So what can we do?

The answer is to find the best method to make sure that our capital is not eroded by inflation.

The only way is to manage it in such a way that it can produce income at a rate very similar to that of inflation; therefore, we could turn to safe haven assets: these are those assets that, in the long run, have an increase in value.

By definition, the safe haven asset known to everyone is gold.

But being able to secure one's savings from inflation by exchanging them for gold is not quite so simple.

Let's see why.

A clarification is needed: we are talking about physical gold and not a surrogate, which could be a CFD (Contracts for Difference) that is used only in trading and for a purely speculative purpose. The same goes for futures, which, although at expiration you receive the purchased product, is still a speculative maneuver of market forecasting.

Buying physical gold can only be done through licensed and authorized dealers, and it is not necessarily the case that all banks can do this.

Moreover, this type of gold has precise purity specifications; in fact, it cannot be less than 995 thousandths.

Gold can be purchased in two different formats: bars or coins.

Ingots

Ingots must have a purity of 995 thousandths and are made either by coining or by melting.

By minting, one starts from the solid and by pressure obtains the ingot (basically the same process by which fiat coins from all over the world are obtained) while by melting the gold in its liquid state is poured into a special mold.

Depending on the company that produces them, there are various sizes (by weight) for example: 2 gr, 5 gr, 10 gr, 20 gr, 50 gr, 100 gr, 1 kg, etc.

Above each ingot are the characteristic data, such as weight, purity and, as a guarantee of quality, the name or logo of the company that produces them.

Coins

Coins, unlike bullion, have a limited circulation and are reproductions of historical coins.

In this way, the nominal value of gold is also added to the collectible value of the coin, which is bound to increase in the long run.

The coins, therefore, have an added value compared to "simple" bullion.

As can be guessed, the details of the minting company are not given: in fact, a certificate is issued where all the "registry" data of the coin are given; including mintage and purity of gold, which, as with bars, cannot be less than 995.

Having clarified the possibilities of purchasing the precious metal, an additional condition is added: storage.

The storage of this material is advisable to entrust it to companies in the sector that have insurance and trained personnel, as well as security devices that the private user can hardly access; for example, safes with extremely high burglar-proof class and specially built places with all the necessary features for the purpose. What is commonly called a vault.

As we have been able to see, preserving one's savings from the erosive force of inflation is quite articulate if not exceptionally complex.

In the field of precious metals, in addition to the gram, and particularly in gold, the troy ounce, which corresponds to about 31 gr in the SI, is also used as a unit of measurement (unit of mass).

Why gold?

As we know, since ancient times when trade had a certain evolutionary thrust, gold was used as a currency of exchange: depending on the weight of the coin, thus the amount of gold, a certain amount of any good was supplied in proportion to its value.

This was because gold, as a metal, had to be mined from mines or collected by sifting sediment from certain waterways; thus, in limited quantities and with a very high "cost" in terms of labor.

Nowadays, although mining technologies have evolved exponentially, costs have not decreased.

For these reasons, but mainly because of the difficulty of finding it and the scarcity make its value increase almost constantly over time.

If we go back to the graph I inserted just above, we can see that the gold exchange rate in August 2021, so with still the aftermath of the pandemic, was around $48, if we look toward the end of the graph, so about present day, we are around $58, so we can consider a 20% growth in about 2 years which, annually we can consider an AVERAGE growth of about 10%.

Below I will repost the graph from the previous article, and compare the growth in percentage value of the precious metal against inflation, we have the answer to our questions.

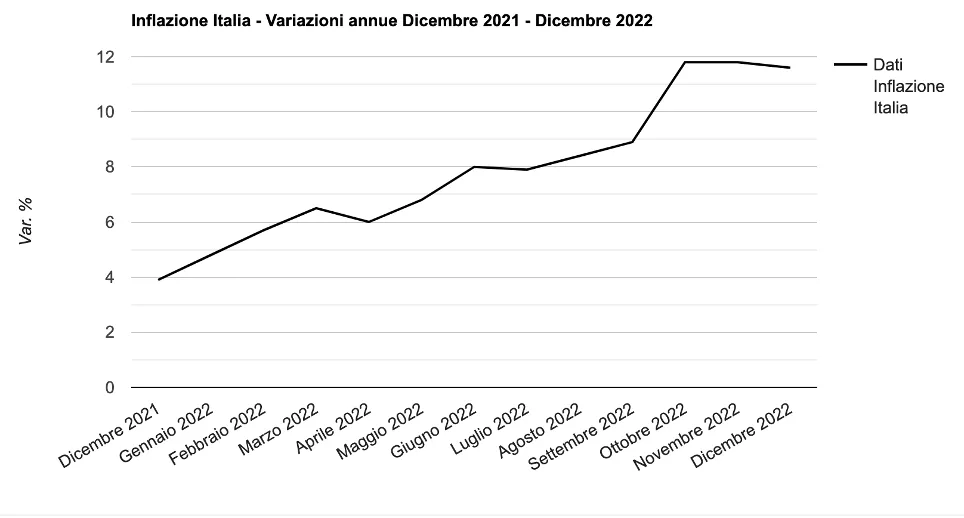

As we can clearly see, from December 2021 through November 2022, we had an increase of 8 percent; reaching the highest value of just under 12 percent. In this case, the data, given the current world situation (the pandemic and, subsequently, the war in Ukraina), have undergone rather sudden variations, but this helps us to understand that converting one's savings into safe-haven assets, allows us to keep their purchasing power almost constant.

Now that we have made it clear how gold works as a safe haven asset and why to choose it, in the next part we will delve into the new blockchain technology to see what conveniences it offers and whether we can consider cryptos safe haven assets and why.

Until next time!