Welcome to week 38 of my latest Hive Goals review as part of the Saturday Savers Club. It has been 1 week since my last update. You can check what week it is here. I like to do this post to keep track of things and measure my progress.

Buying Crypto Below Market Value

Last week we talked about Scarcity vs. Abundance and lead on to how we can invest at a profit to get ahead of the crowd. I suggested one way would be to buy assets below the market value.

Now you might be thinking, OK Steve, that sounds great, but how do I do that?! Aha. So let's break this problem down today with a crypto example. One problem as I mentioned with gambling is that over the long term, following the odds-on favorite bets is a losing proposition long term. Can this also be the case with Crypto?

If everyone is buying a certain crypto, this is likely to drive the price up above the fair market value, but on the other hand, this could be safer as you are buying a crypto with market demand. This is like buying a crypto after a 200% or 300% gain. Unless you already owned it, you haven't gained much.

So how do we buy crypto or crypto assets such as NFTs etc. below their market value?

Let's rephrase the question, WHY would someone choose to sell their assets below the market value? and then it becomes easier. We can then also see that this GAIN we can get will come with some RISK. Therefore you would need to evaluate the potential gain vs. the risk you will take.

- Urgent need for liquidity

- Large position and lack of enough liquidity

- Illiquid market

- Convenience

- Low Transaction costs

- Fear of asset price depreciation

- To cash out gains, and the difference is immaterial.

- To distribute tokens, airdrops, etc.

What reasons could you think of?

Now we know why people might sell below market value, can we take advantage of any opportunities that this might throw up?

Are there people exiting positions without enough liquidity? Have a look through some of the tokens on Hive Engine.

Are there any events coming up that people may require liquidity for? We just had Riftwatchers, perhaps the launch of the Splinterlands Soccer Game? Maybe some assets will drop in value or there may be a requirement for liquidity in the diesel pools on Tribal Dex?

This isn't investment advice, please do your own research.

Slow and Steady Wins the Race!

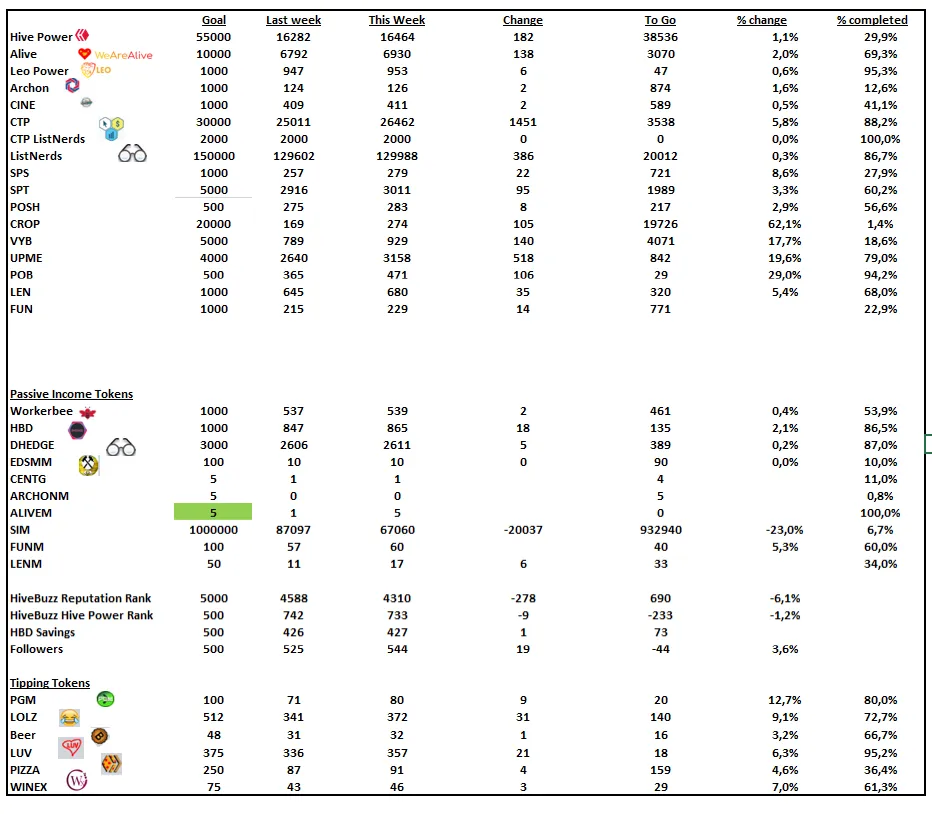

Right, let's look at the table this week:

My Hive Power increased by 182 this week after I powered up an extra 100 Hive from fiat.

My LEO goal increased by just 6 this week as I slowly reach my LEO 1000 goal.

My Alive tokens grew by 138, I have been burning 7 tokens a day as part of their burn competition, so this would affect my numbers. I also invested in a further 4 ALIVEM miner tokens.

My CTP goal increased by 1451 this week as I purchased some extra CTP on the market as the price crashed with some whales exiting. I have some more buy orders in to buy up any offers if I can.

My ListNerds increased by 386 and I am mostly stacking these and keeping some liquid.

My HBD increased by 18. The weekly interest increased to 3,33 which is a pretty good HBD income to have.

I reached my ALIVEM miner goal so will increase this to 10 now. I will do a write up about this token and why I bought it next week.

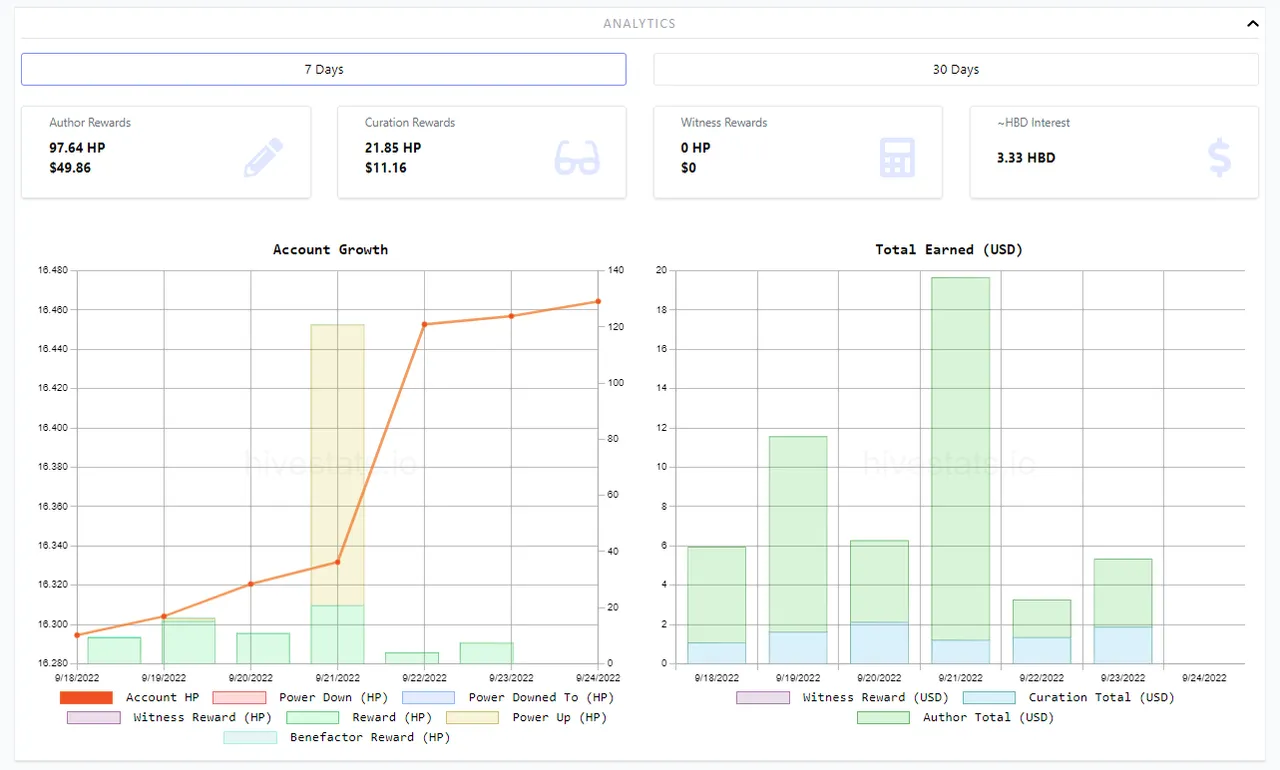

Here is the growth in the last 7 days from hivestats.io:

My author rewards were 97,64 HP this week and my curation 21,85 HP. Overall a pretty good week with over 100 HP powered up.

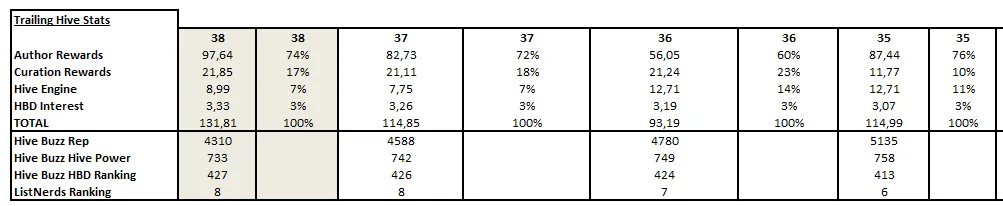

In the above table with the trailing stats, you can get a better picture of the progress. I have increased to 4310 in terms of reputation and moved to 733 in terms of Hive Power. In the HBD savings category, I actually have fallen back 1 place, despite increasing my HBD holdings.

It seems HBD paying 20% is very popular and I am thinking to increase my holdings there. Moving up the Hive Power rankings is getting more difficult now compared to a few months ago with just a 9 place increase with +182 HP.

That's it for this week, but before I go, be sure to check out the @eddie-earner or @susie-saver accounts for more details about the Saturday Savers Club. This is run by @shanibeer.

Resources:

Hivestats screenshots taken from Hivestats.io

Title image created in canva with image created by @doze and source

HiveBuzz stats taken from HiveBuzz

Disclaimer

This is not investment advice, please do your own research before investing.

Sign Up For ListNerds:

Let's connect : mypathtofire