

According to CoinTelegraph analysis, the number of bitcoins purchased by the well-known bitcoin investment institution Grayscale is three times that of bitcoin mining output in December. At the same time, the purchases of PayPal, Cash App and other institutions have also led to the actual circulation of bitcoins in the market. The decrease in the number of coins may cause Bitcoin to rise further in 2021.

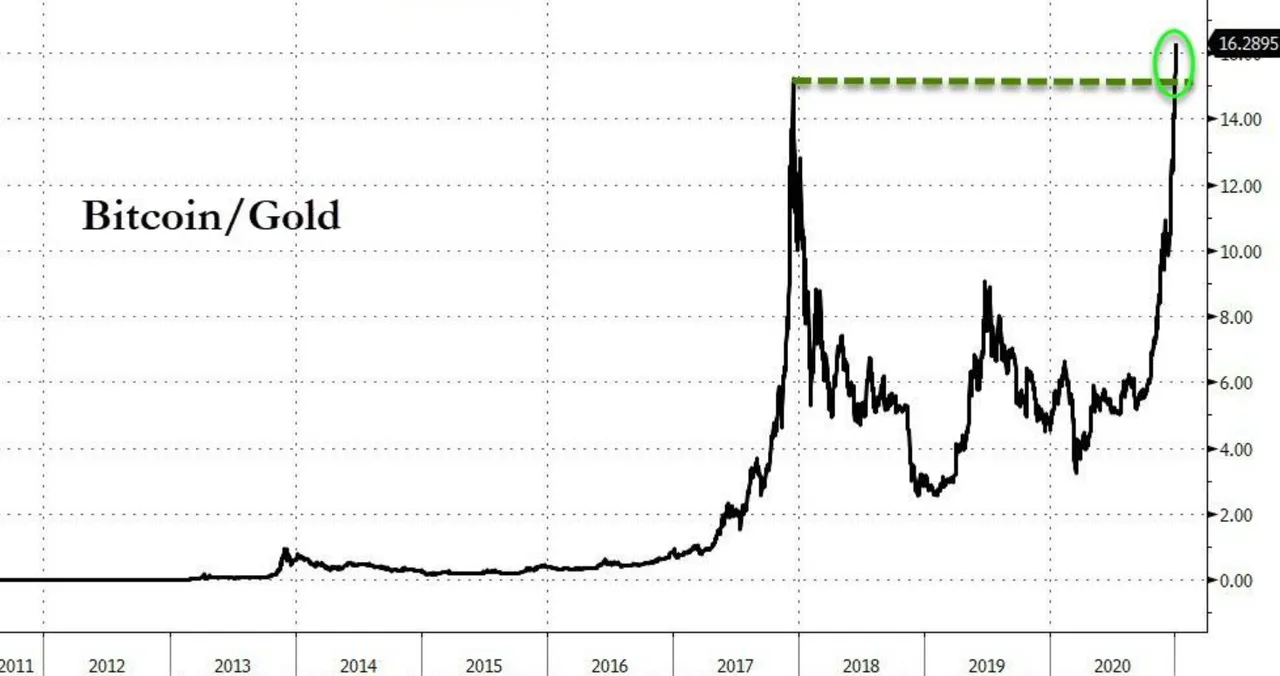

Another point worth noting is that many people regard Bitcoin as a substitute for gold, and therefore transfer the assets originally used to allocate gold to Bitcoin.

JPMorgan Chase is the most well-known institution that holds this view. The investment bank believes that the concept of "digital gold" in Bitcoin is sucking away investors' funds in precious metals.

As of now, the ratio of Bitcoin to the price of gold per ounce has exceeded 16, exceeding the previous high of 15.6 set in 2017.

How much can the price of Bitcoin reach next? Nicholas Pelecanos, head of investment in digital currency trading company NEM, believes that the price of Bitcoin may rise to $50,000 before Valentine's Day. "I think it is now at the beginning of a bull market."

However, Pelecanos also said that for any asset, such a long and rapid rise is worthy of vigilance. " I call on those who trade Bitcoin not to be trapped by this extreme enthusiasm. "