Bitcoin's price surged above $62,000, following the announcement of an interest rate cut by the U.S. Federal Reserve (Fed), after hovering between $60,000 and $61,000. Over the past month, Bitcoin has gained 8%. This price rally coincided with the Fed's monetary policy adjustments, signaling optimism for the cryptocurrency's future trajectory.

Fed’s Interest Rate Projections and Economic Outlook

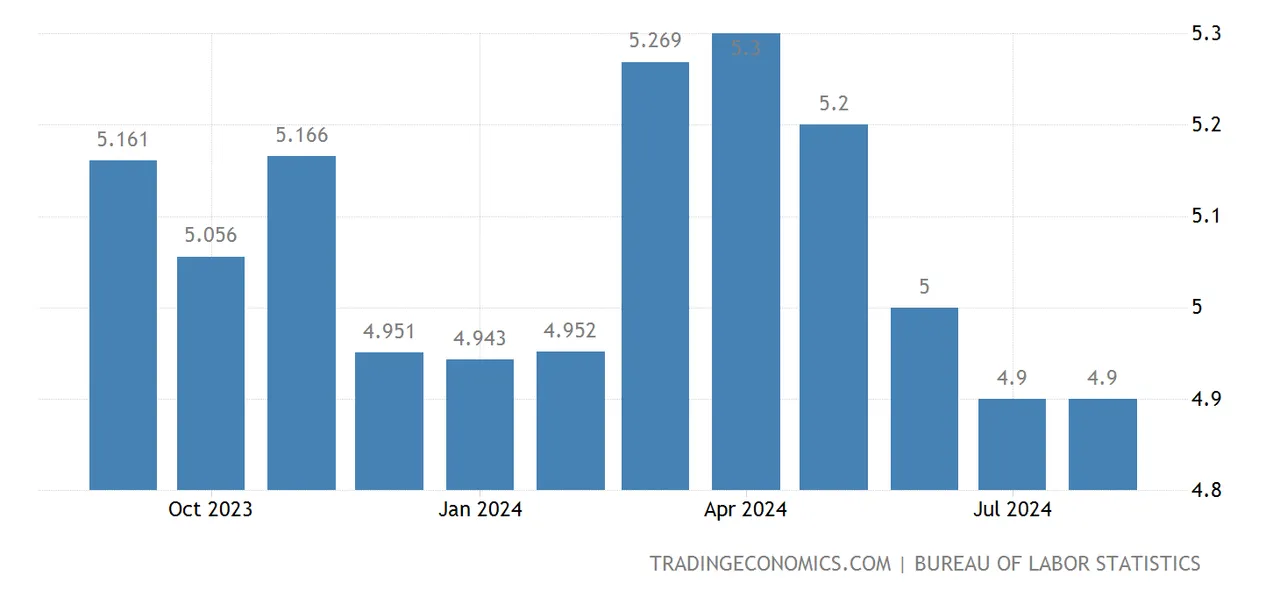

In addition to the immediate rate cut, the Fed’s "dot-plot"—which illustrates its members' rate expectations—revealed plans for a further reduction of 150 basis points by the end of 2025. The central bank also released new economic projections, predicting inflation will continue to decline towards the 2.0% target and that the unemployment rate will remain stable through 2026.

During a press conference following the announcement, Fed Chair Jerome Powell reiterated confidence in the resilience of the U.S. economy, despite the planned aggressive rate reductions. The Fed appears to believe that the U.S. economy can withstand these cuts without slipping into a recession.

Positive Macro Environment for Bitcoin

The expected decline in U.S. dollar strength and treasury yields creates a favorable macroeconomic environment for Bitcoin. As long as fears of a U.S. recession remain at bay, Bitcoin could climb to $70,000 in the coming weeks. The backdrop of declining inflation and interest rates could further support Bitcoin's rise, especially as investors seek alternative assets amidst declining returns on traditional investments.

Altcoins Join the Rally

As Bitcoin gains momentum, altcoins have also surged, indicating broader market optimism. According to the CryptoBubbles chart, several altcoins—such as TIA, SEI, HEX, TAO, POPCAT, BEAM, and FTM—are experiencing significant price increases, some nearing 30%.

This resurgence is seen as the beginning of the much-anticipated year-end bull run. The recent Bitcoin halving in April and the Fed’s monetary policy shifts may provide the boost needed to kickstart a broader crypto rally. If Bitcoin continues its upward trend, an exponential rise in altcoin prices could follow, providing relief to these smaller cryptocurrencies, which have struggled in recent months.

Market Outlook: Bitcoin and Altcoins in Bullish Territory

In conclusion, BlackRock’s support for Bitcoin as a hedge against geopolitical instability aligns with current market conditions, where falling interest rates and inflation provide a bullish backdrop for the cryptocurrency. As Bitcoin strengthens, altcoins are also likely to experience renewed interest and price surges, setting the stage for a potential end-of-year bull market in the crypto space.