Bitcoin's Lightning Network, designed to address the low throughput and high transaction fees of the Bitcoin blockchain, has been a transformative solution. Despite its potential, adoption has been slow, prompting a closer look at its capabilities and challenges.

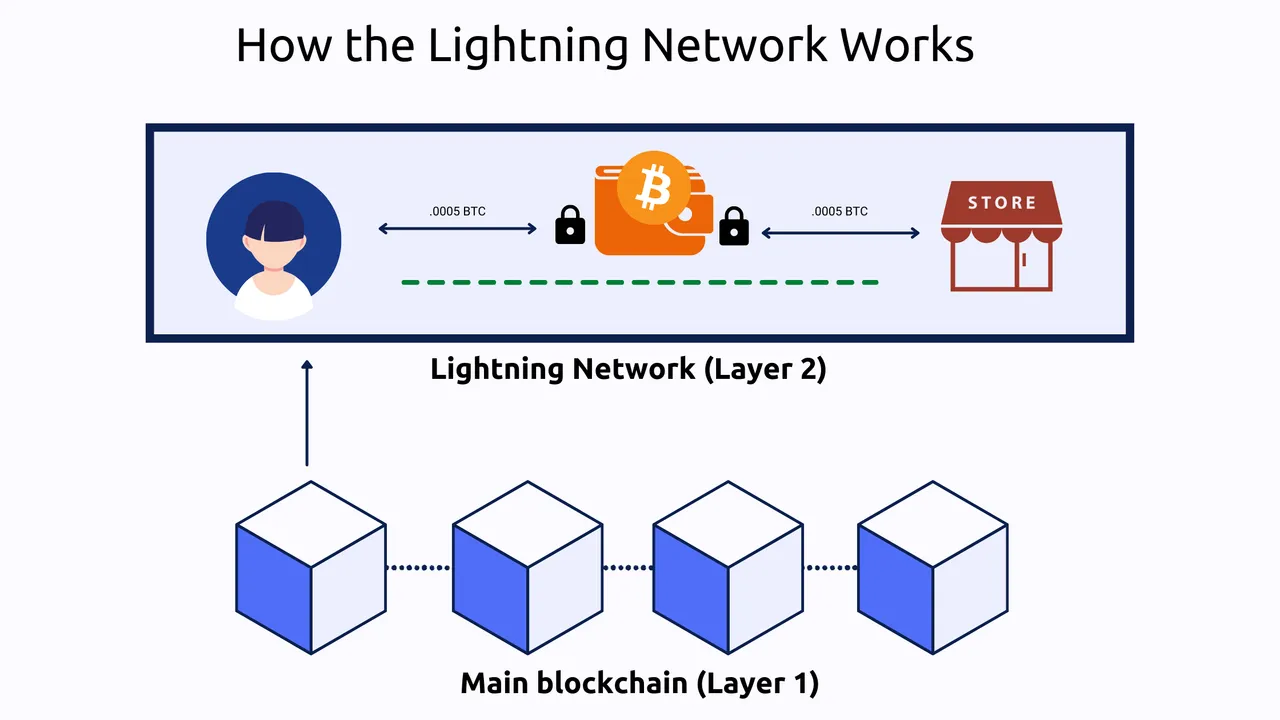

While Bitcoin introduced decentralized, cross-border peer-to-peer transactions, its low throughput of seven transactions per second (TPS) led to historic transaction fees. In response, developers created the Lightning Network, a layer-2 scalability solution enabling off-chain transactions.

Creating a peer-to-peer payment channel between two parties, the Lightning Network allows near-instant, low-cost transactions. Functioning as a micro-ledger, users can make smaller payments for goods and services, enhancing Bitcoin's practicality.

Despite its potential to surpass existing payment solutions, Lightning Network adoption has been gradual. With 87,000 payment channels and 4,570 BTC locked (valued over $111 million), it represents a fraction of Bitcoin's circulating supply and market capitalization ($460 billion).

Transaction Speeds:

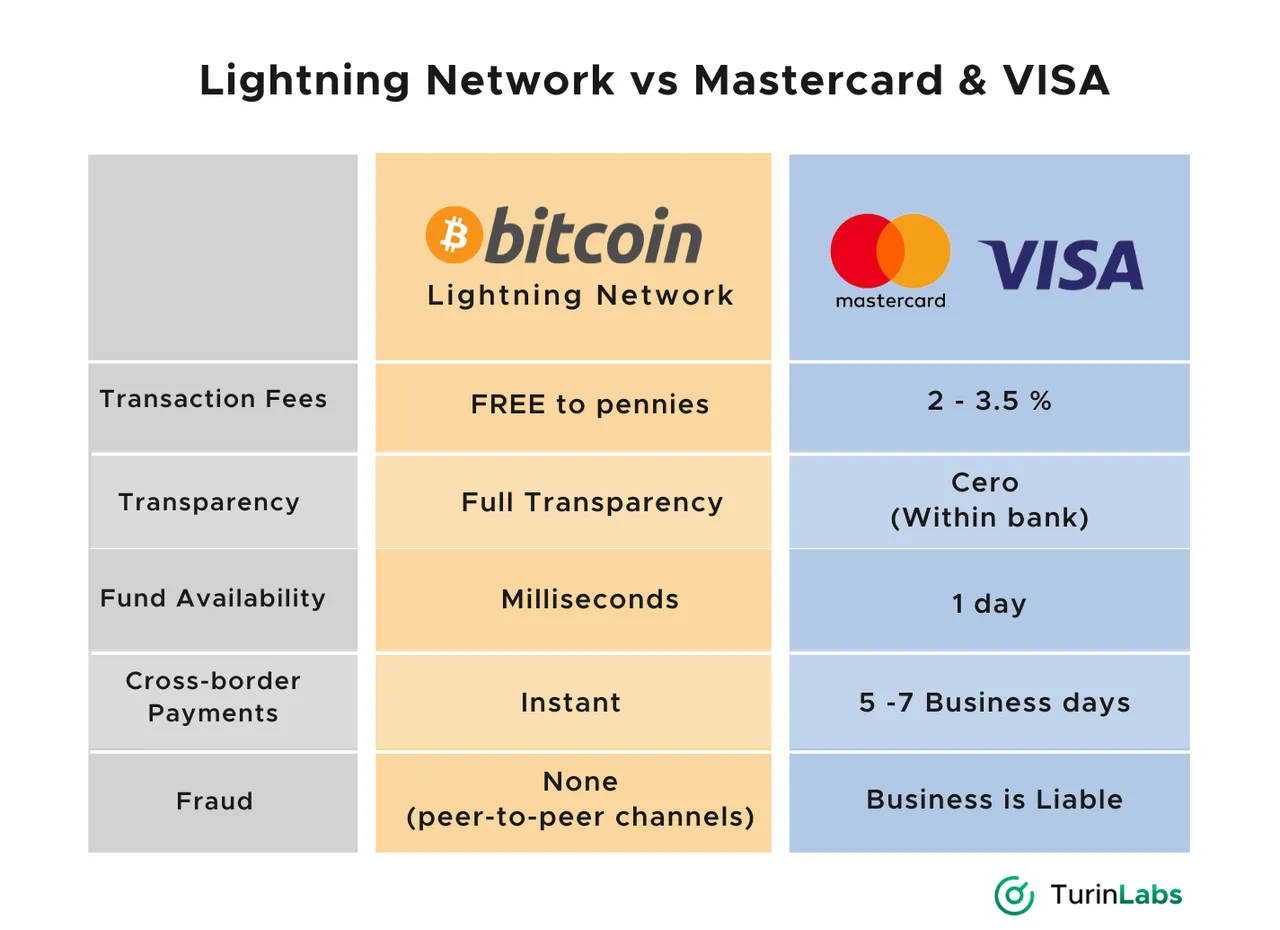

In contrast to traditional giants like Visa (24,000 TPS) and Mastercard (up to 5,000 TPS), the Lightning Network boasts impressive scalability, processing up to 1 million TPS. This positions it as the world's most efficient transaction speed system.

While some hail Lightning Network as the next evolution in money, critics highlight scalability challenges. Opening and funding a Lightning wallet may be less straightforward than traditional banking, impacting user liquidity. Industry leaders emphasize its pivotal role in fostering a permissionless payment system and accelerating global cryptocurrency adoption.

Pros and Cons of Lightning Network:

The network's advantages include decentralized and censorship-resistant attributes, contrasting with centralized systems like Visa. However, challenges include potential offline transaction scams, a need for third-party services to mitigate risks, and complexity in opening channels and maintaining liquidity.

Max Rothman from Checkout.com emphasizes that cryptocurrency's effectiveness relies on seamless exchanges. While the Lightning Network presents a peer-to-peer model, its institutional administration can be resource-intensive. Solutions bridging Web2 and Web3 offer smoother transitions.

Comparisons with Traditional Payment Solutions:

Bruce Fenton emphasizes the Lightning Network's decentralization and resistance to censorship, distinguishing it from other blockchains. While Solana and Decred offer high throughput, they compromise decentralization. The future balance between speed, privacy, and decentralization remains uncertain.

For widespread adoption, the Lightning Network requires support from more services. The reluctance of major exchanges like Coinbase, Binance, and FTX to embrace the network inhibits growth. Competing with centralized providers calls for continued innovation to address user concerns and drive broader acceptance.

Conclusion:

The Lightning Network stands at a crossroads, offering unparalleled transaction speed but facing hurdles in user accessibility and industry support. Its potential to redefine financial systems depends on addressing scalability concerns and winning over major players. The ongoing evolution of cryptocurrency payments will determine whether users prioritize convenience over privacy and immutability, reshaping the landscape of financial transactions.