What Correction?

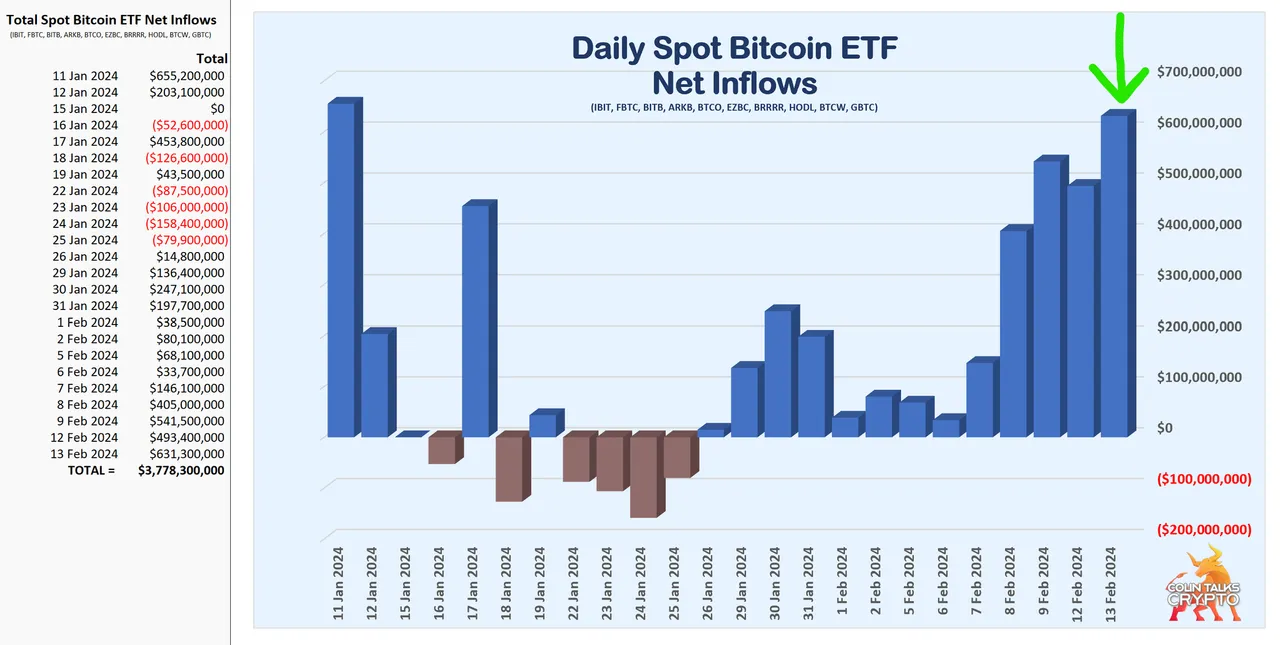

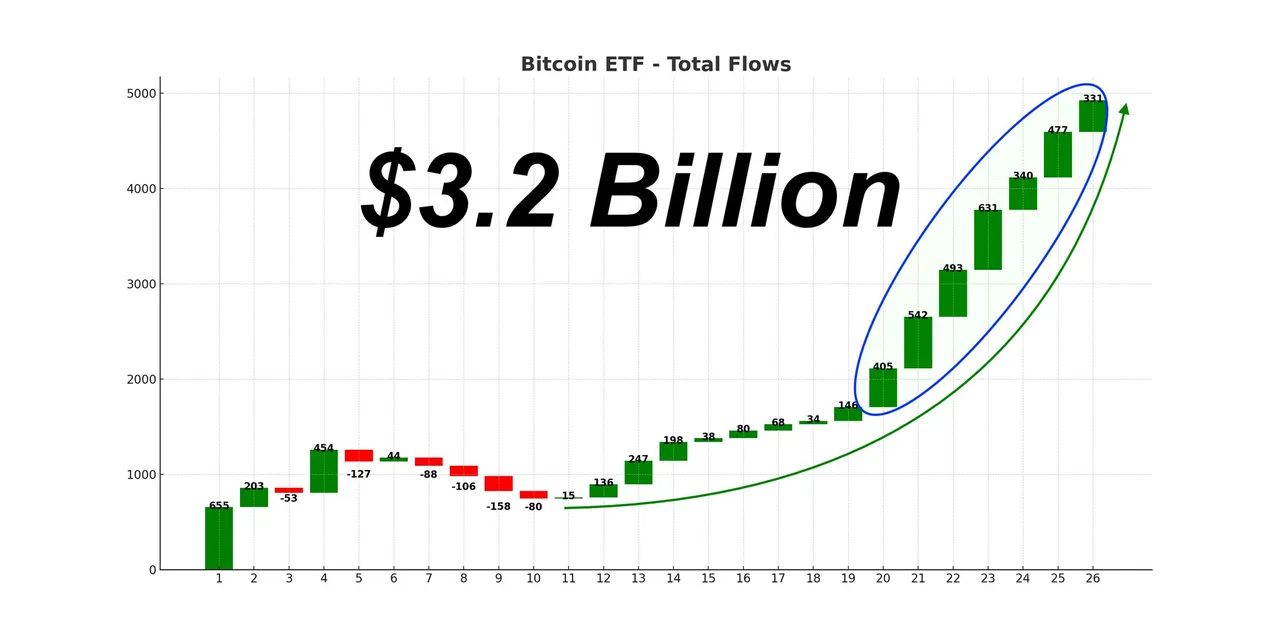

Everyone who has expected corrections in the market so far has been corrected. The market doesn’t care. TradFi money have never entered the market in this manner before. History is not working here because it is being recreated. Most of the things happening henceforth will be very significant. Already, TradFi has injected $4.2billion into Bitcoin.

Corrections will come no doubt, markets will market but if anyone is saying it like forecasting this market based on past events is a no brainer, such person will be corrected, I’ve seen it happen many times now. In this moment, the bulls have taken over.

The bulls have taken over but to be honest, I really don’t have a solid plan to maximize this bull market, majority of my portfolio is staked, this is a common staker problem, one important question is at what price do I intend to sell, for example, Hive! $3? 5$? $15?

Wen Cash Out?

Don’t get me wrong, “cashing out” is not my goal here, certainly I would love to fix some things around my house like a TV, A car would be fine too, A vacation for bae and me, A wedding, A dog, some stables for rainy days and a stash of stables to buy back Hive in the following bear market.

Cashing out to fiat is the last thing I’ll do, yet, there's a delicate balance to strike between realizing gains and holding for the long-term vision. It's this balance that keeps me awake at night, pondering over the right moves to make in a market that's as unpredictable as it is crazy.

This is why I’m also airdrop hunting, it opens me up to opportunities to expand into other assets that could provide liquidity when needed without completely liquidating my top positions. This is about positioning myself to take advantage of multiple growth avenues within the crypto space.

Vacay with Bae 😍

I'm also exploring the utility of crypto-backed loans as a way to meet some of my financial goals without selling my assets. This way, I can potentially fund that vacation or even the wedding without saying goodbye to the potential future gains of my crypto holdings.

It's a complex calculation that involves interest rates and market predictions, but it's an option that aligns with my goal to remain invested in the market's future.

The thought of a market correction does indeed carry a weight of uncertainty, but it also opens the door to reflection and strategy. My stance has always been to see beyond the immediate fluctuations, understanding that the true value of my investments isn't dictated by short-term volatility but by the long-term vision and fundamentals of the projects I support.

Correction or not

So, whether or not a correction comes, my focus remains on the big picture, financial freedom. It's about ensuring that my investment strategy is robust, diversified, and aligned with my long-term goals. It's about continuous learning, staying engaged with the communities I'm a part of, and contributing in ways that extend beyond financial investment.

Whether or not a correction comes, the entry of traditional finance (TradFi) institutions into Bitcoin could surpass many people's imaginations in terms of its impact on the market.

The significant buys of Bitcoin by entities like BlackRock and their ilk are a signal to a broader, more sustained interest in cryptocurrency from the financial mainstream. This influx of institutional money can fundamentally alter the dynamics of supply and demand in the Bitcoin market forever!

Bright New Day

Moreover, the sheer volume of funds that institutions can bring to the table is staggering. As these entities continue to allocate a small percentage of their portfolios to Bitcoin, we could see an influx of capital that dwarfs what we've seen in previous bull runs.

This could not only set new price floors but also propel Bitcoin to new heights, as the available supply becomes increasingly scarce in the face of growing demand.

So, whether you're a seasoned crypto veteran or a newcomer drawn by the recent surge of interest, the message is clear: the future is bright, and the best is yet to come. Let's get ready to carve out our path in this new era of digital finance. Together, we are creating history.

Thanks for reading.

Share your comments below.

Images were generated with Ai.