Source of original image: https://www.osc.org/popular-science-myths-debunked-%E2%80%A2-clearing-up-misconceptions/

In the last months, we have been seeing a lot of bad press and a lot of scams getting huge popularity in the media. I am going to debunk them in a dedicated series of articles called ScamBuster, but here, I am going to debunk the five biggest false myths about cryptocurrencies that are:

- Cryptocurrencies are used for Money Laundering

- Cryptocurrencies are too volatile

- Cryptocurrencies will take too long to reach Mass Adoption

- People Lose Money with Cryptocurrencies

- Cryptocurrencies Mining Pollutes too much

1) Money Laundering

Money Laundering has been the first false truth that mass media and banks tried to make people believe. This has been the first myth I have tried to debunk in this article.

26 January 2022. Source: https://www.bbc.com/news/technology-60072195

8 February 2022. Source: https://www.justice.gov/opa/pr/two-arrested-alleged-conspiracy-launder-45-billion-stolen-cryptocurrency

Cryptocurrencies can be used to launder money. And that is a fact. Anyway:

“a falling tree makes more noise than a growing forest. “

That’s why Messari once published a study demonstrating that Cryptocurrencies were losing the laundering money battle against traditional money for 1:800, meaning that for each 800$ of traditional money used for illicit markets, just 1 dollar for illicit markets was used in the equivalent form of cryptocurrencies.

These are no peanuts!

800:1

Anyway, I cannot find that research from Messari anymore, even if I quoted it in my Italian article back some years ago.

I no longer have that source, so let’s find other available statistics.

From this research made by Europol, the size of the total laundered money in worldWorldetween 2 and 5% of the World-GDP (Gross Domestic Product), being between 715 billion $ and 1.87 trillion $.

From this other research, the laundered money with cryptocurrencies for 2021 has been 8.6 billion $.

Comparing these two sources, we can create a heterogeneous statistic placing cryptocurrencies in the range of 1.2% and 0.46% of the total laundered money.

If compared to Messari’s stats, we are looking at a range between 1:83 and 1:217.

As I said, this is heterogeneous stats since it’s produced from the same source of data but published in two different moments.

One additional thing, for which we just need to look around.

In Europe, a unified regulation has been introduced to track and create a census of cryptocurrency service providers. A lot of exchanges have introduced stricter rules for KYC (Know-Your-Customer) procedures.

The introduction of new rules shows a clear scenario about how the trend of illicit money traffics with cryptocurrencies will decrease more and more, thanks to increasing controlling measures.

And still, let’s focus on the growing forest (the huge crypto ecosystem) and not just some falling trees (negative news and bad press in general).

2) Volatility

The damnation about Cryptocurrencies’ volatility became evident in February 2018, when the CBE President, Mario Draghi had this speech

“A Euro today is a Euro tomorrow. Its value is stable. The value of Bitcoin oscillates widely (wildly). Of all things I would not call Bitcoin a currency, for this reason but also for another reason: Euro is backed by European Central Bank, the Dollar is backed by the Federal Reserve. Currencies are backed by Central Banks or their government. Nobody backs Bitcoin”.

There are several imprecision in this speech:

→ A Euro today is a Euro tomorrow: this is an identity. It’s intrinsically true.

→ The value of Bitcoin oscillates widely (wildly). Oscillations of Bitcoin PRICE are really wide BUT it’s not the Value oscillating. It’s Bitcoin PRICE. Dear Mario: do you know the difference?

One more thing, dear Mario: you cannot compare Euro with Euro and Bitcoin with something else (what? You forgot to tell us). They have two different unit of measure: meaning that they cannot be compared!

→ Euro is backed by CBE and Dollar is backed by FED: honestly, I do not see any warranty here. Playing with interest rates and cash emission into the market is the approach of Central Banks.

National currencies had a real backing when they were backed by Gold, until 1971, when the Bretton Woods agreements were definitely broken up. Bretton Woods Agreements started in 1944 when testing unbind of the national currencies was decided. This measure was initially intended to help countries better facing the after-war debts and eventual imbalances of national cashflows.

Have a look here, at the monetary supply in USA, from the birth of the Federal Reserve until today

Source: https://fred.stloiusfred.org/series/CURRCIR

In the vertical axes you can see the amount of circulating dollars from August 2017 up today.

At the very beginning of this chart, only 3.714 (3 billions and 714 millions) of dollars existed. At the end of the chart, July 2022, the amount of circulating dollars is 2,279 (two thousands 219 billions).

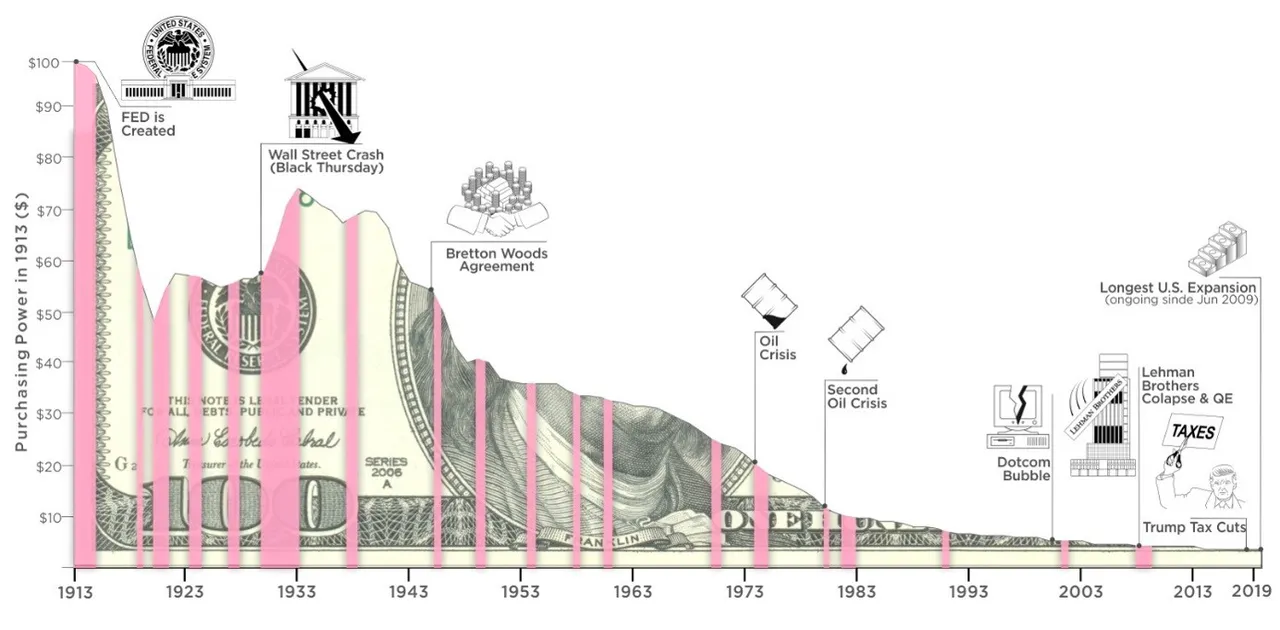

And let’s now have a look at the value of the dollar in the same historical period:

Source: https://howmuch.net/articles/rise-and-fall-dollar

In the last 100 years, the United States Dollar has lost almost 99% of its value.

Bitcoin price raised from the first official stated price (the purchase of the pizzas and beers from Lazlo Hanyecz on the 222 May2012) of 0.004$ per Bitcoin, equivalent to the purchase that Lazlo made with 10000 bitcoins for a total value of 40$. to buy a couple of pizzas and beers.

So, can we feel so safe for that “backing from central banks”? In my opinion not.

And what about the actual volatility?

Well, Bitcoin price is very volatile against national currencies and this is not a news.

Anyway, Van Eck, a major investment firm, created a statistic which showed that 22% of the stocks from the S&P500 are more volatile than Bitcoin on a daily basis and 29% on a YTD basis.

Source: https://www.vaneck.com/us/en/blogs/digital-assets/bitcoin-less-volatile-than-many-sp-500-stocks/ . 22 November2020.

So at first, Bitcoin is not really going out from the first percentile volatility when compared to companies listed into the Standard and Poor’s 500.

And since Mr Draghi tells expressly that Bitcoin is not a currency, what if we compare Bitcoin to major moves of national currency from the last years?

We have already seen the devaluation of the USD. But that was an overview of its purchasing power across its lifespan in a long-time perspective.

From a short time perspective, are the national currencies so much stable?

Let’s start from the first evident case: the Russian Ruble. I will be intellectually honest, so I will exclude from my example its trend between from late 2021 towards 2022 (potentially onward).

Source: Google Images

I am going to address my attention to the Russian Ruble evaluation in 2014.

This is an Italian article, that I usually use when I coach and have live sessions on cryptocurrencies in Italian language.

It literally says:

“After another ‘black Monday”, today Ruble is the currency with the worst performance in the worldWorldm the beginning of 2014 it has lost more than 50% of its price. ……. On the 15 Decemberitself, the Ruble lost 10% of its price against the Dollar”.

It is dated 16 December2014. And we are talking abut Russia, one of the most powerful economies in the WorldWorld

Image source: https://www.plus500.com/it/Instruments/EURUSD/The-History-of-the-EURUSD~4

By the way, you may think that Russia is not a good example, so let’s jump to the EUR-USD pair in 2021–2022 period. I see the inflation, the war and so on, but how is the pair EUR-USD doing in this moment? We are comparing two so-called “Western Economies”. I would expect stability.

While I am writing this part, we are on the 223 August2022, and you can see in the last year and a half the trend of EUR versus Dollar: Euro has lost more than 19% against Dollar in one year and 8 months. So, when Mario Draghi said that “One Euro is One Euro today and it will be One Euro tomorrow”, maybe it intended that “One Euro today was going to be one Dollar tomorrow”?

Anyway, if you are still not persuaded, let me bring at your attention the case of the Swiss Franc that happened in 2015.

On 112 January2015, Jean-Pierre Danthine, the vice-chairman of the SNB, said on a national television:

“We are convinced that the minimum exchange rate must remain the cornerstone of our monetary policy.”

It was about keeping the peg of the Swiss Franc(CHF) with the Euro Currency.

When, three days later, the SNB did the exact opposite, it was a complete surprise to the market.

The Price range of the news is between the two green labels: from 0.9785 CHF/USD to 1.3446 CHF/USD. An excursion of 37.4% in just one day. I think that THIS is “wild volatility”.

Guys, I am stopping the article here because it is very long.

I will publish the second part next week!

Ah, if any of you can't wait 7 days, I have published the full article here!